Hello Visitor! Log In

Blind Spots of Interdisciplinary Collaboration - Monetising Biodiversity: Before Calculating the Value of Nature, Reflect on the Nature of Value

ARTICLE | November 6, 2016 | BY Joachim H. Spangenberg

Author(s)

Joachim H. Spangenberg

Abstract

Defining, assessing and valuing biodiversity and ecosystem services is an exemplary field, illustrating the necessity as well as the obstacles to interdisciplinary collaboration between natural scientists and economists. Despite the frequent use of identical individual motivations and similarities in the terminology, the discrepancies and misunderstandings run deep. A main reason for the lack of reflection regarding the disciplinary and partly incommensurable world views, their ontologies, epistemologies, anthropologies and in particular their specific axiologies. While considered self-evident in their own disciplines, the lack of awareness regarding these basics hampers cooperation between disciplines. The challenges involved may be one reason why the readiness to participate in interdisciplinary research is actually decreasing amongst mainstream economists. In particular axiology (philosophy of values) is causing problems: at a closer look, there is a diversity of legitimate value systems, within which economic valuation is an important but limited niche. Recognising this implies acknowledging the limitations to economic valuation, and to economic statements more generally. Epistemological discrepancies show up in diverging interpretations of the same terminology. Interdisciplinarity requires rethinking of basic disciplinary assumptions in all participating disciplines, to generate results which are not based on assumptions in contradiction to secured insights of other disciplines in charge of the issue in question—otherwise integration of results is not possible. This is the basic law of interdisciplinarity, and it requires significant changes in academic education.

1. Why is this the Case?

Economics has long been considering itself the “king discipline” of social sciences (Lazear 2000), which is still the mainstream feeling. Others find the king to be naked and call for “debunking economics” (Keen 2001) or campaign against the discipline’s perceived autism for a post-autistic, real-world economics (Alcorn, Solarz 2006). Both hypocrisy and autism show up in valuing biodiversity. Furthermore, other disciplines in the social sciences have for sure not been isolated from the real world, but have blind spots of their own. Sociology, for instance—in particular in the German tradition since Max Weber—has made the basic assumption that every social phenomenon can and must be explained exclusively by social processes: not too helpful for collaboration with ecologists.

Natural scientists, on the other hand, have long believed—and most still do—that they are objective, with no subjective influences, and that they are measuring reality and based on that, exploring the “truth”. The resulting attitude towards the policy of “truth speaks to power” is still widespread in the scientific community (Spangenberg & O’Connor 2006), and the basis of the call for “fact-based/science-based politics” in the political domain. However, as soon as political actors use scientific arguments for purposes other than those intended by the scientists, many scholars feel abused and head back to the ivory tower.

Consequently, real cooperation is rare and usually only happens if made indispensable by forces outside the respective scientific communities like funding conditionalities (this refers not to pioneer groups like environmental sociology, ecological economics or social ecology, but the mainstream representatives). Valuing biodiversity and ecosystem services is one such case where the circumstances require the cooperation of disciplines (mainly biologists/ecologists and economists, with some doses of climatologists, geoscientists, sociologists and political scientists) which are mostly unprepared for doing so. The result ranges from enthusiastically adapting each other’s terminology without really understanding its meaning, to plain rejection of others’ approach as inadequate.

The enforced cooperation is full of misunderstandings, partly a consensus based on overlapping interests and a joint ignorance regarding the philosophy of science, and partly a clash of cultures. What is becoming rare is cooperation based on mutual understanding and insight into the complementarity of knowledge.

2. Consensus with Conflicts

2.1. Consensus Basis I: Subjective Devotion

Usually bioscientists and economists share a common subjective desire which leads them into this field: to contribute, with their respective disciplinary knowledge, to halt the loss of biodiversity and ecosystem services. Both try doing so by applying their respective methodologies, with the scientific analysis resulting in limits, threshold values, etc. which we suggest should be introduced legally to avoid unacceptable damages (both disciplines most often forgetting the social construction of necessities and acceptability sociologists analyse). Economists use their tools to search for the optimal solution, providing a maximum of welfare (ignoring that welfare is much broader than their monetary yardstick). The personal, pre-scientific joint motivation can establish a strong bond between different agents, a level of mutual trust which even facilitates the mutual acceptance of scientific results without really understanding them or their implications.

