Hello Visitor! Log In

Financing Human Capital: Families & Society

ARTICLE | October 18, 2016 | BY Neantro Saavedra-Rivano

Author(s)

Neantro Saavedra-Rivano

Abstract

The Organization for Economic Cooperation and Development (OECD) describes human capital as “knowledge, skills, competencies and attributes embodied in individuals that facilitate the creation of personal, social and economic wellbeing.”* It follows from this interpretation that investment in human capital includes the sum of all costs that allow a new being to reach economic autonomy. In this paper we analyze the family and social dimensions of human capital and discuss how decisions on human capital formation are taken and how its associated costs are shared. The discussion leads us to identify an important paradox underlying human capital formation, namely the fact that while families are its main contributors the benefits of such investment go primarily to society as a whole. This paradox and its consequences are central to two very important current issues. The first issue, one that is common to many developed countries, is low female fertility which is the source, in particular, of population aging. The second issue, affecting chiefly developing countries, is the inequality of opportunities, a problem lying at the root of underdevelopment. Two options are discussed to respond to this dilemma, one based on redistributive programs and another on market solutions. The paper discusses the limits inherent to redistributive programs and goes on to present at length the alternative market solution. In a nutshell this consists of securitizing the human capital of individuals so as to finance the expenses leading to their upbringing, from birth to adulthood. In addition to describing this scheme the paper analyzes its advantages as well as the difficulties associated with its implementation. It concludes by exploring possible interpretations of the scheme and feasible routes for its adoption.

1. The Multiple Dimensions of Human Capital

We all know the importance of children for families, not just for the happiness they bring to their parents but for the role unwittingly played by them in the consolidation and stability of the family unit. In this sense children, enriched by education and other care devoted to them, are not just important for their own families but for the family as a social institution. At this point, it is important to make a crucial observation, which is to be developed later: namely, that important decisions on the formation of human capital, more precisely procreation and investment in new beings, take place predominantly in the realm of the family.

"The main source of wealth of a nation lies in its accumulation of human capital."

In this line of analysis, we cannot ignore the social dimension of human capital. In fact, far beyond giving continuity to a name, a clan or a dynasty, new generations are the thread that ensures the continuity and permanence of the society and civilization to which they belong. Especially in the modern world, with an ever increasing mobility of individuals, it is possible to argue that the benefits that society derives from the generation of new beings, endowed with the human capital they receive, are greater than those obtained by families who made their existence possible in the first place.

Let us adopt now an economic approach, narrow perhaps but nonetheless extremely important. It is commonly accepted that human capital plays a central role in defining the state of development of nations. Just to give an example, human capital, the object of attention of economists for a long time, had a central position in the analysis of the development experience of East Asian countries of the last fifty years. We can say that, nowadays, there is a consensus† that the main source of wealth of a nation lies in its accumulation of human capital. Increasingly, human capital is what distinguishes one country from others and what defines their relative level of economic and social development. Deficiencies of developing countries in this field are the main obstacle for them to finally take a steady route to sustainable development. Not only is investment in human capital by families in those countries limited by poverty but existing income and wealth inequalities imply that, in general, only a fraction of all families are able to make such an investment. This paper intends to discuss concrete steps to initiate a systematic program of reconstruction of human capital, in principle applicable to all developing countries.

2. Decisions on the Formation of Human Capital

It is important to distinguish among two types of decisions, in principle independent of each other. One is the decision on the generation of new beings and the other, the decisions that will be taken on how much will be invested in the formation of human capital. In a way we could say that these decisions relate respectively to the quantity and quality of the new generations. As to the first decision, this is usually the exclusive domain of the family. The family power over these decisions can be affected by policies to control or stimulate births but, with rare exceptions, the effect of these policies is limited. This paper will turn its attention mainly to the second type of decision, which refers to the expenditure or investment in the human capital of those already born, and less to the decisions that led to their birth.

