Hello Visitor! Log In

Job Creation through Sustainable Investing Using Human-Centered AI: An Integral Approach

ARTICLE | June 13, 2020 | BY Mariana Bozesan, Thomas Kehler, Thomas Schulz

Author(s)

Mariana Bozesan

Thomas Kehler

Thomas Schulz

Abstract

The COVID-19 pandemic has vividly demonstrated that humanity is not well prepared to address global challenges, particularly existential threats. This paper shows us how to restart the economy and ensure employment using an integral approach to sustainable investing in early stage start-ups using human-centered AI. As stimulus packages are being made available, the need for fast-tracked, digitized and scalable investment decisions for implementing the UN SDGs within Planetary Boundaries becomes an obligation. Based on three decades of investment track record and four years of AI application data, this paper shows how to identify the black swans of integral sustainability and how to significantly improve the de-risking processes through human-centered AI. This AI has proven that automation of the investment analysis and prediction process using collective intelligence and machine learning results in a successful prediction accuracy that is four times higher than current methods and scalable.

1. Introduction

It is only 2020 and already we are confronting the fourth pandemic of the century: COVID-19 was led by SARS in 2001–2004, H1N1, the swine flu, in 2009, and Ebola in 2014–2016. Although we could have heeded, for example, Bill Gates’s warnings of many years* about our collective vulnerability in the face of a pandemic, we did not, as it is now demonstrated by the general lack of preparation in the face of the COVID-19 outbreak. Unfortunately, the frequency of such infections is likely to increase due to a combination of natural disasters and irresponsible human behaviors inflicting constant damage to wild animals’ habitats and driving animals into urban areas. As both climate change and the global population continue to grow, so too do the extent and scope of the crisis.† One related vulnerability is that how we respond nationally and internationally to this and comparable crises could determine the future of democracy.‡ Governments around the world are taking drastic measures to address the COVID-19 pandemic but seem to be even less well equipped for the subsequent recession, or depression, caused by it. Why? Because current stimulus packages are similar to those issued in 2008 in response to the financial crisis that provided liquidity to an already bankrupted financial system without changing it at its core—such packages were essentially fiscal enablers.§ The COVID-19 crisis is only reviving the problem and so systemic change becomes inevitable if we want to protect democracy and ensure the future of life on our planet.

Scientific reports1 are warning about climate emergency with only 10 years left to address it.¶ Led by the European Commission, the political will to respond is also manifesting through the European Green Deal** and its 10-step action plan for implementing sustainable finance,†† aimed at transforming the economy to achieve carbon neutrality by 2050. This long-term strategy includes three points of particular importance:

- Taxonomy, a unified green classification system

- Sustainability-related disclosures to ensure that manufacturers and distributors of financial products fully inform investors about the impact of sustainability on decisions and financial returns.

- Climate benchmarks and environmental, social, and governance (ESG) disclosures to help investors adopt climate-related strategies.

While exponentially growing technologies2,3 are shifting the world economy,4 the massive amounts of capital made available by current stimulus packages must be allocated in line with the requirements of systemic change while enabling accelerated job creation and ensuring the restart of the economy across the board. This transformative action is important because it also addresses the big question on how investors (businesses and entrepreneurs alike) can contribute particularly from an early stage investing (Business Angels and Venture Capital) perspective. Small to medium enterprises (SMEs) are a significant economic force globally—with a contribution of “about 90% of businesses and more than 50% of employment worldwide. Formal SMEs contribute up to 40% of national income (GDP) in emerging economies”‡‡ and in developed countries too. For example, in Germany, SMEs’ “contribution towards Germany’s economic strength, [represents] approx. 35% of total corporate turnover... In terms of their contribution to GDP, these companies even account for close to 55%.”§§

Therefore, early-stage investing is also undergoing massive transformations as it is adapting to the changed context and must become more efficient, more effective, and scale fast. It can transform and respond quickly, because it relies on human expertise, values, and mindset. However, questions related to screening, de-risking and other due diligence aspects as well as monitoring, and successful exits are tightly intertwined with measurement criteria, taxonomy, disclosures and other benchmarks because they determine the outcome. They depend on the strategy and its implementation, some of which will be briefly addressed next in order to highlight the growing complexity of the matter (including the mind shift). The intention is to identify how human-centric AI can provide significant support moving forward.