Both camps are aware that the conservation needs decisions, and that their advice can influence them. However, both groups undertake analyses and derive recommendations in the context of and shaped by their own world view, its epistemology, ontology, anthropology and axiology (Spangenberg 2016). As a result, they tend to take their respective body of knowledge as the relevant set of information on which decisions should be based, and are unable to recognise their respective limits.

2.2. Consensus Basis II: Ignorance regarding the Theory & Philosophy of Science

In the recent past, economic considerations have played a more and more dominating role in decision making. Economically speaking, biodiversity is no public good, but a common pool resource: it is rivalrous (one agent using it diminishes the opportunities of the other agent to use it) and it is difficult or costly to exclude users. Due to the latter characteristic it is no market good, has no economic value, and its value (i.e. its importance) is not reflected in decision making based on economic considerations, e.g. based on cost-benefit analyses CBA. This led both scientists and economists to conclude that defining a price for biodiversity might be an option to overcome its “undervaluation”. Doing so, they fall victim to a category error, confusing the non-existence of an economic value with the existence of an economic value of zero.

Following the “causation principle” (Verursacherprinzip, established in the German legislation in 1972 and translated into English as “polluter pays principle”), compensation for damages became the norm, usually in the form of non-monetary compensatory measures like establishing restoration or replacement for the damage done. The non-existence of an economic value led to other kinds of values dominating the compensation. More recently, monetary valuation, tradable shares and futures, and biotope banking have become more prominent, all based on the assumption that economic value can be calculated or constructed. The more the monetary aspect of “polluter pays” dominates, the more it is important to monetise biodiversity by including any damages done to the environment in compensation packages. This became even more urgent in Europe with the EU legislation introducing liability for damages to biodiversity, calling for compensation payments.

However, while for bio-scientists the value of biodiversity lies in the importance of a function for the functioning of the ecosystem (and in the case of political ecologists the value lies in the functioning of society), for economists the value is defined as a market price (real or hypothetical) in real or hypothetical markets. The difference in thinking tends to go undetected, in particular as both science and economics share a systematic ignorance towards the philosophy of science, which has the capacity to put the different approaches into perspective.*

Axiology or the Philosophy of Value and Valuation

Axiology is one branch of ancient philosophy, encompassing a range of approaches to understanding how, why, and to what degree humans should or do value objects, whether the object is physical (a person, a thing) or abstract (an idea, an action), or anything else. In philosophy, value is a property of such objects, representing their degree of importance. An object with philosophic value may be termed an ethical or philosophical good. Different kinds of value can be distinguished, based on different philosophical traditions and approaches (for a more detailed version see Spangenberg & Settele 2016):

- Ideal values emerge from Platonism, the view that there exists such things as abstract objects, real and objective things that exist independently of us and our thinking, which are entirely non-physical and non-mental. In addition, they are unchanging and causally inert—that is, they cannot be involved in cause and effect relationships with other objects (Balguer 2009). Ideas and values are such abstract objects, eternal, unchangeable, perfect types, of which particular objects of sense are imperfect copies. As these ideas cannot be perceived by human senses, whatever knowledge we derive from that source is unsatisfactory and uncertain. In his “hierarchy of ideas”, including justice, truth, equality and beauty, among many others, Plato identified the idea of the good as the supreme and dominant principle, determining the value of different actions. Valuation then may be described as treating actions themselves as abstract objects, allocating value (i.e. a degree of importance) to them based on their content of goodness. This allows for an ordinal scale ordering of actions, but not for a cardinal measurement.

- Real values are emphasised by Naturalism, a summary term for a variety of philosophical, scientific and artistic approaches. As opposed to Platonism, they consider real world objects as the only relevant basis to be taken into account, while all phenomena and hypotheses beyond this, in particular all those commonly labelled as supernatural, are either false or not inherently different from natural phenomena or hypotheses. The approach of ontological naturalism can be summarised as “nature is all there is and all basic truths are truths of nature” (The Encyclopedia of Philosophy 1996). Epistemologically, this leads to methodological naturalism, the requirement that hypotheses are explained and tested with reference to natural causes and events (familiar to natural sciences, but less so to economics). In this system of thought, values are necessarily determined by the inherent characteristics of the natural objects, which are predetermined and evolve according to the laws of nature, not subject to human judgement.

