Hello Visitor! Log In

The Riches of the Ocean for Humankind: Rethinking Value in Economics and Development

ARTICLE | May 14, 2014 | BY Orio Giarini

Author(s)

Orio Giarini

Abstract

We acknowledge the inadequacy of the ancient model to develop the wealth of nations and the recognition that both economics and ecology are the best possible ways to manage world and human resources to achieve a better wealth of nations. The rebuilding of economics and of a credible strategy for increasing the wealth and well-being of nations is today at the center of the problem of providing a sound basis for the legitimacy and credibility of public institutions and governments. If the dichotomy between traditional economic goals and new ecological and environmental requirements for sustainable development will not credibly combine, the political consensus and the legitimacy of governments at the local, national, and international levels will have a tendency to produce on the new liberalizing world disaggregation effects that could be as extensive as those witnessed in former Marxist countries.

The oceans are a fundamental part of this patrimony and Elisabeth Mann* should be remembered for her very important dedication on this issue.

1. Introduction

I had the privilege of knowing Elisabeth Mann Borgese for over 20 years. I first met her on the occasion of the conferences of the Club of Rome. She was clearly one of those persons who provides you with an example of how human beings, from time to time and thanks to exceptional individuals, are capable of creating a better standard for the civilized part of our human history.

I am still so grateful to her for having been interested in my efforts to better understand “in the present world” the search for the wealth of nations that is really going on. Over 50 years of experience in the chemical industry, industrial and technological research, the financial sector studying the management of risks and uncertainties, teaching my subject (service economics) at university, and having even some political experience within the European Federalist Movement, have served as references to build up some hypotheses and ideas. I have also drawn on the views expressed in relevant economic and social literature. But it is clear that my views have grown somewhat diverted from those of the economic establishment.

Elisabeth was in fact looking for a better answer to the question “What is the value of the oceans?” Value in conventional economics – as it was borne of a consequence of the development of the Industrial Revolution – is linked to the basic notion of scarcity of resources and to their pricing in the market system. Resources that are not scarce and are not exchanged have in principle no theoretical value. But what about those resources that are not scarce in the beginning, but which become scarce when over-exploited or polluted?

Adam Smith wrote the fundamental starting text of economics over two centuries ago – The Wealth of Nations. What about the economic price-value of goods and services that have become scarce after having been available at no cost?

Furthermore, at the macroeconomic level, the average educated person is not conscious that a measure of the gross national product is a measure of the flow, whereas talking, for instance, of the value of the oceans and of any other resource on earth is a matter of evaluating a stock. That is, a stock that can become scarcer and therefore more and more costly and “valuable” and where sometimes technology and advancement in research are capable of creating a situation of such abundance that the products of services become almost free, as could be the case in the telecommunications sector. All this is linked to what I have tried to describe in a few books as the passage from the industrial economy, which is the basis for modern economics, to a service-based economy where the notion of stock, performance, and uncertainty in time replaces day-by-day equilibrium-based traditional economic theory.

I am a sea and ocean lover, but I am not an ocean expert. Nevertheless, the question of identifying the economic and social value of the oceans has inevitably to do with the identification and measurement of a stock (i.e., in terms of price and indicators), whatever its nature.

I was always very thankful to Elisabeth for having grasped the essence of my attempts to enter and develop this debate. As a consequence, she made reference to my writings in many of her books and articles.1 In one of her last writings,2 she even went on to the issues of risk and uncertainty that are inevitably linked to the new service economy and to the identification and discussion of any policy that has to do with the performance and sustainability of any stock – and even more so the oceans – in the future. In the following paragraphs, I insist on two key issues: the economics of common heritage and the notion and strategy of sustainable development.

2. The Economics of Common Heritage

2.1. The Concepts of Common Heritage of Mankind and Dowry and Patrimony: In Quest of an Adequate Notion of Economic Value

The concept of Common Heritage of Mankind as developed by its principal author, Arvid Pardo, Ambassador of Malta to the United Nations in the 1960s, is characterized by the following:

- the non-appropriability of the common heritage;

- a system of management in which all users share;

- an active sharing of the profit and benefits derived from shared management and transfer of technologies;

- the reservation of ocean space for peaceful purposes; and

- its reservation for future generations.

As Elisabeth Mann Borgese stated in her report to the Club of Rome, The Future of the Oceans,3 there are some startling similarities between the concepts of Common Heritage and Dowry and Patrimony (D&P) developed in the report to the Club of Rome.4

In fact, a lot of work has been done in the last few decades by private research centers, as well as by international organizations, to define the value of so-called non-economic goods.† Although I respect and take into account all these efforts, I feel the necessity to become more provocative and to say that conventional economic wisdom does not fundamentally provide instrumental measures that are adequate to evaluate the real economic value of oceans as common heritage.

