Hello Visitor! Log In

New Paradigm in the Service Economy The Search of Economics for Scientific Credibility: In between Hard and Soft Sciences

ARTICLE | October 19, 2014 | BY Orio Giarini

Author(s)

Orio Giarini

Abstract

After the very long cycle (about 10,000 years) of societal and economic development based on agriculture, followed by a short cycle in which the industrial revolution became the prime mover (for less than 3 centuries), the world has entered a phase marked by the growing and determining importance of service activities (both monetarized and non-monetarized) . This transition is a key to understanding many of the current ‘crises’ confronting humanity and to benefitting from and promoting emergence of a new era in human development. The right starting point is to redefine the notion of value on which the Wealth of Nations is now more and more based. This is not simply a technical issue concerning the growth of services over purely industrialization processes. It implies a fundamental change. In a modern service economy, the production of value starts long before the actual point of manufacturing with fundamental research, continues through numerous stages of technological and social process, and extends beyond the time of sale through a prolonged period of utilisation of products and systems – the true basis for measuring added value), and finally ends with waste disposal (a negative value). All this happens during a period of time largely based on uncertainty and management of all sort of risks (foreseeable and unforeseeable). From this perspective, all the pretentions of classical economics to generate and measure value based on the idea of static equilibrium appear more and more antiquated and inadequate. Prices and costs have to be estimated based on hypotheses including the future.

1. Introduction

The Economic Wealth that has to be developed in the future must, inevitably, take account of the context of the New Economy which is characterized by the predominance of services as factors of production. This, rather than the limits to the industrial revolution, is the key change in economics as the basis for building the wealth of nations. The Club of Rome achieved worldwide renown, sometimes stimulated by strong criticism, after the publication of its report on Limits to Growth in 1972. This was a very critical time since, after World War II the high rate of growth of the economies of most of the industrialized countries had, until then, been around 6% per year. From 1973 until the present this rate of growth has declined, on average, to about 2% and less per year. The “scandal” of the Club of Rome consisted in the fact that doubts were expressed as to the possibility of a continued and, as one would say today, a “sustainable” growth.

This article summarizes another point of view: during these years there has been a fundamental change in the way in which wealth is produced. The industrial revolution, based essentially on investment in new machines, tools and products, had, in all sectors of the economy, given way to the emergence of service functions as the key factors of production. This issue therefore is essentially a view from the supply side of the economy. Through the Club of Rome a series of reports were proposed to support this analysis based on the experience of over two decades in the manufacturing sector as well as in the traditional service sector.1

The difficulty, which persists today, is that classical and neo-economic analysis is still bound essentially to fundamentals linked to a reality in which the manufacturing system would be dominant. When services become the determinant in the production of the wealth of nations the very basic notion of economic value changes its connotations and the issue is, in the end, philosophical: value can no longer be defined as the result of an equilibrium system where disequilibria have to be considered a matter of imperfect information. In the service economy such information is bound to remain constantly imperfect because it involves the utilization of products and systems in time. An ever larger part of costs in the performance of such systems in time is linked to future events where even the duration of utilization is uncertain. The value system, therefore, is basically dependent on the uncertainties of reality.

The assumption is that the deterministic model, which is still dominant in the traditional macroeconomic analysis, has in fact given way to indeterministic systems. As a major consequence, the key economic issue today is that of understanding and managing risks, uncertainty and vulnerability as fundamental problems. Today, the main problem is to redefine value as the basic point of reference for the wealth and welfare of nations.

2. The Legacy of the Industrial Revolution

2.1 Producing Tools and Goods to Increase the Wealth of Nations

Of course economic analysis and even economic theories had existed long before Adam Smith. But it was Adam Smith who, in 1776, laid the foundations of economics as a specific discipline or science, as distinct from more general societal or historical analyses. So why Adam Smith? His impulse was by no means exclusively intellectual. It was prompted essentially by a new economic revolution brought about by the descendants of Adam and Eve in their struggle against scarcity. Indeed, during his lifetime Adam Smith experienced the birth of the Industrial Revolution - the big switch from an agricultural to an industrial economic system.2 This transition is very well illustrated by his opposition to the views of Francois Quesnay, Madame Pompadour’s illustrious doctor, and a physiocrat (the French school famous for the saying “laisser faire – laisser aller”) of even greater celebrity status.

