Hello Visitor! Log In

Innovative Financial Engineering to Fund the SDGs - A WAAS Initiative*

ARTICLE | June 13, 2020 | BY Stefan Brunnhuber, Garry Jacobs

Author(s)

Stefan Brunnhuber

Garry Jacobs

Abstract

Development needs have primarily been financed through private sector financing, conventional public sector funding and philanthropic commitment. These traditional sources are not sufficient in scale and speed to meet the pressing finance needs. The world community is too busy repairing, stabilizing and refunding the given to maintain the stability of the existing system, relying on a mechanical model. Out-of-the-box approaches which blend in with the given tools, providing new financial engineering are required. The introduction of a parallel electronic currency specifically designed to finance global commons and human-centered economy would provide a systemic non-linear and complex approach to create the necessary resources to achieve the UN SDGs and addressing asymmetric shocks (COVID-19, among others), while stabilizing the existing monetary system. The development of cryptocurrencies based on blockchain distributed ledger technologies has prompted leading central banks and other agencies around the world to study the potential application of this approach to directly inject purchasing power without dependence on the banking system. Proposals are now being studied by an international expert group on how this approach can be utilized to finance the huge multi-trillion-dollar annual investment requirements for achieving the Sustainable Development Goals, with special emphasis on investments in human resources and environmental protection. A first outline is given in this preview. A full report (The Tao of Finance) of the expert group will be published in late 2020.

1. Introduction: The Traditional Way

In 2015, world leaders signed up in NY for a future road map with 17 Sustainable Developments Goals (SDGs) to improve Humanity, the Planet, Wealth, Peace and Partnerships. Most of these SDGs focus on common goods such as clean air, universal access to health care, education and maintaining biodiversity. These goods are not exclusive and should be accessible to and enjoyed by everyone. Each of these goals have enough scientific evidence, technological know-how and political consensus to be achieved, and are valid for the entire planet. But these goals are expensive to achieve and require approximately 5 trillion USD/year over the next 15-20 years to finance. Our global Gross Domestic Product (GDP), which includes all goods and services, is approximately 80 trillion USD/year. The conventional way to finance social and ecological projects globally has been by redistributing the money remaining at the end of this pipeline. Historically, the world community has spent 0.7% of global GDP—roughly 500 billion USD/year—to finance common goods. Other than the Scandinavian countries, the vast majority of the world has never attained this 0.7%. But even if all countries attained the 0.7%, this sum is realistically not enough to finance our future. Approximately 8-10 times more funding—equivalent to 5 out of the 80 trillion USD global GDP—is required to meet the social and environmental challenges we face. Withdrawing 5 trillion from the economic process, even in a gradual manner, would lead to a global recession. In fact, it is impossible to finance our future solely through monetary re-distribution. In addition, the stability of the financial system itself is an impediment to sustainable financing.

2. Money is not a Natural Law but a Social Convention

Money is neither a thing nor a natural law. It does not arise naturally in any given society, but is the result of a human invention, backed up by a narrative shared by billions of anonymous humans interacting with each other round the clock in order to improve the welfare of each individual and society as a whole. The more stable, reliable, and trustworthy this social invention is, the more powerful it will become to achieve the purpose each society has set for itself. It is reciprocal trust and mutual tolerance that have the ability to catalyze greater human potential. The opposite is true, too. The weaker, more unstable, more speculative, unreliable and unfair a system is, the less capacity it has to exert its full positive influence on society and its members. Similarly to any social organization and invention such as language, the internet, or the legal system, the monetary system can be used for good or bad. The ultimate purpose of a monetary system should be that of promoting, facilitating and supporting human welfare, security and wellbeing. In this sense the financial system acts like a catalyst, enabling multiple interactions and infinite transactions between humans beyond space and time without becoming altered in the process. However, the more complex and interactive a society becomes, the more carefully the design of this invention needs to be scrutinized.

3. How does Money come into the World?

It is not the production of goods and services, nor the pattern of our consumption, that helps us understand where money comes from, but the underlying values that determine the nature of any monetary system in any society.† Money is a social invention, a legal act and a convention, not a natural law or a thing. Accordingly, we can change it. In this sense, the financial system is one of the most powerful tools facilitating societal achievements that humans have ever invented.‡ Rather than rejecting the internet, our language, the marketplace, and governmental institutions when they serve less noble or ethical purposes, we try to improve their design or usage and minimize their negative externalities. This should also hold true for the financial system. Because the monetary system affects so many aspects of human activity, its steering power should increase benefits and achievements every time it is used. But money not only enables commercial transactions. It is able to facilitate human welfare from a much larger perspective, converting individual goods or services into almost any other desirable social good. In this sense, the financial system not only catalyzes and multiplies, but also potentially transforms our society, channeling the liquidity towards where it can create the most welfare for most people.