This article therefore will be very risky for its author. Firstly it will try to prove that conventional economics does not provide the necessary tools for what is needed. Secondly, it has to explain why the fundamentals of conventional economics have been developed in quite another context and with other objectives for measurement that are now out of context. Thirdly, this short article has to open some avenues to find other plausible and useful references.

The reader will admit that such tasks are almost equivalent to intellectual suicide. I have a little excuse in the fact that these ideas are based on more than 40 years of research and practical testing in economic activities, both in industry and services. Perhaps the most demanding element of this article is to try to explain how and why a conventional economic theory functions as it does today, and why it is theoretically inadequate.

3. Measuring Value in the Industrial Revolution: The Monetarized Flow

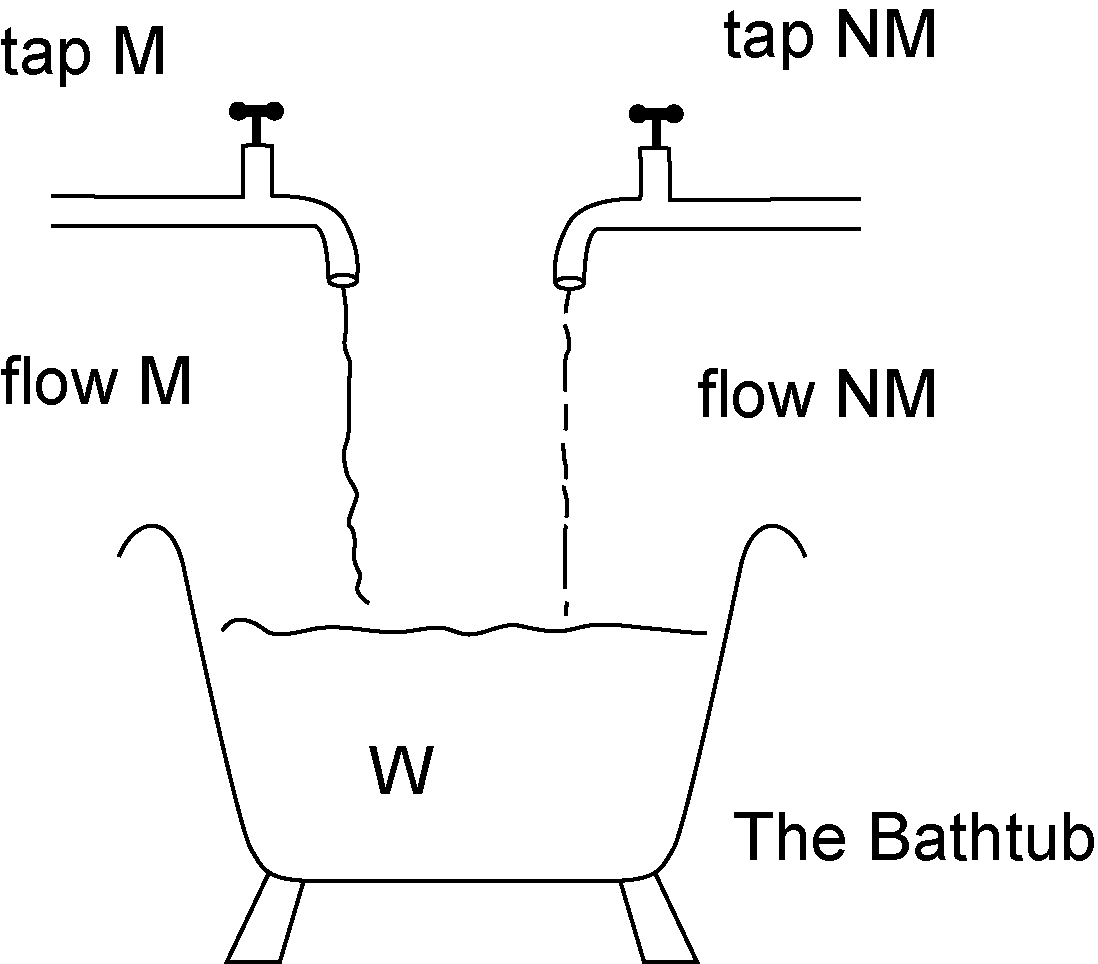

It is essential to understand that the measurement of value in economics refers to the measurement of a flow. This can best be explained as a bathtub with two taps, as shown in Figure 1. The bathtub contains a certain amount of water W, representing a stock of wealth that we use for our needs and pleasure. This stock of water W is fed by two taps:

- the tap M represents the flow of monetarized production, which pours additional wealth into our stock W;

- the tap NM symbolizes the flow of goods and services that also increase our wealth, but the production of which is nonmonetarized. It refers for instance to free, unpaid human contributions, or free goods like air.