- Subjective values are also based on real world objects, but are not based on their inherent characteristics, but on subjective preferences. Thus they are not natural characteristics, but social constructs, based on what humans individually or collectively value as important to them. This is the domain of economic valuation, but covers not only economic values. Instead, subjective values can be

- Intrinsic: the value of moral subjects (anthropocentrists and biocentrists disagree whether this comprises only humans or also animals, but both emphasise the importance of this value category). As a value intrinsic to the subject as such, it can neither be enhanced nor be diminished by the situation the subject is in, and thus constitutes an equality of value between all humans (at least). The intrinsic value is the basis for general human rights, and the campaigns for animal rights. Since it is tied to the subject, it is a priori not open to exchange and substitution.

- Inherent: utility directly provided by a unique object (as opposed to a subject which has intrinsic value). As typical of utilitarianism, traits of an object are judged by humans regarding the utility they provide. Inherent value exists if a good which cannot be substituted is valued for its own sake. For instance, for bird watching a binocular has instrumental value (see below), but the birds themselves have inherent value. However, which elements of nature are unique, and which ones are indispensable, or in which state of the overall ecosystem the elements cannot be substituted even at the margin will remain disputed and can probably only be decided case by case.

- Instrumental: an object has instrumental value as a means for achieving a given purpose. As the same object can be used for different purposes, instrumental values cannot become absolute values, but the value of the same object can vary with the purpose for which it is used. Achieving the purpose provides a utility, and the instrumental value is the value of this utility. A landscape, an ecosystem, can be assessed to have very different utility, depending on whether it is analysed from the point of view of resource use, or from a leisure and health perspective. Some economists (most prominently Marx) distinguished between two kinds of instrumental value:

- Use value describes the utility from having access to and being able to use a certain object. It comprises the solving of problems, improving the quality of life (improvements in a given situation), and also the personal satisfaction gained from the use of the object. Thus use value and the understanding of utility it incorporates are multidimensional, and—for subjectively valued, for instance, inherited objects—can be much higher than the exchange value.

- Exchange value measures the value by determining the ratio in which objects (in this case called goods) are exchanged against each other based on the subjective preferences of different agents for one good or the other. Note that in this case utility is conceptualised as a scalar, a common property of all goods, not directly measurable or quantifiable, but is the basis of all exchanges or transactions. According to this concept, goods of all kinds are mutual substitutes exchanged on markets, and the ratio of their exchange is based solely on their respective utility.† Modern economics is essentially a theory of exchange, and defines a cardinal scale of product values based on it. This value increases with the scarcity of the goods traded, and decreases when cheaper or superior substitutes are developed.

However, exchange can still be barter trade, i.e. without monetisation of goods (one cow is three sheep, one sheep is two pairs of shoes, but how much is a camel? Or in the modern version: how many tanks for a million barrel of oil?). This is where monetisation comes in, with money providing a universal means of exchange, and a storage for value. As all value is measured in transactions, the market price reflects the utility and is used as the only yardstick to measure the value of goods (goods not traded on markets have no monetary value).

Furthermore, the exchange value does not measure the utility provided by a stock of goods, but only the marginal utility, i.e. the price of one additional unit of the good, dependent on the relative scarcity prevailing. Marginal utility based valuations are per definitionem not applicable to valuing the stock as a whole, and they cannot be added up. It is impossible to determine the total value of a good, e.g. all freshwater on Earth, but the economic value of one more glass of water can be measured: that is the market price people are willing to pay for it. Obviously, this price will change with the external conditions, in particular with scarcity or abundance of the good, and with their financial endowments.

Given the diversity of value definitions and their diverging underlying concepts, consider the economic understanding of the value of an ecosystem: as such, it is a stock, not traded and thus has no value. But it provides services, which are flows people are willing to pay for. Then the total payment over the period of use, i.e. the value of a certain service aggregated over time (and depreciated, but this is a different issue)‡ is taken to represent the value of the stock, i.e. the ecosystem. This is as close as economics gets in measuring the monetary value of eco-systems, but it usually ignores that each ecosystem provides a diversity of values between which trade-offs may exist. Calculating the maximal value implies an optimisation process, exploiting all different services over time so that a maximum of utility/income is generated. Even theoretically it is hardly conceivable (natural systems have infinite characteristics, i.e. they cannot be described exhaustively with a limited number of statements). The very attempt usually takes too much effort, and so only a few easily measurable services are taken into account (like freshwater provision and carbon fixation). Other services go unaccounted, let alone fill up bioscience knowledge gaps.