4. Discovering New Territory

Over the last 40 years, the financial system has become more unstable, with over 425 banking, monetary, or currency crises; and with every consecutive event, higher debt load and greater expenses amounting to more than 10% of the GDP. Because of this, the world community spends much effort repairing, stabilizing, and refunding the monetary domain to maintain the status quo. This limitation in our financial system thwarts any improvements in the technological and political field to make the world a better place. Is there a different way to finance our future? Using systems thinking, we propose an outside-the-box solution to generate the funds needed to finance global common goods: (a) Central banks would be given an extended monetary mandate to create and issue the 5 trillion US Dollar-equivalent liquidity using block chain technologies.§ Alternatively, (b) properly regulated corporate initiatives (cryptocurrencies) or complementary communal currencies (LETS; Regiomoney) would receive a mandate to issue additional liquidity. These funds would be earmarked and used exclusively to finance SDG-related projects¶. This electronic liquidity would run through monetary channels other than the ones in the conventional system. We would then have a supplementary currency operating in parallel to the conventional monetary system generating the 5 trillion USD-equivalent annually needed for the next 20 years.**

Research on optional parallel digital currency systems has shown a dozen positive effects. For example, this new technology could be used to create and channel targeted financial liquidity to millions of African citizens through their mobile phone network. In India, the existing microcredit banking system could be used to transfer additional liquidity to millions of Indian citizens. Any dollar spent and invested through these green, parallel channels has the potential to reduce or even eliminate absolute global poverty substantially. The electronic format would prevent corruption and fraud, as each transaction is transparent and public. Once the currency is eligible to pay taxes, communal offices would have additional liquidity to rebuild public infrastructure such as kindergartens, public parks, communal hospitals and public libraries. And the millions of nongovernmental-organizations globally would finally receive the funding they need to properly do their jobs. This targeted added liquidity would enhance education and access to universal health care that would otherwise never happen. It would reduce resource depletion and clean up air avoiding the negative effects on our planet and common health. We would eventually tap into the untapped potential of millions of unemployed individuals through the creation of new jobs, thereby unleashing the creativity of billions of humans.

“If we are prepared to change our mindset and the underlying narrative about money, unlimited options are possible.”

What would be the effects on the conventional economy? The annual 5 trillion USD-equivalent added liquidity would not hurt or harm the conventional economy. In fact, the opposite would be true. Corporate and state planning, production and price level would become more robust and reliable with a longer-term vision. Furthermore, it would stabilize the cyclical economy of booms and busts. And such a parallel system is far from being inflationary. Applying the right monetary channels, additional liquidity injected to reduce poverty and hunger, increase the access to health care and education and invested in renewable energy will eventually reduce the pressure on the general consumer price (CPI): Reduced costs for damage control, increased productivity of a more healthy and educated population and the economy of scale are some of the components that enable a parallel currency system to operate rather in an anti-inflationary and anti-cyclical manner.††

Despite arguments to the contrary, we need much more financialization (Finance/GDP). However, it must be designed in a more democratic and human-centered manner, to protect the planet while increasing wealth for the two thirds of the global population and to cope with ongoing asymmetric shocks (COVID-19, global warming) the world community is facing. If there is a single most important variable beyond technology, governance, behavioral changes and demography to change the world, it is a parallel monetary system. This is the “game changer”. All this can be started in less than 6 months, if the largest Central Banks agree to create a parallel, optional complementary currency and all this could be implemented on a country level in 12-16 months with measurable outcomes. We are aware that a redesign of the financial system does not solve all our problems, but all our problems can more easily be addressed by it. This, or a very similar mechanism, is the missing link to achieving greater Humanity, Wealth, Peace, a greener Planet and better global Partnerships.