Figure 1: The Bathtub of Economic Wealth

Flow M: The flow of monetarized goods and services including money itself.

Flow NM: Flow of goods and services that also increase wealth but the production of which is nonmonetarized: unpaid human contributions, or free goods such as air.

W: The stock of wealth that we use for our needs and pleasure; the utilization value of this stock depends on the quality and quantity available.

When reading about economic indicators, many problems arise in our mind from the lack of distinction between what relates to our stock of wealth W (monetarized or not) and what refers to the flow F (monetarized or nonmonetarized). The value added in economics is essentially a measurement of the monetarized flow.‡ It measures how much monetarized production is passing through tap M to increase the stock of wealth W. The underlying assumption rooted in the Industrial Revolution is that any additional flow represents an equivalent increase of the stock W (i.e., a value added).

The first reason for choosing the monetarized flowFM instead of the stock of wealth W as the measurement reference is that the statistical measurement of the flow is easier to do. The measurement of the stock, in contrast, appears much more complex because all sorts of nonmonetarized production that inevitably intervenes may not be noticed and because, in the case of the sale of a part of our stock, a definite reference value to refer to the loss in stock or wealth may not be available. However, the fundamental assumption of this reasoning still is that the production of the monetarized flowFM is equivalent to an increase in wealthW!

Over the last 20 years, we have perceived the emergence of a new type of problem linked to environmental and ecological constraints, which strongly suggests that the monetarized flow is not always an addition to wealth; the monetarized flow contains a nonnegligible part of pollution that does not add to, but destroys wealth.5 Part of the “added value” is then in fact a “deducted value.” The measurement of growth as expressed in the gross national product is precisely and only the measurement of such a monetarized flow at the macroeconomic, national level. It excludes the standard accounting practice used by all industrial companies and individuals: an accounting of total assets or stock available, and total liabilities incurred (the balance sheet), of which the analysis of the flow of activity performed during a given period of time (the statement of income and expenses) is an integral part. At the microeconomic level, it is a matter of common knowledge and common sense that the differential in total value of assets (e.g., stock) does not necessarily coincide with the volume of activity performed over a given period of time. The accounting of assets is a process that determines the accumulation of an activity during a longer period of time, rather than simply measuring if the monetarized flow during this same period of time has increased or decreased, but remaining always by definition bigger than 0!

During the classical Industrial Revolution, it could be assumed that the amount of monetarized flow largely corresponded to increases in the stock of wealth. In the modern economy,6 this is no longer true; the real level of wealth (i.e., the stock) depends also on nonmonetarized contributions and deducted values. In the first phase of the industrial revolution, value added coincided largely with the real utilization value and as such became the primary indicator of the growing wealth. The notion of utilization value itself refers to the assets (stock) and the way it is used in time, in contrast to the notion of added value referring to the flow of monetarized production.

The measurement of such stock can of course only be approximate and will be partly subjective: this means that the decision of what has value partly becomes a matter for political consensus. The future choice may well be between a system of flow measurement that is quantitatively precise but is increasingly losing its significance, and systems of asset measurements that might be less precise but will be more relevant to the real world. The quantification of nonmonetarized wealth elements can be achieved by adequate indicators. This is a crucial topic, as any method of asset accounting would also enable a better definition of riches and poverty, and this avoids the perpetuation of a system accounting a misleading level of wealth, as the nonmonetarized contributions to the wealth of one country may be higher than the one of another country.7

4. Old and New Shortcomings: Wealth and Riches

Classical economists, and in particular, Ricardo, were well aware that the accounting of economic wealth that they were elaborating was not really comprehensive of the real level of wealth of an individual or a country. A clear distinction was made between the notion of riches, on the one side, and of wealth, on the other.8 There was even an implicit admission that an increase in wealth could eventually correspond to an increase in riches.

However, these considerations remained secondary because the main problem during the Industrial Revolution was to identify the most dynamic system of increasing the wealth of nations, that is, the industrialization process, and to concentrate on its development. Inconveniences and discrepancies between wealth and riches were considered to be of minor importance. The writings in classical economics and some of the later commentators9

were a consequence of the fact that the first formalization of economic theory was a description of the industrialization process; the priority was to measure a flow of goods and the value added.