“The 17 SDGs are ambitious, transformational goals for the creation of a prosperous humanity on a stable Earth system. However, there are grave contradictory issues within these goals, which increases the risk of one favorite goal being pursued at the expense of the others.”

2. Early Stage Investing and CO2 Neutrality

We can only achieve what we measure, but it will take time until the new policies on taxonomy, disclosures and benchmarks for the new green deal become available. Early stage investors (and entrepreneurs) are moving fast and need to know now how to contribute toward the implementation of the Paris Agreement. Therefore, it is important to understand the first line of global metrics, namely the 17 Sustainable Development Goals of the UN¶¶ and how they can be implemented within the Planetary Boundaries, the safe operation system of the planet starting today.

2.1. The UN SDGs Only within Planetary Boundaries?

The 17 SDGs are ambitious, transformational goals for the creation of a prosperous humanity on a stable Earth system. However, there are grave contradictory issues within these goals, which increases the risk of one favorite goal being pursued at the expense of the others. For example, if we pursue goal #8, Good jobs and economic growth, by burning fossil fuels such as coal, it will be impossible to achieve goal #14, Life below water, or #13 Climate Action because we will continue to emit destructive CO2 into the atmosphere, literally fueling the existing vicious cycle. These contradictions could be the reason why we have made so little progress since their adoption in 2015. However, according to Transformation is Feasible,5 if we act now and stay within Planetary Boundaries,6 we can still address the climate emergency.

2.2. Transformation is Feasible

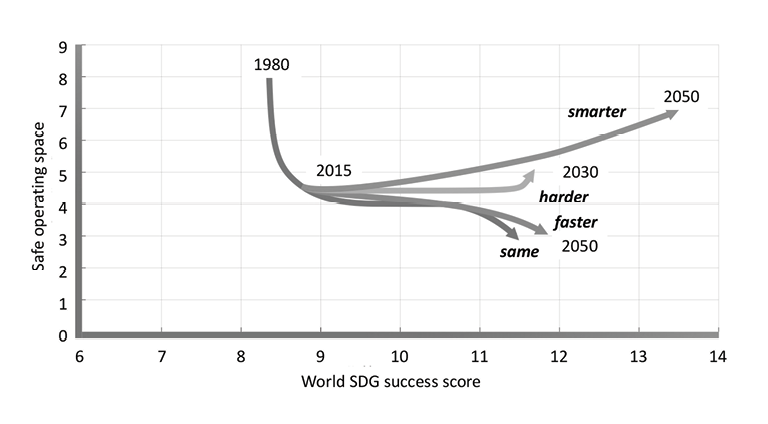

Based on a complex System Dynamics Model and data collected over the past decades,7 we have tested, built, and simulated 4 future scenarios up to 2050 that are shown in Figure 1. On the vertical axis, there are 9 Planetary Boundaries (PB), the 9 factors that regulate the stability of the earth’s operating system. They include, for example, biosphere integrity, freshwater use, ocean acidification, ozone depletion, and climate change. The higher the value on the vertical axis, the higher the harmony level between the PBs (the green area) and the lower the PB-value, the less probable human existence would be possible (the red area).

The horizontal axis represents the number of UN SDGs that would be implemented collectively at any one point in time, with the intention being to realize as many of the 17 as possible, moving consistently toward the higher value, the green zone to the right. In order to successfully implement all the SDGs within the Planetary Boundaries, humanity must operate within the green areas on both axes; the higher the values, the better.

The four scenarios are the following:

- Same: shows how far business as usual will take the world to 2050 while creating severe global warming, costly weather events, social instability with increased political insecurity, rising nationalism, and growing inequality as well as social unrest.

- Faster: shows where accelerated economic growth of 2.8% per annum in 2018 to 3.5% per annum would lead. With slightly less than +1% GDP growth per person per year until 2050, we would risk significantly destabilizing the planet.

- Harder: shows what happens if governments and industry try even harder by increasing our ability to deliver on our promises by 30%–50% across all global sectors of society, from climate to trade agreements. But the results would not be significantly different and would not take us back to safe PB.

- Smarter: could solve the problem by 2050 and shows the transformational path.