The dispute between Adam Smith and Francois Quesnay focused on the origin of the Wealth of Nations.3 Both had an explanation. For Quesnay, looking at the main source of wealth in France, it was obvious that the wealth of nations derived from a flourishing agricultural system. Adam Smith, however, was more concerned with the new development of manufacturing activities he saw around him in Scotland. Since Adam Smith’s times, the industrialization process has come to be seen as a crucial weapon in the fight against scarcity, as the road of progress leading, in a sense, back to the Garden of Eden. After all, Adam Smith was essentially a moralist, like many other great economists such as Thomas Malthus and Alfred Marshal would later be.

Concentration of production meant that production-consumption for own use began to diminish: specialization increased and with it the need for trade and the exchange of products. It was this phenomenon of the specialization of manufacturing activities and the growth of an independent structure (i.e. a market) to make them available, which provided the empirical background to Adam Smith’s conclusion that the real wealth of nations can be built through the development of the manufacturing process, i.e. industrialization.

The key to industrialization was the increase in productivity, i.e. the ability to use scarce resources so as to produce more goods with fewer resources. Industrial technology had thus moved to centre-stage in the struggle to increase wealth and welfare, in a situation in which both human culture and environment proved capable of developing it and putting it to use in an efficient way.

It is important to note here that the technical leap at the beginning of the Industrial Revolution was not a qualitative, but a quantitative one. Technology has always existed in the form of tools since man first became active. One could equally apply the notion of technological performance to artifacts developed in the animal kingdom (a bird’s nest, for instance).

Intrinsically there is no major difference between the technology of the prehistoric “engineers” who specialized in shaping stones in order to produce arrowheads or cutting tools, and the “engineers” of the first Industrial Revolution who developed tools, which by contemporary standards would be deemed extremely simple. In fact most of the inventions of the first industrial revolution have been designed in such a way that almost anyone of us, without specific university or scientific education, could probably reproduce the same design with the tools available in most hardware stores. The “steam engine” is in fact nothing more than a sophisticated system for controlling the increased pressure produced by a volume of water transformed by heat into steam in a given space. The common pressure-cooker, which many people now use in their kitchen, is based on the very same principle. The real problem is to produce the materials, recipients and related mechanisms, capable of resisting the pressure and controlling its release. Similarly, the notion of the flying weaver-shuttle is very simple: the problem was how to produce a fixed hammer capable of hitting the shuttle with enough force to send it to the other side of the loom.

Only much later, towards the end of the 19th century, did the manufacturing of tools and products start to depend on scientific knowledge, i.e. on the examination and understanding of problems and materials beyond the immediate perception of our senses. We know how to cut a piece of wood and we understand how boiling water transforms into a larger mass of steam. However, we need scientific research to discover that the same molecules found for instance in cotton fibres can be reproduced in a similar, although by no means identical, way by using oil as the raw material. Scientific research and the exploitation of technology based on science thus started to gain ground at the beginning of the twentieth century and have come to be fully and professionally exploited only during and since World War Two.

Up to the middle of the 1920s there was no consistent investment in research laboratories in industry or elsewhere. The cost of production, till then, could be accounted only in terms of the cost of labour and capital. It is only since the 1930s that more and more money has been invested in research and development and this activity has achieved professional status. Nowadays, research and investment, frequently ten to twenty years in advance of actual production, can in some cases cost a company twenty five or even thirty per cent and more of its total sales income.

The period of the Industrial Revolution has witnessed tremendous evolution, punctuated by many discoveries and new technological adventures. The main discontinuity has been the changeover from the sustained period of development of traditional technology that had lasted throughout human history up to the end of the 19th century to a new period in which the main, although not exclusive, impulse has come from the coupling of technological applications with the advance of scientific knowledge. This new process or marriage reached its peak of full maturity after World War Two and has been responsible for twenty-five years of continuous high growth rates in most industrialized and industrializing countries. In terms of quantitative economic growth this has been a unique phenomenon in the entire history of mankind.

The legacy of the Industrial Revolution as a whole has been, then, one of a series of victories in the struggle to increase the wealth of nations giving priority to the production of new tools and products in an increasingly economic way, i.e. enhanced product output for diminished resource input.

2.2 The Monetarization of the Economy Developing Capitalism

The second essential characteristic of the Industrial Revolution has been the monetarization of the economy. Money has, of course, always existed in some shape or form, either directly (gold or silver or copper coins), or indirectly (exchanging three goats for one horse implies the existence of an exchange-value component which is one of the typical connotations of money). However, until the beginning of the Industrial Revolution only a very minor part of all economic activities had entered the monetarized system.