In the modern economy,10 when the industrialization process, although important per se, is no longer identified as the prime mover to increase the wealth of nations, the problem is quite different and the contradiction between wealth and riches becomes much more important. The divergence of the notion of riches versus the notion of wealth corresponds to what can be called the development of deducted values in the modern economy. The increase of these deducted values stems from the increasingly higher allocation of economic resources to activities that do not add to the real level of wealth or of riches, but which are in fact absorbed by the rising costs of the functioning of the economic system (e.g., the costs for waste management).

5. The Global Stock of Our Riches: The Dowry and Patrimony

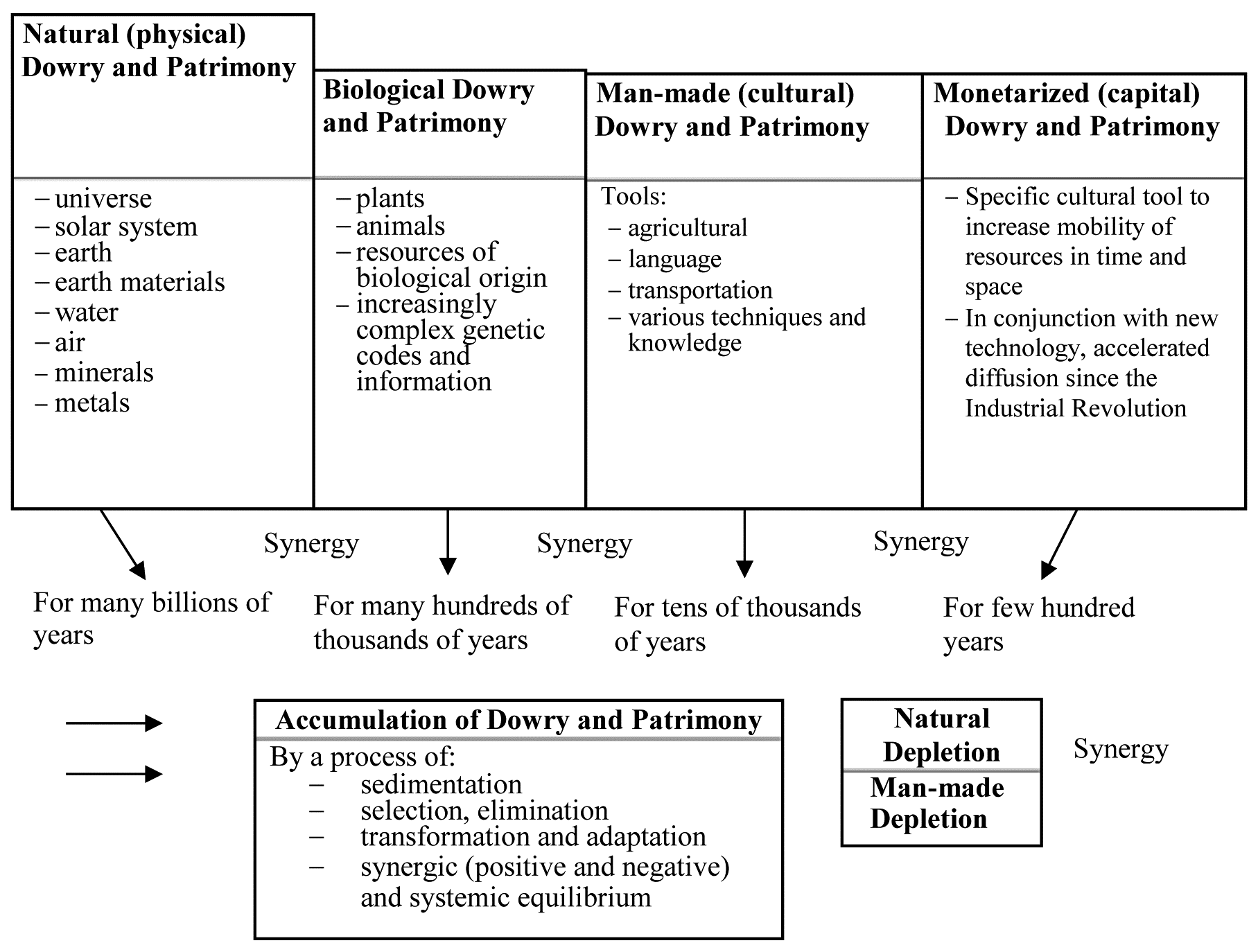

The stock of riches, which provides all the resources and the environment for our life on Earth, can be summarized in the following table (See Figure 2). We call this stock Dowry and Patrimony (D&P) and we would like to underline the fact that it is the ultimate source of economic value. Within these different types of riches, there is one, the monetarized patrimony, which represents the contribution of the Industrial Revolution to the overall accumulation of wealth.