5. A Blended Six-pack is Required

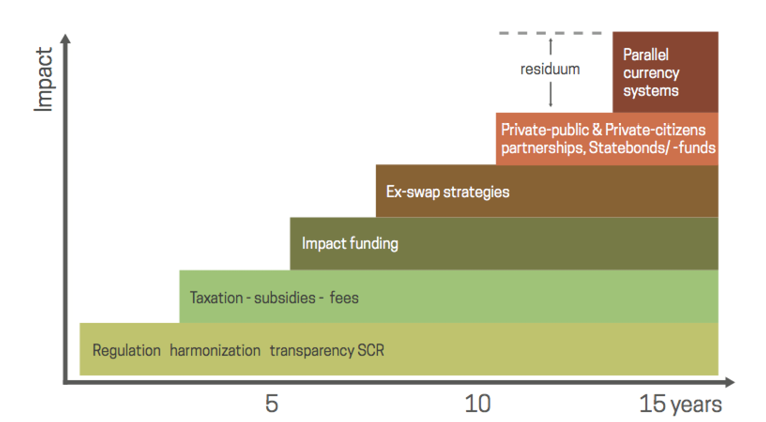

A mix of policy instruments is necessary to tackle the challenge of financing our future. The six most relevant financial engineering tools to do so and establish a more sustainable common future at the same time are structured like a staircase (see Figure 1). This stepped approach is sensitive to time, to the capacity for collective action, and considers a balance between current and future generations.‡‡ It builds upon the wisdom and experiences we have gained in traditional finance in the past (regulatory efforts, taxation, impact funding) and extends that wisdom and those experiences into the future, adapting and enriching the instruments in question according to the challenges ahead. In general it has the following rationale: the more time available and the stronger and denser the multilateral agreements on which global transactions are built, the more likely it is that the lower traditional steps are favored. Conversely, the less time we have and the more multipolar or bilateral our world becomes, the bolder and more unconventional the monetary and financial decisions must be, as embodied in the higher steps. This will finally lead to supplement the residuum left by additional liquidity injected through a parallel financial system.

6. Some More Concrete Examples

Some examples, where conventional financial tools can be further developed using the parallel mechanism to stabilize and steer our society towards a more sustainable future, are summarized in Table 1.

Table 1: Concrete Examples of How a Parallel Optional, Digital Monetary System

can help Finance our Future and Cope with Asymmetric Shocks

|

Green Bonds |

Catastrophic Bonds (CAT-bonds) Pandemic-emergency facilities (PEF) Forced Migration Facilities (FMF) Harvest Default bonds (HAD) |

|

Green Credit Easing |

green TLTRO (Targeted Long Term Repurchasing Organization): Conditioned Lending for SME, Private Households and public sector entities to finance green investment, consumption. Green Repurchasing agreement: (Repos) Green assets are eligible to borrow liquidity from Central banks. They serve as collaterals for financial institutions for short term refinancing and operate as a criterion in case of a haircut. |

|

Green Quantitative Easing |

Additional base money issued for Developing banks/ EIB, operating also financial intermediaries for conditioned green lending. |

|

Green Private Public Partnerships (PPP) |

Performance Contracting between the private and the public sector, where the public infrastructure remains in public ownerships, the management is running through private companies. |

Let us take this argument one step further: catastrophe bonds (CAT bonds), pandemic emergency facilities (PEF), forced migration facilities (FMF) and harvest default bonds (HAD) all operate along a similar principle: a region signals a hazard and asks the World Bank for financial insurance assistance. The World Bank or the IMF then issues bonds with an interest rate and a complex contracting agenda to the private sector, which buys up the bonds. The contract determines when and how the private sector must commit to paying for the hazard or alternatively is reimbursed if the hazard has not occurred. Examining harvest default bonds more closely, we see that two-thirds of global farming are small enterprises operating for self-sufficiency. Once a drought occurs, HADs come into play. However, it is unnecessary to loan money from the private sector and reimburse them with a risk premium. A supplemental digital currency, as explained in this text, operating through a non-profit cooperative banking sector and monitored by the UN, could take over this task with less risk and higher yields for the community. In each case, the World Bank’s balance sheets increase in the first place. In the case of a harvest default, the World Bank will need to write the event off and decrease its balance sheets in the second place, but millions of farmers are saved from insolvency and can continue their business.§§

In fact, there are almost unlimited permutations possible, as each of the financial facilities is backed up by Development Banks (like EIB or World Bank), funded by Central Banks,¶¶ monitored by the UN and enabled through domestic and national agencies. If we are prepared to change our mindset and the underlying narrative about money, unlimited options are possible.