In a pure agricultural society the vast bulk of production and consumption does not enter the exchange system where money has its origin. Trade in fact gives rise to money. Even if we take into account the glorious histories of the caravans, which times past travelled Europe and the rest of the world or the numerous towns of Renaissance Europe which flourished as international market places for certain parts of the year, its quantification will show that a very limited part of all the goods produced and consumed in those times was exchanged within a monetarized system.

It has been calculated that up to the 16th century, no more than 1% of the average life of a European was organized in a monetarized system (the time spent in selling his time for money or using his time for trading).* Today, the corresponding percentage would be at least over 16%.

It is also very revealing that, at a time when kings and aristocrats were the rulers they often possessed little money since money was not an indicator of real power. The fact that banking activities could often be developed by marginal groups which did not really belong to the upper classes, shows that, up to the beginning of the Industrial Revolution, money was still a secondary tool in societal organization, something that could be left to those who did not form an integral part of that organization.

In the past money has always been linked to limited (by modern standards) trading activities and, until the beginning of the Industrial Revolution, very little or no recognition was given to it as a means of stimulating production.

It is not because Pope Gregory XII in the 13th century was particularly conservative or exceptionally moral, that the notion of interest on money was condemned by the Catholic Church. It was because money lending for interest, not being linked to any productive function, was equated with usury, which was simply a way of making the poor poorer. Before the Industrial Revolution, having debts was always “bad”. Today, in most instances it is the very nerve of investment.

Here again we must recognize the importance of Adam Smith and the social weight of his moral convictions. In his book on the Wealth of Nations he completely reverses the “moral” attitudes of the past centuries. He clearly states that the God-loving person, one who avoids sin and endeavours to cultivate the most acceptable moral and social attitudes, is the person capable of saving. Savings, which were potentially a sin before the Industrial Revolution had, with the beginning of the new era, become a measure of moral worth especially in those countries which witnessed the first waves of the industrialization process.

Saving, hard and virtuous saving, is then the prime capitalist virtue: through his accumulated money the capitalist is able to buy the machines or tools which the new Industrial Revolution needs if it is to develop within a specific environment outside the farm or cottage.

Increased specialization depends on more trade; and trade increases require more money. Greater availability of money makes it possible to save more and therefore to create capital for investing in new production activities. This, then, is how the mechanism works, through a process which has monetarised the industrial world on today’s vast scale.

As we have seen, the development of new moral and cultural attitudes parallels the emergence of new production processes and technologies. There can be no question that Adam Smith succeeded in making a virtue out of saving. One hundred and fifty years later, with John Maynard Keynes, even dis-saving (creating debts) would, in his time (when the situation was clearly deflationary), come to be considered a virtue rather than a vice.

Only during the second half of the 19th century did banks, which up to 1800 were mainly involved in trading, start to contribute to the saving and investment functions of the Industrial Revolution. In Adam Smith’s day, money used for investment amounted to no more than 5% of total sales in a given industrial activity. During the 19th century this percentage (as a function of increased concentration and productivity of the new technology) approximately doubled. Various savers (capitalists) joined together to share the ownership of a new industrial venture. Thus the “corporation” or sharing of ownership came into being. Corporations grew and started to spread their shares beyond the restricted circle of new enterprise initiators. Banks then entered the picture as a professionalized system for collecting savings from all sectors of the population and then began to function as intermediaries in channeling those savings towards productive activities.

It is important to distinguish between the forms that monetarization took before and after the Industrial Revolution. Before the Industrial Revolution, monetarization of the economy was a relatively marginal phenomenon. Its acceleration and development as an element essential to the functioning of the manufacturing process, however, are typical of the Industrial Revolution. Parallel to this, a shift of power occurred as society moved from the pre-industrial to the industrial state. In the latter case the very control and availability of money became an instrument of power, both social and political, whereas in pre-industrialized society power could be, and indeed was, exerted outside the direct control, and independently, of the few directly monetarized activities in social life.

In this sense, when we speak of capitalism, we are merely alluding to the sociological and economic aspects of this fundamental phenomenon: the monetarization of the economy as an essential part of the Industrial Revolution. The Industrial Revolution, therefore, cannot but be capitalist. The only important political question we need to resolve then is to what extent capitalism (the monetarization of economic activities) is compatible with, or even requires, a specific degree of political democracy. In any case even a Communist society, undergoing an Industrial Revolution is, in this sense, of necessity, capitalist to some extent.