Obviously the oceans, as any other Earth resource, are a combination, in terms of riches, of the various types of D&P mentioned in Figure 2.

6. Assessing Riches, Wealth and Welfare

In the previous paragraphs we have already tried to point out two key elements that make conventional economics an inadequate tool to evaluate the economic value of common heritage and of the oceans in particular. The first concerns the very notion of value, which relates to a flow of monetarized (or implicitly monetarized) goods and services. This flow is always supposed to be positive, but in fact it is also negative in terms of wealth accumulation. Secondly, it is a measurement that is very partial with regards to both the nonmonetarized flows and the results of all flows on the level of riches or D&P. All this intellectual construction of classical economics rests upon the assumption that the flows of added values are adding to wealth, at least as a priority tool, and as such remain the major reference for economic policy.

We contend that although the management and stimulation of value added in this sense is still very important, it tends to be of secondary importance, at least in the terms conceived during the Industrial Revolution, in an economy where one has to evaluate the final results on the level of the riches on the one side, and where the very process of the production of added value depends more and more on service activities.11 The real problem we have to face at this stage is to reformulate a definition of value so that we can elaborate a system of indicators more appropriate to evaluate, monitor, and establish economic policies, and to complement the single indicator of the monetarized value added.

Figure 2: Dowry and Patrimony (D&P): The Accumulation Process of Resources12

At this stage we have to go back to consider all the indicators that have been provided for the last decades to measure various aspects of economic activities. Many indicators have been proposed and used in both a socioeconomic context (“social accounting”), in an institutional company context (“social audit”), and even in an individual context (“satisfaction indices”). The World Bank has made in the last few years consistent steps in our direction by publishing reports integrating various welfare indices. The problems and criticism against such indices vary.

The first criticism, coming from economists, is that social indicators are sociological tools that do not directly concern economics. This criticism derives once more from the identification of economics with the monetarized economy. In fact, it should be recognized that these indicators are related to the definition of and search for wealth and welfare, and that their existence and even proliferation are a sign of the growing dissatisfaction with the traditional tools of economic measurement, precisely in view of economic goals (i.e., developing the wealth of nations) and research objectives.

| The traditional concept of value in economics may constitute an unacceptable factor because it presupposes a world in which living conditions, constraints, and appreciations are uniform. |

The second criticism is that the indicators are very often too qualitative and difficult to quantify. This is obvious; however, there are also clearly many cases in which quantification is, in reality, a meaningless process. For example, because value added entails certain deducted values, it can no longer be considered a reliable indication of wealth and welfare even though it can be measured relatively easily. The first requirement is to be sure that the measurement in question has the expected significance. To select factors in a system on the basis of their direct measurability and not in terms of the behaviour of the system in itself and its goals clearly leads to aberrations.

The third criticism relates to the multiplicity and variety of these indicators. The “indicators” movement may seem to be the outcome of different situations; it leads to very different types of motivation. Two types of answers can be discussed. The first is that wealth and welfare can be differently defined in different places and cultures, as well as in different moments in time. It is the very inflexibility of the traditional concept of value in economics that may constitute an unacceptable factor, because it presupposes a world in which living conditions, constraints, and appreciations are uniform. The diversity which, in fact, exists should not be taken as evidence of any lack of consistency and logic of the “indicator” movement. On the other hand, the earlier-mentioned lack of any adequate theory of wealth and welfare has probably impeded a more successful use of such indicators.

A more comprehensive theory of wealth and welfare of the kind proposed here tries to provide a basis for a more consistent approach and actually encourages utilization of the indicators. In fact, the whole target of this article can be defined in the following way:

- first define a new theory of value (utilization value);

- then devise the most appropriate methods and possibilities of measurement and the judgment (selection of indicators);

- in this way open the possibility of defining new operational economic policies, for instance, in the fiscal and monetary field as well as in the preservation and development of nonmonetarized resources.