7. Conclusions

It is an erroneous conclusion to assume that human social systems are inherently physical and the principles of entropy and the laws of mechanics apply to society as well as physical nature. Human beings at higher levels of consciousness are creative and not merely (re-) productive; creativity is capable of creating infinitely more from less and sometimes even from nothing. Humans’ perception of money often is like a fish’s perception of water. Fish see water as neutral, unchangeable, like a natural law. Similarly, many of us consider money a neutral element that helps us accomplish our individual desires and societal goals. Money is seen to be like a thermometer: we insert it into water and it simply measures the temperature. But money is not neutral. If we want to understand the nature of water, we need to first step out of it, then examine it. The same is true of the monetary system.

There is a subtle but substantial difference:

Acknowledging that there are over 40 trillion USD in assets under management (AuM), a global bond market with outstanding interest bearing loans of over 100 trillion USD and locked-in assets in the fossil energy sector, the so called carbon bubble of over 20 trillion USD, we are not proposing a potential best and ideal typical solution for the financial system (which will remain a theoretical proposition). We are rather advocating for the single practical best next step in the development of our monetary system that maximizes our ability to finance our common future over the next 15 years.

If we consider the current COVID-19 pandemic as one of the first asymmetric shocks the world community is facing in a long series of future shocks to come, we should take this argument two concrete steps further: First; if a governmental body (for example, the EU) is setting an agenda where the leading monetary regulators, financial secretaries and heads of states (all together not more than 50 people) agree to such a parallel monetary mechanism, allowing citizens to pay taxes and to pay wages, this can be implemented technically in less than 18 months; And if, as a second step, the lead investors (not more than 50 people, meeting at the World Economic Forum (WEF), for example) are introduced to this parallel monetary mechanism, allowing to shift their assets into this ‚green new market place‘ by additional new financial tools (partly explained in this text and further explored in the upcoming report‚ TAO of Finance’), we have a reasonable chance to get out of the incremental way of doing politics and transform our profit, our people and our planet.

From a systems perspective, the well-known ritual of debate between neoliberal and Keynesian arguments (between austerity and stimulus) is relatively unproductive, intellectually exhausting and economically inefficient. Identifying the smallest common denominator will lead to a suboptimal solution. It resembles a “feel-good” exercise or a symbolic gesture with next to no practical use that does not change the game. Instead of repeating the debate over and over, it would be more fruitful to identify the unquestioned commonalities that both parties rely on, of which the monetary monopoly and linear, sequential thinking are undoubtedly two characteristics. Societal change always starts with the minds and hearts of individuals and small groups who are prepared to think, feel and act differently. In contrast to former times, this change has accelerated and gained momentum in recent decades and years. Whereas most changes in history took place unconsciously, we are now in a situation to refer to scientific information and data and apply that knowledge and wisdom in order to take charge of this process intentionally and consciously, steering our society towards higher values, increased wealth and greater sustainability. Consciously we are able to convert the best ideas into power and promote “leadership in thoughts that lead to actions” (WAAS’ motto). Whereas any scientific knowledge remains divided, the reality will always remain an unseparated, integral whole. The financial mechanism described in this text acknowledges the empirical findings of different disciplines, applying new technologies and approving new monetary governance. It should be part of a future social equation that maximizes individual freedom, embedded in a social construct that catalyzes the change required. This “TAO of Finance” should be a main component of such a future.***

Bibliography

- Breitenfellner, A., Pointer, W., & S Schubberth, H., 2019, the potential contribution of central banks to green finance, Quartely Journal of Economic Research , DIW Berlin, vol 88/ 02/2019, pp: 55-72

- Brunnhuber et al. (2020), The Tao of Finance – A Mechanism that can change the world; A WAAS-Initiative (in press)

- Claringbould, Duco, Koch Martin & Owen Philip, 2019, Sustainable finance : The European Union’s approach to increasing sustainable investments and growth – opportunities and challenges, Quartely Journal of Economic Research , DIW Berlin, vol 88/ 02/2019, pp: 11-28

- Dag Hammarsskjörld Foundation, (2019) Financing the UN Development System Time for Hard Choices, United Nations MPTF Office, Sept 2019: https://www.daghammarskjold.se/wp-content/uploads/2019/08/financial-instr-report-2019-interactive-1.pdf