“Integral (sustainability) Investing contends that all investment activity must be rooted in the essence of all existence, the mind-set (consciousness) aspects including culture, values, ethics and morals as well as exterior reality, the material world .”

However, in order to implement the Smarter scenario, a significant mind shift across all players in the society and the following five transformational actions are required. These could help achieve all 17 SDGs while keeping humanity in the green zone of the Planetary Boundaries:9

- Energy: Accelerated renewables growth to halve emissions every decade starting with 2030 and create a global energy democracy.

- Differentiated Growth: Rolling out sustainable development models in developing countries.

- Food: Accelerated shift to sustainable food chains and agriculture to decrease the food production footprint.

- Active inequality reduction: Address extreme unfairness, create jobs despite automation and AI, and redistribute total output and wealth.

- Investment in girls’ and women’s education, gender equality, health, family planning: to stabilize the world’s population.

Only the future will show how humanity will make this transformation feasible particularly since a shift in mindset is the premise for change. However, the outlined strategic direction represents an important guiding post for investors, entrepreneurs, and businesspeople alike because it enables smart action and supports current efforts of already awakened market leaders such as the Global Alliance for Banking on Values (GABV),*** UN PRI††† signatories and GIIN‡‡‡ as well as a myriad of other leading sustainability investors.§§§

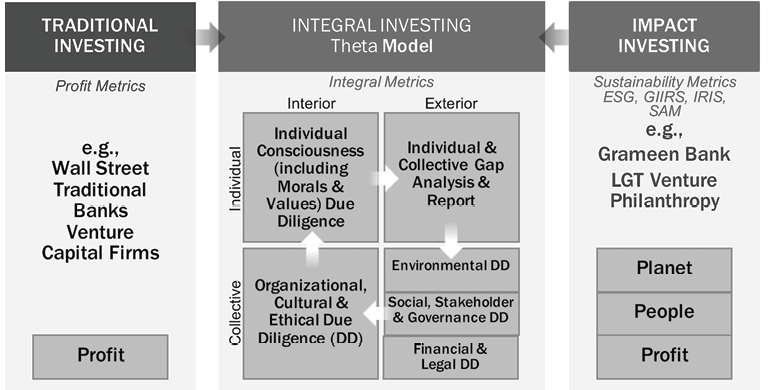

From an early stage investing perspective,10 Integral Investing (Figure 2),11 as an integrative framework for sustainable early stage investing using integral theory, is proposed.12 Its de-risking process has been developed and tested since 1993, is entitled the Theta Model (Figure 3) and will be introduced briefly.

3. An Integrative Model for Scalable & Sustainable Early Stage Investing

The integral investing framework integrates, transcends and includes both traditional investing and impact investing practice with the intention to build integrally sustainable companies from the very beginning. Integral (sustainability) Investing contends that all investment activity must be rooted in the essence of all existence, the mind-set (consciousness) aspects including culture, values, ethics and morals as well as exterior reality, the material world (environment, infrastructure, etc.)

Integral Investing makes it obvious that financial sustainability is inseparable from the environmental, social, cultural, and an ethical impact, as well as individual self-actualization, joy, and personal happiness (in short, the 6Ps: Parity of People Planet and Profit with Passion and Purpose); and provides an integration framework. However, the increased complexity also begs the question how the entire value chain creation from screening to exit can be implemented within the context of the de-risking process. The answer can be found in the Theta Model (Figure 3).

3.1 De-risking with the Theta Model

Being a seed and/or early stage investor often feels like fishing in a muddy pond that is well stocked. However, only very few fishes are worth catching. The probability that a new startup will develop and eventually provide a large, integrally sustainable exit to its investors is rather minuscule.