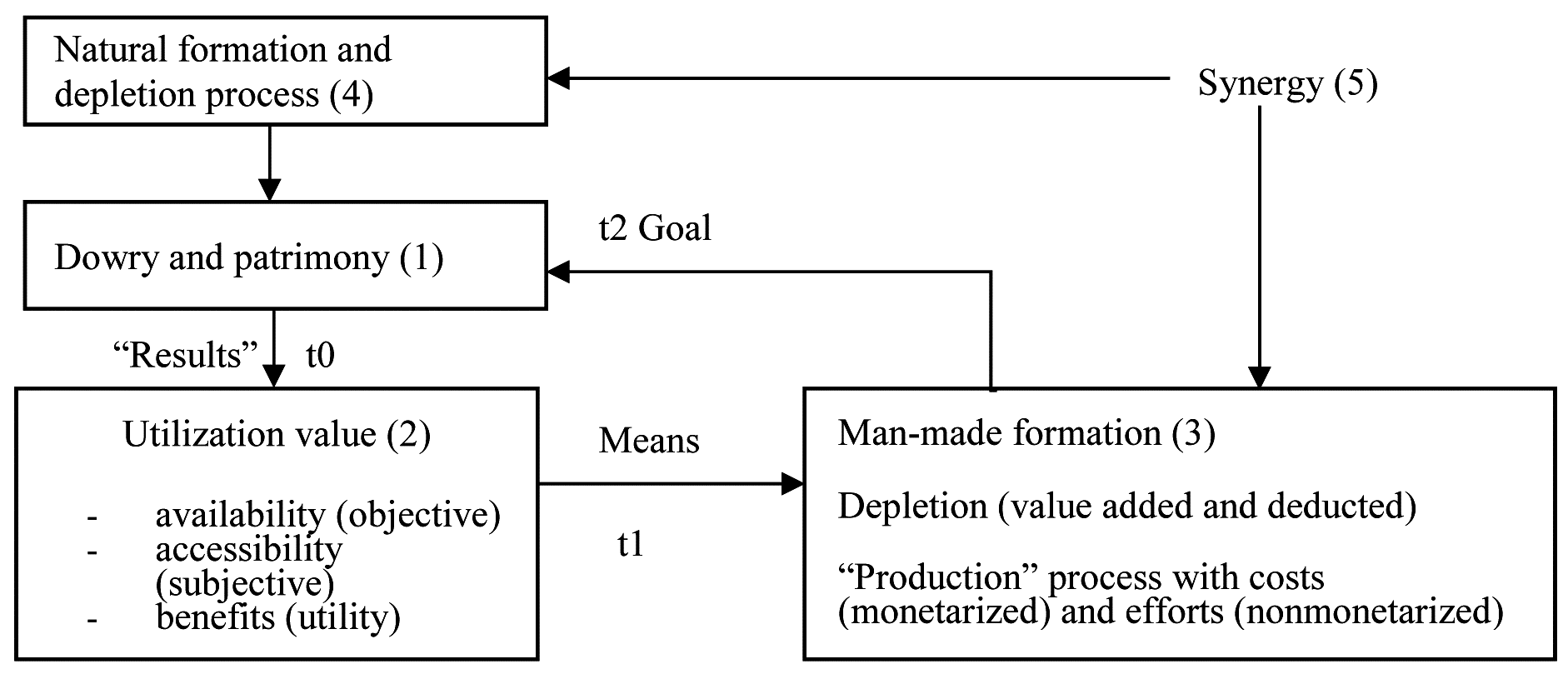

We will therefore bring together the various ideas on D&P, utilization value, and deducted and added value in an attempt to set out a systematic reference framework for assessing wealth and welfare on the basis of figure 3. Figure 3 proposes a logical sequence of D&P formation and use in time and space, a prerequisite for any research on its general structure.

Figure 3: The Dynamics of Dowry and Patrimony and the Classification of Indicators

Central to the notion of wealth and welfare is the concept of Dowry and Patrimony (D&P, box 1), including every available resource and asset, material and nonmaterial, monetarized or nonmonetarized. Economists have taken a timid partial step in this direction when they talk of human capital, including qualitative indicators. D&P, as we have already indicated has a utilization value (box 2), which represents the (objective) availability of D&P (e.g., apples on a tree, the music of Beethoven, a bank account) and the (subjective) accessibility to it (i.e., both material and cultural: I appreciate Beethoven, I am in a position to use my bank account and to get the apples from the tree). It represents, to use a keyword much in favour with economists, the notion of utility in its widest sense.