We can observe in the first place, regarding the second type of decision, that decision-making capacity is shared between the family and, through the state, society. Indeed, the state can provide, among other services, education and health at no cost or at a subsidized cost. In many cases some of these benefits have a mandatory character so that the option that families might have, say, to deprive their children of education, is barred from the legal context. Thus society not only contributes to investment in human capital but limits family decisions and, indeed, begins a process of appropriation and assimilation of new individuals. This is undeniably the meaning of, for example, basic education programs established at the level of a Ministry of Education. Despite the existence of social participation in decisions and expenses relating to the formation of human capital, and the fact that they tend to take an increasing importance, the fact is that most of the spending that makes it possible for a newborn to join the adult and social life is still borne by the families. This happens for several reasons. First, spending on education and health is, in the broad interpretation of human capital presented at the beginning of this paper, only a portion of total spending. Second, even in countries with high levels of social development, education subsidies mainly cover the direct expenditures on education and not the indirect costs associated with this activity. Anyway, most of the world’s population lives in countries whose governments do not have economic or political conditions to contribute significantly to spending on human capital formation.

The above discussion leads us to identify what is arguably one of the great paradoxes of society. We have just seen that most of the cost and associated decisions with the formation of human capital are borne by families. On the other hand, we also saw that the benefits of human capital are received to a larger extent by society than by the families. This paradox is not just a curious fact but presents us with a dilemma of undeniable importance. On the one hand, the growing awareness by families of insufficient returns on their investments leads inevitably to diminished incentives to make this investment, a phenomenon that results in decreased fertility entailing the well-known demographic and economic consequences. On the other hand, investment decisions in human capital follow a family logic or, more precisely, a “dynastic” rather than a social logic. Especially in societies with high economic inequalities and acute social stratification this logic considerably impairs the efficiency of investment in human capital.

3. Answers to the Dilemma of Human Capital

One answer to this dilemma that might seem obvious, even though the same cannot be said about its implementation, is the socialization of human capital formation. In its extreme version this would involve social control of all decisions and expenditures on the human capital formation of already born human beings (for simplicity I will not include here decisions on the creation of new individuals). A less extreme version could be formulated leading to control over most decisions and expenses relating to the formation of human capital. This type of transfer of decision-making power from the family to the social realm would naturally generate more efficient investment in human capital and, therefore, establish a social order with equal opportunities for young people. At the same time, removal of the burden of the cost of investment in human capital from families has the potential to correct current demographic trends.

When it comes to socialization of human capital formation it is natural to immediately think of the use of the state apparatus to cover the associated costs. There is no doubt that concerns about deficiencies in human capital formation are not new and many governments, both in developing and developed countries, have established programs that directly or indirectly aim to improve this situation. And the vast majority of these programs are funded by public resources which, in turn, come from tax revenues. Ultimately we deal with programs based on income transfers. We should note, however, that transfers based programs, even if they are an indispensable component of the arsenal of government policies, are limited as a result of political and economic factors. Politically, the natural resistance of the privileged segments of society to subsidize the needs of the disadvantaged increases along with the expansion of transfer programs and may eventually lead to a rupture of the political fabric of society. Economically, the rise in levels of taxation resulting from ever costlier transfer programs can lead to a contraction in investment and thus to a reduction in economic growth. In the case of countries with large needs we must confront the reality that transfer programs may not even meet modest goals for the development of their human capital without exceeding these limits. This is certainly the lesson we can draw as we observe the limited success ongoing programs so far have had.

There is yet another option, so far largely ignored by decision makers. This option comes from the financial markets, which handle large volumes of resources and are guided by the criteria of profitability of their investments. Investment in human capital is undeniably one of the most profitable and this raises the question of how to attract investment flows from the financial markets. The key to successfully face this challenge is a combination of non-reimbursable programs (transfers) and reimbursable programs. The latter would be directed to finance the formation of those elements of human capital that directly increase the potential of their holders to generate wealth, such as education and the acquisition of other productive capacities. The simplest method to finance this investment involves the issuance of impersonal (anonymous) securities by the beneficiaries. These titles would be centralized by a public body responsible for the administration and supervision of the system created for this purpose, traded in financial markets, and rescued by the beneficiaries themselves once the investment begins to pay off. The advantages that this option offers are manifold. First, the impersonal nature of the securities, in addition to the dissemination of risk among a universe of beneficiaries, allows any individual, regardless of their family status, to have access to this type of financing. It thus generates an equity environment highly positive in economic and social terms. Second, investment in human capital through these human capital (HC) securities responds to the interests both of investors and beneficiaries, thereby eliminating resistance from the most privileged sectors of society to development programs on human capital. Third, the development of human capital of the population has a powerful effect on economic and social growth: in the short term, the expansion in demand for goods and services; in the medium and long term, full realization of the potential of the country.