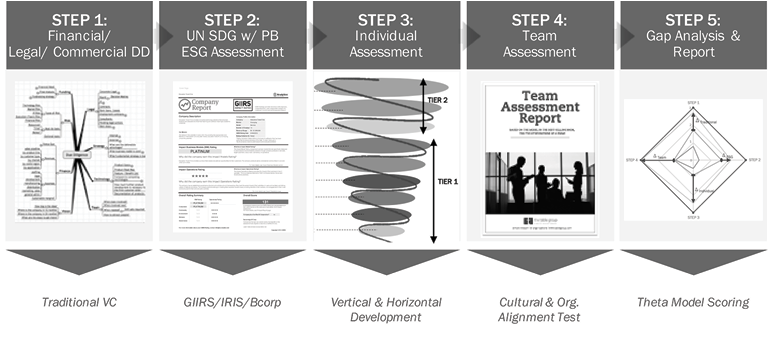

For decades, investors have tried hard to beat this average, but, as a rule of thumb, only 10% of startups in a fund portfolio have a chance to become successful exits. The investor, therefore, uses assessment tools to screen investment opportunities that are presented to them and try to predict the “winners” and “losers.” The essence of the Theta Model (Figure 3) is to identify the losers as early as possible by identifying the winners with a high sensitivity and by exposing the losers with a high specificity.

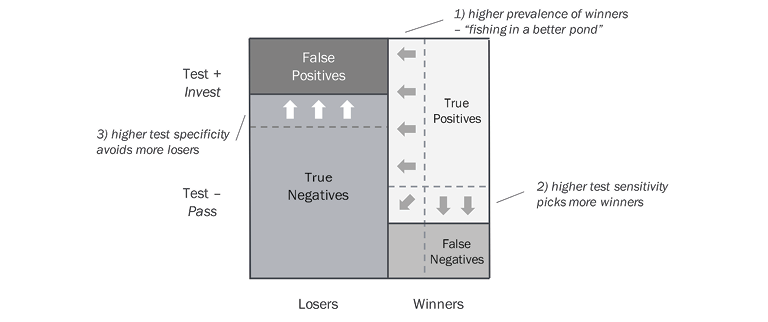

Screening is the process that enables the investment manager to decide either to “invest” or to “pass”. This process can be as short as a few days or take a few months. During screening, the evaluators consider many aspects of the opportunity, using diagnostic tools: pitches, personal interviews, investment exposés, pitch decks, market research, customer references, technology expert interviews, psychological assessments for individuals and team culture, legal and financial opinions, to name a few. The choice of tools and the order of using them is different in each case, based on the experience of the evaluator, the cost, the risk, and the potential diagnostic value of the tool. This is very similar to medical diagnosis. For the purpose of this paper, we are looking at the screening process as a statistical test that is predicting the future success or failure of the opportunity. There are “Winners” and “Losers” (Figure 4).

Early stage investing is an art and not a science. This is why there are few performance statistics available. The winners are defined as startup companies that will raise a significantly follow-on round or generate a profitable exit with a positive impact. Experience shows that few VC firms have a long-term positive track record; for at least two reasons: (1) the prevalence of winners in the deal-flow is low, and (2) the industry’s average prediction accuracy is rather mediocre. Traditional screening processes are rather volatile, unsystematic, and depend on individuals’ “gut feelings.” Such tests yield only few successful investments (true positives). Many unsuccessful investments (false positives) lose money and sometimes the winners (false negatives) are missed. In other words, the tests have low sensitivity and low specificity.

The Theta Model creates a “better fishing pond” through the five de-risking steps outlined in Figure 3. In short: STEP 1 deals with the traditional early stage process currently implemented in the VC industry. STEP 2 addresses the UN SDG/ESG and other sustainability factors. STEP 3 deals with individual, consciousness, behavioral, inter-objective, and inter-subjective aspects. STEP 4 deals with collective team assessment, cultural, and leadership development. STEP 5 provides the ultimate decision based on steps 1 to 4. Overall, the process is always addressing profitability, scalability, and explainability.

The overall profitability can be increased in the following way (see Figure 5):

- By focusing on deal-flow with a higher prevalence of winners“fishing in a better pond” (see 1 in Fig. 5). The Theta Model achieves this by concentrating on opportunities that are driven by exponential technologies and address the UN SDGs within Planetary Boundaries.

- By increasing the test sensitivity to avoid missing the innovative outliers, the “black swans.”

- By increasing the test specificity which leads to screening out more true negatives early. The Theta Model sets the bar higher for founders and teams.

The overall scalability of the early stage investment process can be increased by (1) enhancing the screening process with AI, and (2) by making the screening and due diligence process more focused and therefore more efficient.