Utilization value allows humankind to live and therefore to produce (i.e., positive and negative yields, and added and deducted values in their monetary and nonmonetary sense). Box 3 relates to man-made formation and depletion of D&P, and box 4 indicates the natural D&P formation and depletion process, which influences directly the total D&P, but which develops in synergy (point 5) with the man-made process. Boxes 3 and 4, in their synergy (point 5) determine the level of total D&P. Utilization value is then the reference for identifying the economic value of a stock, which in fact in our case would also refer to common heritage and the oceans.

| If you are used to driving a car, you do not simply fly an airplane applying the same rules as those used for driving. |

If we take the notion of utilization value from another angle, we can identify this notion with the contemporary “service economy,” which we have tried to identify in another context.13 We are here, in fact, confronted with another fundamental crossroad: the manufacturing industry, the producer par excellence of value added, has become in a modern economy more and more based on service functions (70 percent to 80 percent of their total “production” costs). Within the industrial system, this is transforming the notion of value from a reference related to the instant encountering of supply and demand in a given moment in time, to a notion of value incorporating performance of systems in future time. Whereas, uncertainty becomes a key issue for management and the idea of equilibrium in economics is replaced by the notion of dynamic disequilibrium. In other words, the reality and the evolution itself of modern industry on the one side, constraints of the environment on the other side, are converging in a way to put in evidence what are the key concepts for the economics of common heritage:

- acknowledgment of the value of a stock;

- the identification of its economic value in terms of performance or utilization in time (i.e., in a probabilistic setting).

| It is on the very notion of scarcity that economic science was founded more than 200 years ago. |

In a theoretical sense, what it is at stake here is in fact the development of a general new economic theory that will provide the basic groundwork to mobilize researchers on issues related to indicators. This is to have a consistent frame of reference that can be used and managed for the purpose of efficiently managing our common heritage, our stock of riches, and the use of resources of all sorts in a new context. Many fundamental questions and some of the answers of traditional economics are still valid, but the frame of reference for their application has changed too much today to be used as simple adaptations. If you are used to driving a car, you do not simply fly an airplane applying the same rules as those used for driving.

Our final pledge would then be that to establish the economics of common heritage, it is essential today to stimulate fundamental research in economics on which depends the development of adequate measurement tools for applicable economic policies.

7. Sustainable Development: At the Crossroads between Economics & Ecology

7.1. The Basic Problem for Development

The basic problem that development has to tackle is scarce resources. Such resources are of a material, human, technological, and cultural nature. It is on the very notion of scarcity that economic science was founded more than 200 years ago. It was then that Adam Smith wrote his book on the wealth of nations as a strategy to overcome the limitations to development due to scarce resources.

The Industrial Revolution successfully concentrated for over two centuries on the possibilities of increasing the manufacturing sectors to reduce scarcity of products. The key issue has been the mobilization and improvement of all available resources to make them more abundant and apt to produce wealth. One cannot deny the great overall successes of the Industrial Revolution, thanks to which life expectancy of human beings has increased at an unprecedented pace, mainly in the industrialized countries, but also, very largely, in the less industrialized ones.

7.2. The Political Aspect of the Industrial Revolution: A New Basis for Legitimacy, Credibility, and Governability

For the last two centuries, the legitimacy and the credibility of governments have centred around the methods and ideas proposed concerning the building and development of the “wealth of nations” through the development of the manufacturing systems, that is, the political management of the industrial revolution. The process of industrialization has been the key reference for building political consensus. The long-lasting competition between a liberal and a Marxist system has finally come to an end by the failure of Marxist methods to efficiently control and stimulate this process. Such a failure has resulted in a total loss of the political consensus and has therefore given way to political disaggregation. Even if the liberal system has shown many shortcomings and has experienced very great crises during the last two centuries, both political and economic, it has finally proved to be the least imperfect of the systems and the most efficient one, in the era of the Industrial Revolution.

7.3. The Ecological Movement and the Crisis in the Traditional Notion of the Wealth of Nations: In Quest of Sustainable Development

The Industrial Revolution, after its great successes in developing the wealth of nations, has come to a point at which there is a growing doubt in its capability of pursuing the goal of developing the wealth of nations without some very strong and in-depth adaptations. The ecological and environmental movements in the world are critical of the point that the industrialization process is in fact the right way to improve welfare and well-being of humanity in present conditions. Hence, the efforts of all those involved in promoting economic activity to integrate as far as possible the ecological and environmental requirements not only as an economic opportunity, but above all to reintegrate the very reference upon which the political consensus has been built in the past.

The notion of “sustainable development” refers precisely to the major problem of development that was at the very core of preoccupations of the pioneers of industrialization: the mobilization and development of scarce resources. The word “sustainable” refers essentially to the fact that the industrialization process, in certain cases, instead of increasing wealth tends to produce scarcity of resources. This happens in particular when those resources that were once available in an unlimited quantity (e.g., air, water, land) are themselves submitted to a process of progressive increase of scarcity. In this case, the entry of resources into the market-priced system that were once not taken into account because they were available in an unlimited quantity, is indicative of a growing level of scarcity and therefore of poverty.