4. More on the Securitization Option

Let us present now in some more detail the option just outlined. In a nutshell this section is about securitizing the human capital of individuals so as to finance the expenses leading to their upbringing from birth to adulthood. The first step in this direction is the creation of a personal account for each individual at the moment of their birth. In the full or ideal model of the scheme all expenses related to each and every new individual, say from age 0 to age 22, automatically generate liabilities to the account and assets for the provider of goods or services. The individual must later repay the accumulated debt over a sub-period of his/her working life. An important characteristic of the full scheme is its universality (within a country). Another necessary feature, especially needed for the full version, is that although mainly private financial institutions would carry out trading in the securities that the scheme is bound to generate, the entire system needs to be overseen by the state in order for its soundness to be ensured.

The proposed scheme is based on three principal tenets: first, a comprehensive interpretation of the meaning of human capital; second, a reliance on the use of modern financial instruments and markets, and; third, the assignment to central government of a coordinating and supervisory role. About the first, and as explained before, we adhere to the broadest definition of human capital, not limited to the expenses associated with the obviously marketable skills and abilities acquired through vocational education, but instead covering the total expenses required to take an individual from birth to the labor market. This is, of course, an ideal definition, from which it might be convenient to deviate for practical purposes. But the point to be stressed is that the comprehensive definition of human capital is a better reference than the limited definition comprising only investment in vocational education.

The second tenet relies on the notion of “securitization”, which means that investment in human capital would result in the issuance of negotiable claims on the future stream of earnings of its beneficiaries. These claims would be bundled into financial products of convenient sizes and maturities, which we will call “human capital” securities, or HC securities, with the potential to become one of the main staples of the financial system.

The third tenet is provided by the role assigned to the central government playing the key functions of coordination and supervision of the entire scheme. The case for a government role is strengthened by the obvious need to build public trust in the scheme and by the requirement of universality that is central to its social purpose. Important tasks executed by the central government, through a specially designated entity, would include the anonymization of HC securities (with the consequent socialization of their associated risk), and the enforcement of payments of interest and principal by their beneficiaries.

In the context of the discussion of the previous section, the proposed scheme has the effect of eliminating most if not the entire burden of investment (grants) by families. Although at the operational level the financial markets would manage this investment, in the end it will of course be the public who will undertake it. The novelty is that the investors are now set to receive the return (and principal) on their investment.