The overall explainability of the investment decision can be increased by elucidating it using concepts that human experts understand. For example, “the founder team is missing industry experience, is not complementing each other, and the market opportunity is too small.”

The Theta Model can be significantly enhanced, digitized, and scaled through a human-centric and collective intelligence AI tool that we will introduce next.

4. Human-centered AI

We have developed a specific technical definition for human centered AI that is supported by a technology platform. Symbolic AI systems of the first wave of AI were based on a process of encoding human heuristics into programs based on knowledge representation and reasoning technologies.15 Using a model of collective intelligence supported by an interactive knowledge acquisition method, we construct a knowledge model that represents the collective prediction of a group of investor/expert contributors. The collective knowledge acquisition system generates as output a Bayesian Belief Network that links propositions and quantitative scores to a predictive score. Given an investable asset (e.g. startup), we create a representation of the collective judgement on whether the asset will create sufficient business results to support future investment and growth.

4.1. Maximizing predictive accuracy through collective intelligence

The collective knowledge acquisition system generates as output a Bayesian Belief Network that links propositions and quantitative scores to a predictive score. Given an investable asset a custom team of investor and expert contributors is constructed based on principles of cognitive diversity. The objective is to optimize collective diversity so that systematic bias is minimized, and perspective views are maximized. The evaluating group is taken through an automated single-blind on-line asynchronous interview process that collects feature scoring information described in the section below. The resulting Bayesian Belief Network is a representation of the collective view of the diverse evaluation group. The model represents the collective judgement of the group as to whether the asset will produce a future positive return for investors. The BBN can infer a distribution of outcomes expected by the group based on the evidence provided.

In parallel, a quantitative model can be constructed from the BBN that is trained with follow-on funding data. The quantitative model is Logistic Regression Binary Classifier that learns from follow-on performance data. The two interoperable modes work in parallel to enable evaluators of investments to learn collectively how to become more accurate in predicting investment outcomes.

4.2. Building Diverse Teams

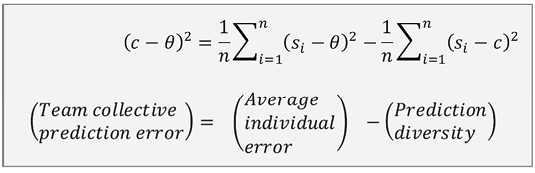

Teams are initially selected based on declared expertise (e.g. LinkedIn profile). Key elements are: investment experience, education, gender, ethnicity, and demonstrated expertise. Once on the system behavioral data is used to maximize diversity. The goal is to maximize the prediction diversity term in the following measure:

Where: c is the mean score of the team. θ is the true value. si is the score of each individual.

4.3. The Knowledge Acquisition Process

Each team member has access to a data room that contains a complete set of diligence materials that include: short video, presentation deck, financials, team bios, etc., the typical items provided to any investor. Step 1 in the process is for the team to see a live Q&A session with the startup team.

The process is single blind. Startup founders do not know the identities of the evaluating team and evaluating team members do not know the identities of their fellow evaluating team members. The first step for an evaluating team member is to provide their inputs of specific questions to the system. The areas of assessment include for example business opportunity, team etc. Each area of assessment is to be scored on a scale of 1 to 10. For each score the team member is asked to give all the reasons for the score.

Once a team member has entered their reasons for a score, they are given a sample. The sample generated is based on a learning process attempting to learn points of alignment among evaluators.