“Pricing unique, and thus non-substitutable objects, means treating objects with an inherent value as ones with only an instrumental value, specifically an exchange value: it is a category error, and no refinement of the measurement methodologies can overcome it.”

In a nutshell, economic valuation is necessarily only partial, as amongst the subjective values only the instrumental ones are taken into account, and amongst these it is undefined for intrinsic, inherent and use values, but only for exchange values. It is necessarily marginal, capable of valuing one unit of goods on markets, but not the stock of goods they flow from. Applying it to stocks is a methodological choice error, and cannot be corrected by skilful modifications of measurement methods. Pricing unique, and thus non-substitutable objects, means treating objects with an inherent value as ones with only an instrumental value, specifically an exchange value: it is a category error, and no refinement of measurement methodologies can overcome it. However, what is non-substitutable, subjectively and objectively, is disputed. In economics, a functional substitute is not one which replaces all functions of another object, but one which provides an equivalent utility.

“In the domain of purpose, everything has either a price or a dignity. Whatever good has a price can be replaced with something equivalent; goods standing above all pricing, and thus having no equivalent, have a dignity.” – Immanuel Kant§

Exchange Value Calculations: Going Beyond the Limits

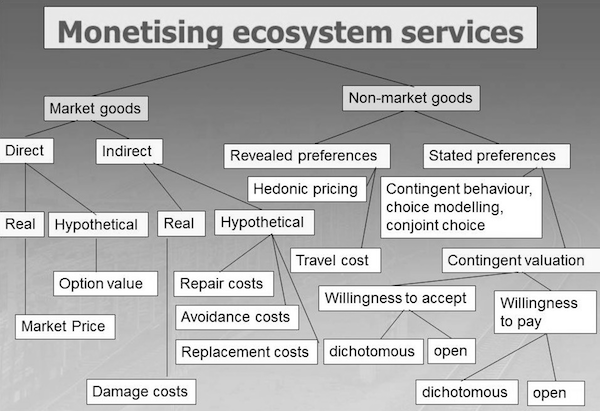

For products traded in markets, the market prices equal the exchange values. However, biodiversity is not traded, so valuations use several hypothetical constructions to derive exchange values. Option values are a direct measurement, covering hypothetical prices for alternative uses of the same resource in real markets. Indirect measurements in real markets are damage cost, like the loss of yield due to invasive species or pollinator loss (they do not measure the value of biodiversity, but the lost contribution from biodiversity to wealth creation; double counting is the rule rather than the exception). Indirect measurements, in hypothetical markets are repair, avoidance and replacement cost, with an increasing degree of uncertainty due to the assumptions which have to be made regarding future prices of substitutes. Despite this caveat, all these price calculations are based on assessing the value of market goods, and thus represent none of the category errors mentioned above. Here the difficulty is more as most of these valuation methods have a high level of uncertainty, and lead to different results.

“A basic assumption in neoclassical economics is that individuals with fixed preferences show a deterministic behaviour, forego choice, and thus have no freedom of choice.”

The situation is different for the valuation of non-market goods in hypothetical markets, based on stated or otherwise revealed preferences. The latter are rather case specific; they include in particular the prices of houses assumed to be a stand-in for the quality of their location (an assumption empirically falsified), and the expenditure for reaching a certain location as the value of being there (travel cost)—easy to measure but difficult to interpret.

The most frequent measurement method is based on stated preferences, the figures people give when interviewed for getting access to a certain amenity or the compensation they demand for losing it. Besides mixing exchange and use values, such figures have little to do with payments in real markets but are ethical statements of diverging quality as is well known from sustainable consumption research. All the diverse methods based on stated preferences are applied to value non-market goods, and thus the objects of measurement are usually characterised by their inherent or intrinsic value: monetisation in these cases is an applied category error.