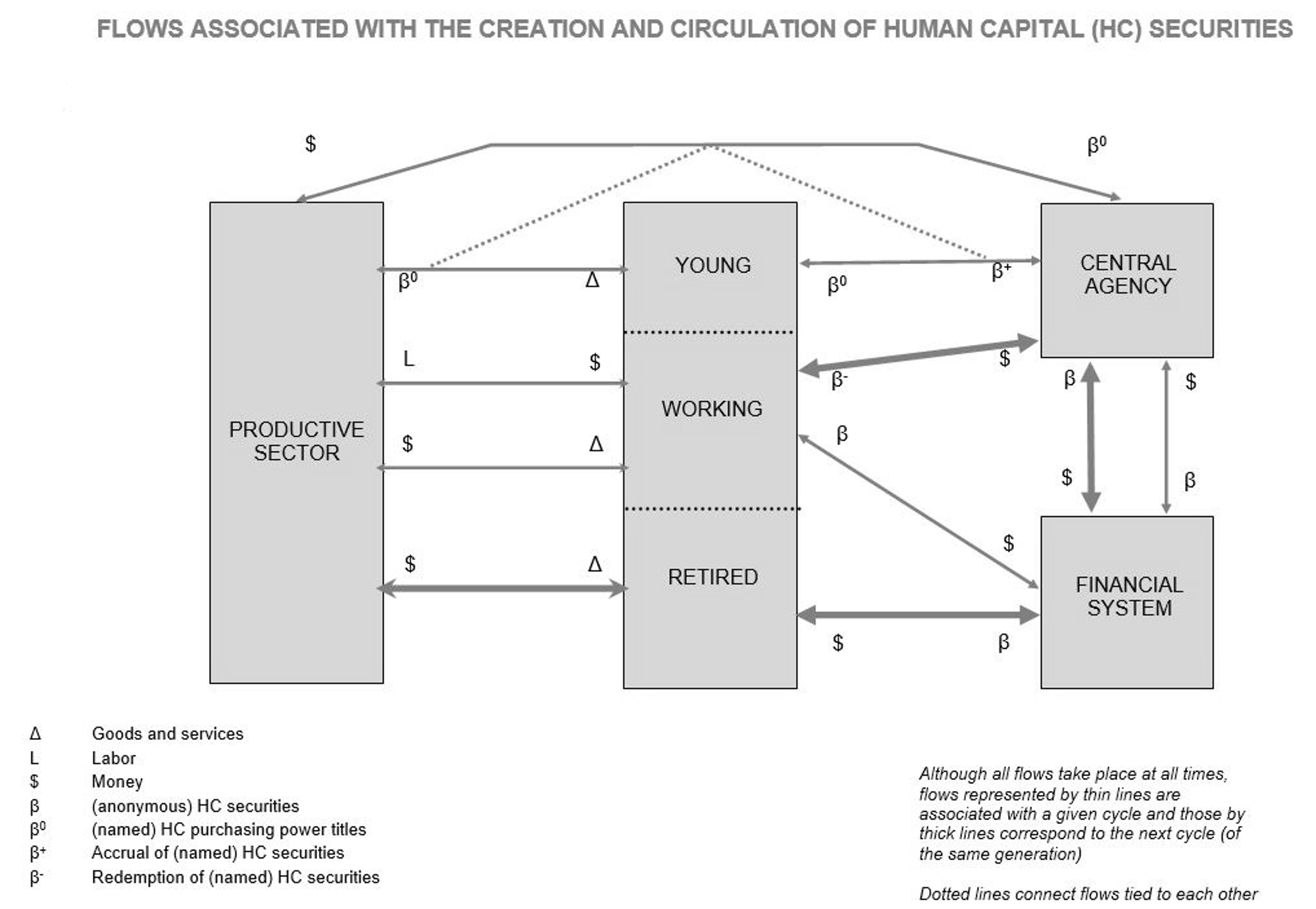

Figure 1 provides a graphical illustration of the economic flows associated with the scheme. The population is broken down into three functional groups or cohorts: young, working adults and retired. The other boxes represent the productive sector, the financial sector and the central agency (CRR). Earnings of the working population, consisting in this simplified model entirely of wage income, are spent in one of three ways: their own consumption, repayment of their own debt to the CRR, and purchase of HC securities issued as a result of the consumption of the young (investment in human capital). The consumption of retired people is financed by the proceedings of the sale of the HC securities they had purchased while they were of working age. The diagram also shows the transactions between the CRR and the financial system, both creation of HC securities and their redemption, and the triangular transactions associated with purchases of goods and services by the young.

Several interesting sub-diagrams or circuits deserve special notice. The first is the circuit of flows between the productive sector, the young population and the CRR that correspond to the triangular transactions previously mentioned. A second circuit is that between the productive sector, the working population, and the financial sector (including the CRR), comprising the flows associated with the financing of the consumption of the young. This circuit highlights the fact that the working-age population finances collectively the (human capital) expenditures of the young. This feature of the proposed scheme is in stark contrast with the characteristics of the existing system whereby the funding of those expenditures takes place at the level of the family unit. The collective nature of this financing is, however, not imposed by the state but is rather the result of rational saving decisions taken at the level of the individuals or families.

While these two circuits are synchronous, relating different contemporaneous cohorts, the next two noteworthy circuits are inter-temporal and involve single cohorts through their lifecycle. The first of them represents the acquisition of debt by the young and their later redemption while working, thus comprising flows between the people at those two moments in their lives and the CRR. And the last involves the purchase of HC securities by working adults and their sale for the sake of consumption after reaching retirement age, thus comprising flows between the population and the financial system. In terms of the mathematical model that this diagram suggests, which will not be developed here, these circuits correspond to some of its equations.

5. Advantages of Securitization

The most obvious advantage of the proposed scheme and also one of its primary justifications is its promise to bring about equality of opportunities for all newly born individuals. Milton Friedman had already noted this effect as a consequence of his proposal‡ to have the central government take equity stakes in individuals through the financing of their vocational education. It should be easy to appreciate, however, that a scheme limited to higher education will afford equality of opportunities only to those individuals who have reached a level of social development preparing them for access to such institutions. The current scheme, relying on the broader definition of human capital, has the potential to extend equality of opportunities to all newborn individuals. This distinction is especially important in the case of developing countries where, typically, only individuals born in the middle and higher classes will be properly qualified when they are ready for vocational education. In the case of least developed countries or regions within a country, realizing equality of opportunities at birth may well signify the difference between life and death. A related benefit of the scheme is the effect it is bound to have on the distribution of wealth and income. This effect would be less immediate than the effect on the equality of opportunities but, clearly, income and wealth disparities would be progressively reduced.