4.4. Learning Areas of Alignment

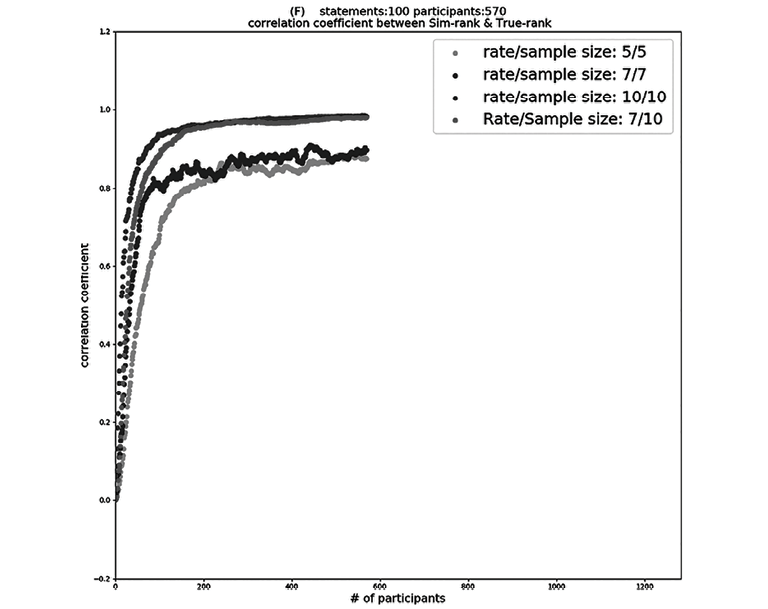

Given a collection of submitted propositions (reasons for a score), a sample is drawn of size n from the collection. The evaluator is asked to rank in priority order those propositions where they agree with their own views. If they do not see points of agreement, they can request another sample. Sampled propositions are given a score and the collection of propositions is updated. Each sample drawn is dependent only on the current state of the system (the process used is a Markov process). The algorithm convergence characteristics are shown in Figure 6.

As participants submit their reasons and rate others, the system rapidly converges to a ranking of propositions based on relevance with an increasing confidence level in the value of the ranking.

Several items to note about the process. One: the participants are encouraged to submit new comments based on their interactions with others supporting the notion of “idea evolution” based on brainstorming. Second, the process is open to startup/evaluator interaction. Thus a startup can respond to a high-ranking proposition, in essence responding to a comment that is representative of a group opinion. Third, the system operates on a peer review concept. Comments not relevant to the group discussion effectively go out of circulation.

The resulting set of propositions ranked based on relevance is then analyzed into a trained set of themes or topics using an NLP model based on NER and bi-directional LSTM in Keras.

The system allows learning topical areas of relevance to the group of evaluators providing the basis for a Bayesian Belief Network. The BBN links these propositions to topics and quantitative scoring distributions.

4.5 Early Experience Applying Human-centered AI to Seed Investing

Over the period of approximately four years the process described above was used to evaluate seed stage companies that were raising $1 million to $4 million in seed financing. Companies were scored using the methodology above. Companies with scores greater than a given threshold received an investment. All scored companies were tracked for follow-on performance.

Startups’ deal sourcing was typically from top ranking accelerators. Each startup had an evaluation team of 20 to 25 evaluators. The evaluation process was conducted over a period of approximately 3 weeks (done asynchronously on-line). Startups and evaluators could exchange information (identity was masked for evaluators). Evaluators were encouraged to rescore and share information as they learned more through interaction with each other and with the startup. Both evaluating team and startup have access to the data as it is evolving.

Each company yielded about 200 to 300 quantitative data points and on the order of 10,000 words of text. The total data set size was ~60 companies with 25 investments. The overall accuracy of the model was >80% in predicting that a company would raise follow-on funding within 12 to 18 months after scoring. This compares very favorably to general results which indicate that around 10% of seed companies transition to follow on growth rounds.

The process is scalable. The process appears to do substantially better at inclusion. Over 40% of the founding teams are led by females for example. This is in stark contrast to traditional methods of venture investing which has very low participation of female founders.

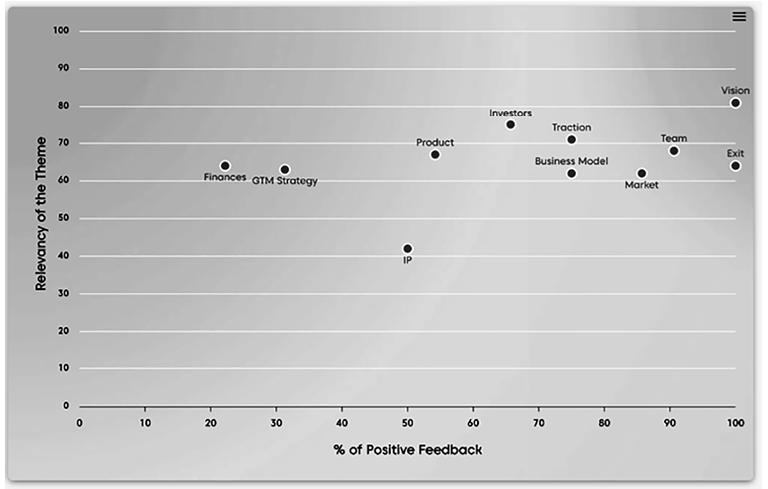

Each startup receives a probability of being in the “invest” class along with an explanation in the form of reports on the natural language data. For example, the following company scored 92% which is well in the invest zone. An example explanation chart is shown in Figure 7.