Furthermore, asking for the willingness to pay in such contingent valuation (CV) experiments presupposes rational choice. In order for this approach to have any predictive power, economists must assume that preferences do not change over some period of time. So a basic assumption in neoclassical economics is that individuals with fixed preferences show a deterministic behaviour, forego choice, and thus have no freedom of choice. This is inherent to the theory’s determinacy: without determinism, no neoclassical theory, with determinism no choice. Consequently, many normal human behaviours are prohibited under the neoclassical notions of rational choice and rationality, and the lack of conceptualisation of the individual or economic agent, leaving out cultural norms, tastes, social motivations and institutions, makes this result inevitable (Rees 2006).

Bio-scientists have problems of their own: they tend to work in a world without human influences (or, if they are taken into account, they are dealt with as external forces, as given, not as parameters to be changed). These diverging approaches to biodiversity and its value are based on diverging world views, underlying patterns of perception which determine (and are shaped by) the basic assumptions of the disciplines, not their explicit teaching or applied methods. To understand the different approaches, a brief look at the pre-analytical world views (Daly 1996) may be helpful.

In ecology, species and numbers play a key role, but energy is another currency that can be used, as demonstrated first by Lindeman 1942.

In economics, utility (a non-quantifiable scalar) is the key unit, measured through market prices. A labour theory of value (in classical economics including Marxism) was given up, but an energy theory of value pops up again and again (Costanza 1980).

In ecology, on the population and ecosystem level, spatial structures including abundances play a key role (spatial spread, island biology, etc.). Thus most ecosystem models are spatially explicit, often GIS based.

In neoclassical economics, space as a category does not exist, it is free of space and real time. Only recently Paul Krugman, a Keynesian economist, showed that space has a role to play in economics, which earned him the 2008 Nobel Prize. Conventional Economic models are space independent and based on national statistics.

Community ecology (e.g. cascades) concentrates on the higher level, above populations, and since May (1975) ecosystems and their complexity have been in focus.

Macroeconomics describes complex systems, but uses mechanistic equilibrium models (even system dynamics models are heterodox), thus simplifying the analysis to make it fit the theory; empirical tests take place in the models (Spangenberg 2014).

In ecology, a range of approaches has always been used, and interdisciplinarity has proven fruitful (e.g. game theory, Maynard-Smith 1976, Dawkins 1978), with resilience and evolution as the key concepts.

In economics, different approaches constitute different, competing and mutually exclusive schools of thought including evolutionary economics (Schumpeter), ecological economics (Daly, Martinez-Alier, Söderbaum) or institutional economics (Veblen). The mainstream tries to “reintegrate” them by interpreting new approaches on the basis of its own paradigm (see the “Keynesian synthesis”, which has little to do with Keynes), while only slowly rejuvenating itself. Even celebrities (Krugman, Stiglitz) criticising not only symptoms but some of the basics risk falling out of favour.

Qualities are of crucial importance in ecology (and in many social sciences and the humanities), but not in economics. They cannot even be expressed in economic language unless they get translated into a quantitative change in economic parameters.

Diversity is a property of ecological systems which (potentially, and empirically in some cases) enhances their resilience. It is of no relevance in neoclassical economics. Diversity means not everything is at the maximum efficiency level, and thus reduces the provision of utility. In evolutionary economics, diversity is considered to stabilise the economy against shocks. Nonetheless, this “insurance function” is dedicated to maintaining a maximum of utility providing services at minimal cost, since they must not be too “expensive”.

2.3. Consensus Basis III: Conceptual Misunderstandings

Based on the different, mostly non-overlapping world views, systems of thought and argumentation, including specific nomenclatures, have developed. Unfortunately, some terms are shared by several disciplines, although each one gives a specific meaning to it. As a result, different concepts are used under the same name, and it requires a basic understanding of the different disciplines to identify commonalities and differences. Some examples include:

- Optimal Solutions: economists look for the optimum in a mechanistic, static system, the highest utility provided overall (distribution plays no role, the optimum is defined as the maximum of the one variable analysed, utility), and whether the system is always in the equilibrium state (the disequilibrium of adjustment processes is considered transitory, and judgement/measurement refers to the equilibrium state).

- Systems: economic systems are teleological, they develop naturally to maximize utility, reaching an optimal state if not disturbed by external influences. Ecological systems evolve without a target, are non-teleological, and there is no such thing as an optimum state from a biological point of view.