“A scheme with the capacity to unleash the full potential of human capital is poised to become an essential element of development policies everywhere.”

A second powerful advantage of the scheme is that it enables a country to realize its full economic potential. As it has been realized by development economists, particularly through the experience of East Asian countries during the latter part of the past century, human capital is the most important component of the wealth of nations.§ A scheme with the capacity to unleash the full potential of human capital is poised to become an essential element of development policies everywhere. In addition, as noted and thoroughly developed in the recent writings of James Heckman,¶ investment in human capital at earlier ages is significantly more cost effective than at later periods of life. The latter constitutes an additional and powerful argument in favor of the adoption of a broad definition of human capital and of the universal application of this scheme.

To the extent that HC securities are traded internationally, the scheme can open the way for the participation of international financial markets in development aid while creating a new role, as intermediaries and guarantors, for multilateral development agencies. This internationalization of the scheme is of particular interest for those countries whose financial systems are little developed. It also points towards its use in designing innovative and integrated programs of international development assistance that would channel funds directly to beneficiaries, thus diminishing the perils of corruption.

There is another potential effect of this scheme, which is of a quite different nature. This effect has to do with demographics and can be understood by an examination of the factors behind fertility. Several factors help to explain female fertility and the size of families, some of them being economic, others of a social, cultural, even religious nature. We will not attempt to offer here a thorough explanation of this complex subject, but it is undeniable that by removing the purely financial constraints on families to have children, the scheme has the potential to reverse the demographic trends that negatively affect an increasing number of countries. While many other factors have an adverse effect on the fertility rate, the purely economic factor remains a powerful one.

6. Relationship with Other Existing Schemes

It is interesting to note that there have been some recent trends having the effect of families transferring to governments, investment in the growth of their children’s human capital. The first trend relevant to this inquiry is the increased use of family policies by governments to promote child development, gender equality, income stability, and balanced population growth. Although these objectives do not explicitly include human capital development, the end result is that family policies effectively increase the share of state and local governments in total investment in human capital. In some instances, this happens through the substitution of investment by families, while in others, it leads to investment that would have not taken place otherwise. European countries, particularly France and most Scandinavian countries, have led the way in the expansion of family policies during recent decades.**

Education policies have had a similar impact in reducing the burden upon families of the investment in the human capital of their offspring. In some cases, as it may happen with educational loans, that burden is shifted to the individuals who are benefitting from them. In other cases, the burden is (partially) shifted from families to central or local governments. As it was the case with family policies, part of the investment (in education) will be “new” investment, and will thus result in an increase in total investment in human capital.

A third interesting trend is a relatively recent set of innovative social programs that channel resources from governments to families through a combination of education and family policies. A prime example is the “Bolsa Familia” program that has been implemented over the last few years by the Government of Brazil. This program makes cash payments to poor families (or rather to mothers) on the condition that children will regularly attend school and submit to health tests. Mexico’s “Oportunidades” program is another similar and successful example that has existed for several years. These are examples of conditional cash transfer (CCT) programs, a new trend in human capital investment.†† All these three trends contribute to the increase in total investment in human capital and have to do with a shift of the shares in total investment away from families and (mostly) towards governments.

It must be noted that they are all based on redistributive transfers rather than, as is the case with the currently discussed option, on markets. In real-life situations both types of instruments will need to complement each other. This is particularly true for countries with large income disparities. Transfers have a clear limitation, not in the least political, as a tool to solve critical social issues in such a context. Likewise, financial tools like the one being proposed here need to be complemented by transfers, at least during the transition period. An example will help to clarify this point. This has to do with the application of the scheme to children living in extremely poor households. It is easy to imagine the awkwardness and flawed character of a situation when children have the ability to automatically fund all of their basic needs while their parents live in extreme poverty. The tensions generated by this scenario have the potential of rendering the scheme ultimately unsustainable, at least for poor families. A possible way of dealing with this situation, during the transitional period, would be the combination of the scheme with conditional cash transfer programs addressed to families and associated with observance of the scheme.