The y axis plots the relevancy score which is a measure of the likelihood of a comment in a theme (e.g. vision which has a high relevance to the review team) to be ranked in top priority by evaluators. With each theme there is an underlying associated quantitative scoring distribution from which we can infer valence. Thus, the upper right-hand corner indicates a highly relevant and highly positive theme. Vision and potential exit were big drivers for investors, and they believed that financial management and go-to market strategies were manageable issues. They turned out to be correct. In the two years that followed the above company raised a Series A and B from top tier VC firms. In addition, it recently won a top innovation award.

5. Digitizing Early Stage Investing with AI 3.0

Early stage investing is characterized by closely held heuristics. Conventional wisdom is that VC investing can only be learned through many years of experience based on pattern matching experience and mentoring. This experience results in heuristics that define investment practices that are tested against reality as measured by portfolio performance.

While best practices have led to high performing portfolios, they are not scalable. In order to scale, the best practices must be turned into a set of evaluation heuristics that create a set of reference frames for knowledge acquisition.

The process used in section 4.3 follows such a pattern. The seed investing process used was based on thousands of interviews.16 The heuristic derived pointed to four key factors: 1. Market and Business Opportunity, 2. Founding Team, 3. Network Impact of Early Advisors and Investors and 4. Level of Commitment of Investors. The associated heuristic is a startup that scores high on those four factors will be successful. The knowledge acquisition process was defined based on using this heuristic.

The Theta Model for de-risking investments has a 25+ year history of practice and performance and is deeper than traditional VC de-risking processes. It extends the business’ focus on a specific problem, i.e. addressing investments that impact sustainability. It focuses on technologies that have an exponential growth rate with the intention to implement for example the UN SDGs within Planetary Boundaries (Step 2).

Moreover, one of the more interesting aspects of the Theta model is the deep attention to the founding team and management leadership (Step 3 and 4). For many investors, team is a highly influential reason for them to invest or not. In most cases, the team’s focus is on their external performance only. For example, one simple heuristic often used to evaluate a founding team CEO is their speed and accuracy in answering a question during a Q&A session.

The knowledge acquisition system discussed above discovered attributes like team experience and adaptability as external attributes that are associated with high team scores. Assessment of external characteristics falls short however when it comes to retrospective analysis of startup failures. Under pressure teams can develop destructive behavioral modes. For this reason, the Theta Model looks closely at psychological profiling and pays close attention to the underlying motives supporting vertical growth and mind shifts. The combination of the Theta Model, the knowledge acquisition system described above and extension of the prediction model to turn for investments specifically aimed at sustainability exemplifies how human-centered AI can be mobilized to address a major global problem.

6. Conclusions

In conclusion, early stage investing is the ideal application for human-centered AI because (1) there is too little historical data available to train a deep learning algorithm, (2) there is too little data per test case, and (3) the know-how is with the human experts and cannot yet be extracted and formalized efficiently. Through its nature, the investment process is looking for innovative solutions, “black swans” that can hardly be predicted by an AI system that would have to have been trained by historical data. Therefore, the evaluators must be a diverse group of industry experts, with “skin in the game” particularly in the face of current existential threats. Therefore, using both internal and external de-risking aspects when evaluating founders, team culture, and product/services helps implement the “parity of people, planet and profit—with passion and purpose.” The deal must address social and ecological needs and must grow profitably. There is no “impact first” or “profit first.” Both are equally important. “Passion and purpose” reflect the intrinsic motivation of all participants and must come from a world-centric, not an ego-centric, perspective if we want to implement the UN SDGs within Planetary Boundaries, avoid depression and create jobs and prosperity for all of us in a post COVID-19 world.