- Competence in science is restrictive, based on knowledge of the object area. In economics the understanding is broad, based on mastering the economic methodology and applying it to diverse object areas.

- Proof in science is not possible (unlike in mathematics), instead falsification and evidence are used. In economics proof by theoretical conclusion from existing economic theory, and evidence mainly from models based on the same theory.

Problems of Decision Making

Given these differences in basic concepts and self-perception, meetings of scientists and economists indeed represent a clash of cultures (if there has ever been one, this is it). This becomes most obvious to those not involved in the dispute when both approaches are used to derive policy recommendations, with diverging results. Political decisions (like business strategies) are always decisions under incomplete information; strategic decisions are often confronted with risk, uncertainty and ignorance.

- Risk means knowing the potential impacts of a decision, but not the probability.

- Uncertainty means not knowing all potential impacts, but having an idea about the probability that something might occur.

- Ignorance means having no idea of either.

Neither natural science nor economics has developed systematic means to deal with these different qualities of information: science tends to exclude all but the “hard facts” from its considerations, while economics tries to transform all kinds of uncertainty into stochastic probabilities to make them accessible to (a fuzzy version of) the deterministic economic concepts inherent e.g. to CGE (Computable General Equilibrium) models. Thus while economists reduce the complexity of reality to make it fit their tools, scientists in order to avoid type 1 errors (claiming a false right) systematically produce type 2 errors (ignoring a right, thus claiming a false wrong).

In continental Europe it is an established truth (a social construct) that politics has to take potential but unproven effects into account, i.e. to avoid type 2 errors, resulting in the precautionary approach. This has long been contested by the USA and other Anglo-Saxon countries, calling for evidence based decisions, i.e. for scientific proofs focussed on avoiding type 1 errors. In this approach, the results of economic models are usually considered evidence.

Thus in the Anglo-Saxon world decisions are systematically based on economic Cost Benefit Analyses (CBA), even in extreme cases. For instance, the European Commission, after calculating that about 5 million Europeans would die from heat related illness by 2100 if no effective climate change adaptation policy is established, then asks: does such adaptation pay out? (EU White Paper on Climate Adaptation). As opposed to that, in Continental Europe decisions (at least until the mid-1980s) have been based more on the scientific approach, introducing limits and thresholds, while economics was used for cost effectiveness calculations, i.e. to help identify the most effective way towards achieving politically defined objectives. Unfortunately, the results of both methods are far from identical, regarding the limits as well as the means.

3. Conclusion and Lessons Learnt

Interdisciplinarity and Transdiciplinarity – Post-normal Science

No single discipline commands all necessary knowledge to deal with complex, co-evolving socio-environmental systems. The existence of different levels and scales even implies the unavoidable existence of non-equivalent descriptions of the same system (Giampetro 1994).

This led us to suggest a law of interdisciplinarity: No discipline must make assumptions which are in open contradiction with the consensus of other disciplines. Note that this does not rule out contradictory results, but refers to assumptions, and does not favour a specific school of thought, but refers to the consensus.

Methodological differences and the enormous competition in each discipline as the (still) rather exclusive peer group often condemn interdisciplinary work as a kind of a hobby besides the “real scientific” work.

It cannot be enforced, but supported, e.g. by incentives like cross-cutting PhD positions (and collaborating supervisors), by grants and research funding (with a diverse spectrum of reviewers), joint workshops, symposia and publications (although the latter may be difficult as most interdisciplinary journals have low impact factors).

Not even all disciplines together could possibly derive a joint, exhaustive and contradiction free system description: they would miss out other sources of knowledge. Stakeholders contribute relevant knowledge, and thus the establishment of an extended peer community including non-scientific knowledge is a means to improve scientific advice, in particular when knowledge is incomplete, stakes are high, values disputed and decisions urgent. Funtowicz and Ravetz (1993) describe this as the typical situation requiring a post-normal science approach as described above.

Living with Complexity

In order to address contemporary issues, economics and biosciences need to expand their empirical relevance by introducing more and more realistic and thus more complex assumptions into their models (Munda 2004). Currently, the systems, the mental models used in bio-sciences are usually dynamic or, at best, self organising systems not easy to simulate in computer models and ruling out predictions (hence the boom in scenario development as an alternative means of exploring the future). However, despite their inherent unpredictability, only the latter are based on a level of system complexity corresponding to one of the systems they intend to describe.