- Grauwe P., de (2019), Green Money without inflation, Quarterly Journal of Economic Research, DIW Berlin, vol 88/ 02/2019, pp: 51-54

- Heine Dirk,Semmler, Willi, Mazzucato, Mariana, Braga Joan paulo, Flaherty Michael, Gevorkyan Arkady, Hayde Erin &Radpour Siavash, 2019, Financing Low Carbpn Transitions through Carbon Pricing and Green Bonds, Quartely Journal of Economic Research , DIW Berlin, vol 88/ 02/2019, pp: 29-50

- Jacobs G., (2016), Foundations of Economics Theory, Markets, Money, Social Power and Human Welfare, Cadmus 2, 6,

pp: 20-42 - Jacobs G. & Slaus I. (2012), The Power of Money, Cadmus, 1, 5, pp: 68-73

- NGFS (2019), First comprehensive report: A call for action. Climate change as a source of finical risk. Network for greening the financial system. Paris

- Orlov, S., Rovenskaya, E., Puaschunder J. and Semmler W. (2018), Green Bonds, Transition t a Low Carbon Economy, and Intergenerational Fairness- EWvidence from gather DICE Model IIASA Working Paper, Laxenburg, Austria.

- Sachs, Jeffrey (2015), Climate Change and Intergenerational Well-Being, In. Bernard L., & Semmler W ( ed.). The Oxford handbook of the Macroeconomics of Global Warming, Oxford: Oxford University Press, pp: 248-259

- Slaus I, Giarini O. & Jacobs G., (2013) Human Centered Development Perspective, Cadmus 1, 6: pp: 18-23

- Jacobs G., Kiniger-Passigli D., Henderson H & Ramanathan J., (2020) Catalyzing Strategies for Socially Transformative Leadership Cadmus 4, 2: pp: 6-45

* The TAO of Finance-Initiative of WAAS: The current proposal is the result of 4 years of an ongoing interdisciplinary process of over 40 expert hearings, panels, background discussions and multiple conferences among scholars, regulators, executives, politicians and non-profit activists to elaborate the new role of financing the future and the future of finance.

† 97% of the money in circulation is generated through the commercial banking system by a credit creation process. 3% is created by the central banks (base money and/or cash). This 3% also acts as a loan to the commercial banking system. In modern times, central banks generate base or hot money as loans and purchase state or corporate bonds as collateral. This is how money comes into the world. This procedure increases their balance sheets, stabilizing our economy and our society as a whole. Theoretically there is no limit to the amount of central bank loans possible. Grauwe (2019)

‡ See Jacobs (2016); Jacobs & Slaus (2012).

§ Whereas the quantitative finance programs of central bank after the 2008 crisis increased the API (asset price index) and were primarily created to stabilize the banking system, our approach is using different monetary channels and different technology (DLT) to guarantee that the additional liquidity is solving real economic problems (hunger, poverty, global warming and the loss of biodiversity).

¶ A so-called digital smart contract implemented into the distributed ledger technology would allow to trace each economic transaction, allowing green investments and consumptions pattern and prohibiting others (buying guns, alcohol, drugs among others).

** Such a parallel, digital, optional monetary mechanism has a positive impact on the price level (stabilizing the CPI), prohibits fraud and corruption, increases potential green public revenues, and will finally shift our entire society from a war prone state towards a more peace prone state. Technical details are explained in the report (Brunnhuber et al., 2020).

†† The impact of a parallel currency system on the CPI (Consumer Price index) is further explained in the upcoming report (Brunnhuber et al., 2020).

‡‡ Sachs (2015); Orlov (2018); Claringbould et al. (2019), Heine et al. (2019).

§§ Or take the TLTRO (Targeted Longer-Term Refinancing Operation) programs run by several central banks. In its traditional reading, a TLTRO is a form of conditioned lending to SMEs, private households or public entities. A green TLTRO would then condition additional credit easing towards green investments. Dag Hammarskjöld Foundation, (2019); Breitenfellner et al. (2019); NGFS (2019).

¶¶ China has announced to roll out a state-run, blockchain-associated digital currency by the end of the year 2020. We will have to explore how this will meet the requirements of an open society explained in this text (A. Mukherjee, Bloomberg).

*** Catalyzing strategies for socially transformative leadership (WAAS, forthcoming 2020).