Notes

- V. Masson-Delmotte et al. Summary for Policymakers. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. (In Press, 2018)

- R. Kurzweil R, The singularity is near: When humans transcend biology (New York, Viking Penguin, 2005)

- M. Tegmark, Life 3.0: Being human in the age of artificial intelligence (London, UK, Allan Lane, 2017)

- P. Diamandis, & S. Kotler, The Future is Faster than you Think (New York, Simon & Schuster, 2020)

- J. Randers et al. Transformation is feasible. How to achieve Sustainable Development Goals within Planetary Boundaries. A report to the Club of Rome (Stockholm Resilience Center, 17 October 2018) https://tinyurl.com/y9epzlmk

- W. Steffen, et al. “Planetary Boundaries: Guiding human development on a changing planet.” In Science. Vol. 347 no. 6223, (13 Feb 2015)

- J. Randers et al. Transformation is feasible. How to achieve Sustainable Development Goals within Planetary Boundaries. A report to the Club of Rome (Stockholm Resilience Center, 17 October 2018) https://tinyurl.com/y9epzlmk

- J. Randers et al. Transformation is feasible. How to achieve Sustainable Development Goals within Planetary Boundaries. A report to the Club of Rome (Stockholm Resilience Center, 17 October 2018) https://tinyurl.com/y9epzlmk

- J. Randers et al. Transformation is feasible. How to achieve Sustainable Development Goals within Planetary Boundaries. A report to the Club of Rome (Stockholm Resilience Center, 17 October 2018), https://tinyurl.com/y9epzlmk

- M. Bozesan, “De-Risking VC Investing for Outstanding ROI: An Interdisciplinary Approach toward the Integration of People, Planet and Profit” In ACRN Oxford Journal of Finance and Risk Perspectives, 2015 Vol. I Special Issue: Entrepreneurship Perspectives, ISSN 2305-7394. Available online: http://www.acrn-journals.eu/resources/jofrp0401d.pdf

- M. Bozesan, “Integral Sustainability or how Evolutionary Forces are Driving Investors’ Trust and the Integration of People, Planet, and Profit.” In O. Lehner (Ed.) Routledge Handbook of Social and Sustainable Finance (pp. 296-321) (Oxford, Routledge, July 18, 2016)

- K. Wilber, A theory of everything: An integral vision for business, politics, science, and spirituality. (Boston, Shambhala, 2000)

- M. Bozesan, “Integral Sustainability or how Evolutionary Forces are Driving Investors’ Trust and the Integration of People, Planet, and Profit.” In O. Lehner (Ed.) Routledge Handbook of Social and Sustainable Finance (pp. 296-321) (Oxford, Routledge, July 18, 2016)

- M. Bozesan, “Integral Sustainability or how Evolutionary Forces are Driving Investors’ Trust and the Integration of People, Planet, and Profit.” In O. Lehner (Ed.) Routledge Handbook of Social and Sustainable Finance (pp. 296-321) (Oxford, Routledge, July 18, 2016)

- R. Fikes, Tom P. Kehler, “The role of frame-based representation in reasoning,” in CACM Vol. 28 no. 9 (September 1985)

- R. Wiltbank, & W. Boeker. Returns to Angel Investors in Groups, working paper (Kansas City, MO, Ewing Marion Kauffman Foundation, November 2007)

¶ UN Paris Agreement 2015, https://tinyurl.com/y9e8fufg

** European Green Deal, 11 December 2019, https://tinyurl.com/vlplq5l

†† EU Financing Sustainable Growth, 2019, https://tinyurl.com/ws6y3qe

‡‡ The World Bank SME Finance, 2020, https://www.worldbank.org/en/topic/smefinance

§§ German Federal Ministry of Economic Affairs and Energy, 2017, SMEs are driving economic success; Facts and Figures about German SMEs: 2017-A successful year for German SMEs. https://tinyurl.com/y3cytbzf

¶¶ 2030 Agenda for Sustainable Development, 2015, https://sustainabledevelopment.un.org/post2015/transformingourworld

*** Global Alliance for Banking on Values, 2020 available online: http://www.gabv.org

††† The UN Principles for Responsible Investment https://www.unpri.org/signatories/signatory-directory

‡‡‡ Global Impact Investing Network, https://thegiin.org/

§§§ Global Steering Group for Impact Investment driving real impact, https://gsgii.org/