7. Practical Issues and Implications

This is clearly a scheme of such magnitude that it will have a massive and profound impact on all spheres of social life. As such it is bound to raise a host of issues, some of which we will discuss briefly in what follows. These issues can be categorized as being of a systemic, economic, political, or social nature.

As for systemic issues, the most important have to do with size and complexity. The universality of the (full) scheme, one of its defining characteristics, implies that its management will require the processing of huge amounts of data whose integrity needs to be protected throughout the lifetime of individuals. The generation of claims by individuals, that of corresponding credits by the providers of goods and services to them, the recording of these transactions by the designated government entity, and so on up to the withholding of debt service payments from workers’ earnings and to the settling of their debts, all of these operations need to be handled by large information systems functioning smoothly, in a coordinated manner, and without fault. Although these requirements are not trivial, similarly massive systems are successfully handled in other contexts. In that sense, they are not beyond the current state of the art information and communication technology. Related systemic issues have to do with the need to control which individual expenses are entitled to the generation of claims, and with the prevention of fraudulent use.

Among the economic issues, two are of the highest importance: they have to do with macroeconomic adjustment to the scheme and its financial implications. It is easy to see that implementation of the full scheme would give rise to a large spike in demand for goods and services that were previously inaccessible to poor segments of the population. No economic system would be able to adjust timely to such a surge in demand that would require, in addition to an accommodation of the provision of goods and of the facilities needed to raise their production, the availability of personnel able to offer specialized services in health and education among others. In addition, and perversely, the less developed the country, the higher the potential surge in demand that would be observed. This is an issue that, though not fatal, makes evident the need for careful adjustment of the scheme to the particular situation of each country, a theme that will also be raised in the following section. The second economic issue is the impact that the generation of claims by individuals and, in consequence, of HC securities has on the financial system. Assuming that the scheme is implemented in its most complete form, the accumulated stock of HC securities may reach an amount equivalent to between four and five times the Gross Domestic Product of the country. These are quite large, although not unmanageable, amounts. They would, however, have an important effect on financial markets and investment in HC securities which might crowd out other less sound forms of investment. Once again, there is good reason to examine ways in which the scheme could be shaped to suit particular national situations.

There are other important issues that deserve notice, although we will only briefly touch them. First, implementation of such a system deepens the bond between the individual and society to an extent that might be considered extreme by some. Whereas in the current social system individuals have at most a moral debt towards their parents for having provided to their needs during an early age, in the proposed system individuals would instead have an actual debt and the associated legal obligation to service and repay it. Such a new situation would require the adaptation of social institutions and attitudes as well as the creation of additional government institutions.

A second related issue is the ethical objection that some might have towards the perceived constraints on individual freedom that the system implies. Although it would be hard to associate this system with slavery, given that eventually everybody would be an investor as well as a debtor, the fact is that it would become more difficult for anybody to break away from the social system.

The third issue that needs to be mentioned has to do with intra-family relations. At least in Western societies, the decay of the family as an institution is a well-recognized and an often lamented fact. The transfer of the economic costs of the upbringing of an individual from the parents to the individual proper has a clear potential for a further weakening of parental authority. These are all difficult issues for which it would be presumptuous to claim proper answers at this moment. We could perhaps say that society has been evolving through the ages and that, whenever faced with choices that combine higher welfare with deeper forms of social organization and control, it has generally adopted them.

8. Scalability of the Scheme and its Parameters

Many of the difficult issues just reviewed are related to the magnitude of the scheme. Downsized versions of the full or ideal scheme, while retaining some of the benefits of the full scheme, will be more amenable to implementation. In what follows we will discuss some of the main axes along which this scheme can be redimensioned and adjusted along with the corresponding parameters that need to be considered. These axes are related to the population covered, the age of coverage, the goods and services coverage, and the depth of coverage.

"The real wealth of a nation, developed or developing, resides in its people and their ability to innovate."