“The context provides the meaning, and the context is legitimately different between disciplines. No discipline can claim the “right” view.”

The challenge to economics is even larger: on the one hand, economic models are usually simpler, despite all their sophistication in details, based on equilibrium calculations and representing fully determined, predictable worlds. Dynamic models are rare, self-organisation models exotic, for a (non-scientific but plausible) reason: economists and the profession as a whole gain much of their reputation, influence and funding from their advisory function, based on model predictions given that it is hard to acknowledge the insufficiency of existing models, and the inability of better models to provide predictions.

Secondly, economics (like the other social sciences) deals with a more complex system than physics or chemistry. In self-organising systems the system as such can learn; this is hardly true when it comes to its system elements, in complex evolving social systems, and partly in ecological systems, the individual elements can learn, in social systems by reflective behaviour. This causes an even higher degree of complexity, making the gap between theory and reality even wider. Thus the challenge is to progress towards reflexively complex systems, and combine systems learning (usually for bio-geochemical systems without reflexive agents) with learning processes of (some of) the system elements (Spangenberg 2014).

For both ecology and economics, learning to deal with complex evolving systems is a necessity on the macro level (macroecology, macroeconomics). This also has impacts on the internal situation of the disciplines: in both, today the micro perspective dominates. All too often attempts are made to derive macro level system descriptions from a micro level perspective, ignoring the fact that the emerging properties on higher system levels condemn every attempt in this respect to partial and inconclusive results as far as the macro system is concerned. On the contrary, if micro level systems, genomes or companies, had been analysed in terms of the macro level context, many past errors could have been avoided.

This will require learning to think outside of the box, to understand that the context provides the meaning, and the context is legitimately different between disciplines. No discipline can claim the “right” view, although the specific competences should be respected.

Mutual Respect and the Need for a Common Language

As mentioned in the analysis, a joint dedication can lead to mutual respect and an uncritical adoption of each other’s views. The challenge is here to progress from imitation to an enlightened collaboration, to a mutual respect based on understanding. To express this joint understanding, a common language is needed, usually the language of everyday communication (a common language without jargon).

However, beyond the everyday language, some classifications, some ideas about the relationship of different disciplines are necessary. We found the DPSIR system (driving forces, pressure, state, impacts, responses) to be such a structure, not as a causal circle, but as didactical tool to come to grips with complexity. It helps to see complementarities and mutual dependencies between sciences, economics, political science and other disciplines.

A different but similarly helpful didactical tool has been the Prism of Sustainability, which illustrates the distribution of themes, agents and disciplines in sustainability research and decision making. In particular, it highlights the linkages, the need for interdisciplinary collaboration as a condition for effective sustainability science. Other tools may do the same service.

Understanding the Basics of other Disciplines

A condition for successful communication is the ability to express the results of one’s own research in the language of the partners, in terminology and analytical categories. Such language skills are hard to learn once someone is absorbed by the disciplinary treadmill—the best option may be a studium generale in the first year of academic education providing a joint basis between the disciplines.

Education is Philosophy and Theory of Science

Finally, as the extended reference to the philosophy of science intended to illustrate, a qualified education in the theory and philosophy of science, pretty unusual in current academic education, may provide the means to arrive at a joint view, put results in perspective and in particular avoid mistakes which are not on the methodological, but on the systemic level. Category errors, method choice errors and the like are easily avoided if the basics are clear and the scholar is aware of them.

References

- Alcorn, S., Solarz, B. 2006. The Autistic Economist. post-autistic economic review 38: 13-19.

- Allen, P. M. 2001. The Dynamics of Knowledge and Ignorance: Learning the New Systems Science, in: H. M. W. Matthies, J. Kriz, (Eds.) Integrative systems approaches to natural and social dynamics. Berlin, Heidelberg, New York: Springer, pp. 3-30.

- Balaguer M. 2004. Platonism in Metaphysics. Stanford Encyclopaedia of Philosophy, http://plato.stanford.edu/entries/platonism/

- Commission of the European Communities. 2009. White Paper - Adapting to Climate Change: Towards a European Framework for Action, COM(2009) 147/4. Commission of the European Communities: Brussels.