The question of “sustainable development” has to do finally with the necessity to cope with the danger of producing scarcity, making resources more and more rare. A particular connotation of this phenomenon is its tendency to be of medium, long, and very long term. This contrasts in particular with an industrial economic process that is strongly conditioned by the market operations in the short term. Sustainability means in the end that resource development has to be mastered simultaneously in the short and long term, and this implies also concentrating on the issue of uncertainty.

| The integration of wisdom from two centuries of economic thinking and the legitimate requirements of the ecological and environmental needs and demands should naturally find their synthesis in a new notion of value. |

8. Acting for Sustainable Development

We acknowledge the inadequacy of the ancient model to develop the wealth of nations and the recognition that both economics and ecology are the best possible way of managing world and human resources to achieve a better wealth of nations. The rebuilding of economics and of a credible strategy for increasing the wealth and well-being of nations is today at the center of the problem of providing a sound basis for the legitimacy and credibility of public institutions and governments. If the dichotomy between traditional economic goals and new ecological and environmental requirements for sustainable development will not credibly combine, the political consensus and the legitimacy of governments at the local, national, and international levels will have a tendency to produce on the new liberalizing world disaggregation effects that could be as extensive as those witnessed in former Marxist countries.

Hence, the strategic priority consists of reviewing the meaning of the wealth of nations today and in finding the best economic methods to promote it in a credible and adequate way, with a vision aimed at strengthening the credibility and the legitimacy of the democratic economic systems. In terms of sustainable development, it means to find a reasonable compromise between the short and the long term to reduce scarcity now and in the future, avoiding the undermining of the patrimony composed by earth resources.

9. The Way to Sustainability

We recognize the fact that a modern industrial economy is essentially a service-based one and that the notion of value has shifted from the production of goods to the production of performances. Service activities of all sorts have today become dominant in every “manufacturing” sector. Services are about performances measured by results expressed in terms of level of health, wealth, well-being, happiness, and pleasure, et cetera. These levels of well-being do not depend only on the quantities of goods available, but on the way in which they are used and they affect the quality of life of human beings in time. This is what is meant by “performance,” which also must integrate the cost of depleting resources and the management of waste (a service activity) in the long term. From this point of view, the integration of wisdom from two centuries of economic thinking and the legitimate requirements of the ecological and environmental needs and demands should naturally find their synthesis in a new notion of value. This is a notion of value where the basis for both economy and ecology is recognized as being the same; the best possible utilization and maintenance of human and natural resources for the well-being and for the wealth of nations. A clear strategy for sustainable development depends largely on the vision generated by the combination of economic and ecological views attacking together the problems of scarcity.

Notes

- E. Mann Borgese, “Integrating Development and Environment Concerns: New Economic Theories,” in Ocean Governance and the United Nations (Halifax: Centre for Foreign Policy Studies, Dalhousie University, 1995), 246; E. Mann Borgese, “The Economics of Common Heritage,” Ocean and Coastal Management 43 (2000): 763-779.

- Borgese, “Economics of Common Heritage,” 2000.

- E. Mann Borgese, The Future of the Oceans: A Report to the Club of Rome (Montreal: Harvest House, 1986), 144.

- O. Giarini, Dialogue on Wealth and Welfare – An Alternative View of World Capital Formation (Oxford: Pergamon Press, 1980).

- See the notion of “deducted values” in Giarini, Dialogue on Wealth and Welfare, 121.

- The modern economy which in fact we call the “service economy” for reasons described by O. Giarini and W. R. Stahel, “The Limits to Certainty–Facing Risks in the New Service Economy,” in International Studies in the Service Economy Series, vol. 1, ed. Kluwer Academic Publishers (Dordrecht: Kluwer Academic Publishers, 1993), 294.

- A. Tevoedjre, La Pauvreté, Richesse des Peuples (Paris: Les Éditions Ouvrières, 1977).

- W. A. Weisskopf, The Psychology of Economics (Chicago: University of Chicago Press, and London: Routledge & Kegan Paul, 1955, also University of Chicago Press, Midway Reprint, 1975), 52.

- Weisskopf, The Psychology of Economics.

- Giarini and Stahel, The Limits to Certainty.

- Ibid.

- Ibid.

- See Chapter 3 of Giarini, Dialogue on Wealth and Welfare.

* Elisabeth Mann Borgese was an internationally recognized expert on maritime law and policy and the protection of the environment.

† Many of the research centers and international organizations are listed in Annex 14 of the paper “The Contribution of Oceans and Ocean Development to Wealth and Welfare,” by O. Giarini and M. Börlin (presented to the International Centre for Ocean Development [ICOD] in Halifax, Nova Scotia, Canada, 2nd December 1988).

- Login to post comments