On population coverage, the ideal model assumes universal coverage. It is possible, however, to envisage coverage initially limited to disadvantaged sectors of the population. Such limited coverage would still go a long way towards fulfilling the main objectives of the scheme and, in addition, leave open the possibility of a progressive extension of coverage to larger sectors of the population. The age of the covered population can also be adjusted so as to facilitate the implementation of the scheme. Both the goal of the equalization of opportunities and the previously mentioned Heckman argument on an inverse relationship between returns to human capital investment and age of beneficiaries, advise towards beginning coverage from birth. On the other hand, the choice of an upper limit age of coverage is related to the degree of economic development of the country, to its educational system, and to labor market regulations and practices. When examining the coverage of expenditures on goods and services it will be useful to proceed to a categorization of those goods and services and to distinguish among them by a degree of necessity. Arguably, coverage should include basic services such as health and education, although even within these some scaling may take place. Finally, the depth of coverage refers to the percentage of expenditures that is to be financed by HC securities. While the ideal scheme corresponds to a 100 percent depth of coverage, practical considerations and the specificity of each national or regional context may impose the choice of lower rates and the definition of depth schedules according to income levels. For all axes being considered, coverage can be extended gradually through time.

This brief discussion makes clear that there are multiple ways in which the proposed scheme can be downsized so as to make feasible an initial implementation. Such a constrained implementation does not preclude a progressively more complete application of the scheme over time. It also appears that the scheme can be of use as an inspiration for much more specific programs aiming at particular aspects of human capital formation. The key to the success of such specific programs is their impact on the overall productivity of labor and the practicality of repayment of the debt incurred by beneficiaries. Finally, the discussion also shows that some existing programs, that make use of financial tools in order to fund social needs, may be seen as potential precursors of the scheme being discussed.

9. Final Thoughts

There are at least two possible interpretations of the securitization option just discussed. As a complete scheme, it is an ambitious proposition whose implementation, albeit in a reduced version, presents many obstacles. Some of them are of a technical or logistical nature and, in principle, could be handled. Others are related to the natural difficulty of accepting radical ideas and to the legitimate ideological differences about the organization of society and the respective roles of families and government. The second interpretation is that of an ideal concept which suggests concrete ways of using financial markets to address development issues that have persistently challenged policies.

The scheme should also be seen in the context of the evolution of the ideological environment of adjustment to the current economic crisis and its consequences. First, there is a growing awareness that the real wealth of a nation, developed or developing, resides in its people and their ability to innovate. Nations should be assessed not by their endowment in natural resources, nor the amount of foreign reserves in its vaults, but by the knowledge and skills embodied in their people. Secondly, there is great disappointment with a financial system that has grown on weak foundations. As the financial system is reconstructed, the proposed securities (human capital) may appear as an attractive new asset type, backed by the safest of all investments, our population.

Bibliography

- Cunha, F. and J. Heckman (2007), ‘The Technology of Skill Formation’, AEA Papers and Proceedings, 37, 31-47.

- Damon, J. (2005), “Les politiques familiales en Europe: aperçu et typologies,” in La famille, une affaire publique, Michel Godet and Evelyne Sullerot, eds, (Paris: La documentation française).

- Friedman, M. (1955), “The Role of Government in Education” in The Economics of Public Interest, Robert A. Solo, ed, (New Brunswick: Rutgers University Press).

- Heckman, J. (2006), ‘Skill Formation and the Economics of Investing in Disadvantaged Children’, Science, 312, 1900-2.

- Organization for Economic Co-operation and Development (2007a), Human Capital: How What You Know Shapes Your Life, (Paris: OECD Insights).

- Organization for Economic Co-operation and Development (2007b), Babies and Bosses: Reconciling Work and Family Life, (Paris: OECD).

- World Bank (2003), The East Asian Miracle: Economic Growth and Public Policy, (Oxford: Oxford University Press).

- World Bank (2006), Wealth of Nations: Measuring Capital for the 21st Century, (Washington: The World Bank).

- World Bank (2009), Conditional Cash Transfers: Reducing Present and Future Poverty, (Washington: The World Bank).

* Oganization for Economic Cooperation and Development (2007a)

† See, for a comprehensive elaboration on this theme, World Bank (2006)

‡ Friedman (1955), p. 143

§ See, for instance, the World Bank (1993) report on The East Asian Miracle

¶ Representative works include Heckman (2006), and Cunha and Heckman (2007)

** See Organization for Economic Co-operation and Development (2007b) and Damon (2005)

†† The World Bank (2009) has analyzed extensively CCTs, in particular their effect on human capital investment.

- Login to post comments