- Costanza, R. 1980. Embodied Energy and Economic Valuation. Science 210, 1219-1224.

- Daly, H.E. 1996. Beyond Growth. The Economics of Sustainable Developoment. Beacon Press, Boston, USA.

- Dawkins, R., 1978. The Selfish Gene, 2nd ed. Oxford University Press, Oxford, New York.

- Funtowicz, S.O., Ravetz, J.R., 1993. Science for the post-normal age. Futures 25, 739 - 755.

- Gowdy, J., Rosser Jr, J. B., Roy, L. 2013. The evolution of hyperbolic discounting: Implications for truly social valuation of the future. J Econ Behaviour & Organization, 90, Supplement: S94-S104.

- Keen, S. 2001. Debunking Economics. The Naked Emperor of the Social Sciences. Pluto Press Australia, Annandale, NSW, Australia.

- Lazear, E.P., 2000. Economic Imperialism. Quarterly Journal of Economics 115, 99-146.

- Lerch, A. 2001. ‘Naturbewertung in ökonomischer und ethischer Perspektive’. Schriften des Vereins für Socialpolitik, Wirtschaftsethische Perspektiven VI, Neue Folge Band 228/VI: 223-246.

- Lindeman, R.L. 1942. The Trophic-Dynamic Aspect of Ecology. Ecology 23, 399-417.

- May, R.M. 1975. Theoretische Ökologie. Verlag Chemie: Weinheim.

- Munda, G., 2004. Social Multi-criteria Evaluation: Methodological Foundations and Operational Consequences. European Journal of Operational Research 158, 662–677.

- Rees, W. E. 2006. Why conventional economic logic won't protect biodiversity, in: D. M. Lavigne (Ed.) Gaining Ground: In pursuit of Ecological Sustainability. Limerick, International Fund for Animal Welfare, Guelph, Canada; University of Limerick, Limerick, Ireland, pp. 207-226.

- Smith, J.M., 1976. Evolution and the Theory of Games: in situations characterized by conflict of interest, the best strategy to adopt depends on what others are doing. American Scientist 64, 41-45.

- Spangenberg, J. H. 2014. Sustainability and the Challenge of Complex Systems. J. C. Enders, M. Remig (eds.), Theories of Sustainable Development. Routledge Studies in Sustainable Development Series. Routledge, Taylor & Francis Group, Abingdon, Oxford, UK: 89-111.

- Spangenberg, J. H. 2016. The world we see shapes the world we create: how the underlying worldviews lead to different recommendations from environmental and ecological economics—the green economy example, Int. J. Sustainable Development 19(2): 127–146.

- Spangenberg, J.H., O'Connor, M. 2006. La ciencia de la sostenibilidad en el espacio de investigación Europeo: descripciones, definiciones y retos, in: Riechman, J. C. (Ed.), Perdurar en un planeta habitable. Ciencia, technología y sostenibilidad. Icaria, Barcelona, pp. 149-184.

- Spangenberg, J. H., Settele, J. 2016. Value pluralism and economic valuation—defendable if well done. Ecosystem Services 18: 100-109.

- The Encyclopedia of Philosophy. 1996. Macmillan Publishing, London, UK

* The analysis in this section follows the approach of A. Lerch (2002), but draws different conclusions.

† To explain the market mechanism, individual preferences have to be aggregated into a collective demand curve, a mathematically questionable procedure but indispensable to economic theory, see Keen 2001. Assuming this kind of rationality, postulating market clearance and the emergence of equilibria, the economy is perceived as a fully deterministic system, a mechanical clockwork (early economists in the 19th century, deeply impressed by the achievements of contemporary physics, described their profession as the mechanics of the economy). This results in an under-complex model of reality, see Allen 2001; 2014.

‡ The depreciation rate is decisive for the “value of the future” as for instance at 3% or 5% depreciation, any event in 100 years has only marginal meaning today, even global climate change. Depreciation assumes that future generations will be better off, thus constituting an imminent necessity of economic growth, and the assumed rate (chosen subjectively) represents a kind of “inherent ethics”. For a critique of assuming an exponential discounting function see e.g. Gowdy et al.

§ Author’s own translation