This analysis of the process of monetarization born of the Industrial Revolution also suggests that there is an equilibrium somewhere between those activities which are more efficiently developed and managed through a monetarized system and those outside it.

Clearly, the process of improving and diffusing monetarization has still a long way to go at the planetary level. Nevertheless, we can today put forward some new questions: which type of productive activities (in a general sense) can be better stimulated through a monetarized system and which through a non-monetarized one? Which blend of monetarized and non-monetarized contributions would be most suitable for each of the main types of productive activity? How far should, and can, monetarized (and non-monetarized) systems go?

2.3 The Utopia of Certainty

The constantly renewed and increasingly efficient struggle against scarcity initiated by the Industrial Revolution can be traced to the search for a paradise lost, free of any anxiety about the need to fight for survival. As a general rule, the idea of progress is defined as utopia, where the normal uncertainty of real life will have been replaced by the dream of achieving some form of eternity through universal truth based on definitive certainties.

Before the European Renaissance this type of progress was essentially linked to a religious vision in which the churches played various intermediary roles between the ultimate certainty (the problem of death) and uncertainty (the reality of life).

“There appears to exist a constant pulse, a striving towards certainty which precludes any acceptance of uncertainty, probably caused by the persistence of ancestral fears.”

With the spread of Cartesianism, i.e. the development of scientific knowledge verified by experimental evidence, with the further development of positivism and benefiting from the evidence of the great advances in scientific discoveries of the last centuries, western civilization had lived a specific type of dream. It believed that by mastering reality “scientifically”, piece by piece, one would one day come very close to the universal truth.

Pascal once said: Science is like a ball in a universe of ignorance. The more we expand knowledge the greater the ignorance encountered by the ball’s expanding surface.

In fact we measure the advance of science by the growing number of questions we seek to answer. Science is more about man’s ability to frame questions than his capacity to provide guarantees about the veracity of the answers given.

In addition, so-called scientific observations and analyses always reach the point where, as they fail to apply under changing conditions, their limitations begin to be apparent. When philosophers, who are after all the fathers of physics, believed that the earth is flat, this theory was perfectly valid for a humanity moving on foot, at low speeds and over a limited part of the earth. The fact that the earth is round was of no particular use during the Roman Empire. The knowledge that the earth is almost round and that it is rotating in a certain way is clearly necessary for organizing air traffic. In the same way, to take the matter one step further, the knowledge that outer space is curved is of no immediate interest to local air traffic on earth, but is essential to space travel. From the standpoint of its application, no knowledge has to be a universal truth to be valid. It is its relevance and application in given space and time conditions, which make it valid and valuable.

At the political level, the Industrial Revolution introduced an assumption that every nation should have its independent state. It is too soon to judge, but overall this has probably been a useful historical step. On the other hand the definition of a nation in modern times is probably less clear-cut than it was when nations were simply tribes. In the modern world the notion of what constitutes a nation has become increasingly vague. The difficulty is that nationalism grows in particular in those who do not feel integrated among the people with whom they live and who, in trying to compensate, go too far. There appears to exist a constant pulse, a striving towards certainty which precludes any acceptance of uncertainty, probably caused by the persistence of ancestral fears. After all, in the course of the Industrial Revolution, political and ideological manifestations of the principle of certainty (frequently in the guise of nationalism and Communism) have provided justification for the unleashing of some of the most barbaric trends in human history. The mass-production achievements of the Industrial Revolution, when pressed into the service of barbarian impulses, have become awful mechanisms. That this was possible at all was due to the habit of looking for certainty and universal truth, which can all too easily be used as instruments for singling out those who are “beyond the ideological pale”, who do not subscribe to the “truth”.

“Certainty and nihilism are twin brothers: both fail to accept reality, the possibility of change, of contradiction.”

Enthusiasm and idealism for achieving new goals are essential to man’s development provided it is always the “better” that is sought and allowance is made for changing the conditions which will permit “even better” or “better still” at some subsequent stage. The quest for the “best possible” which automatically rules out any change or alternative is no more than man’s desperate attempt to eliminate human anxiety by applying the principle of certainty beyond its limits of applicability in time and space. The search for certainty, very much a part of the mobilizing utopias of the Industrial Revolution, is also a source of nihilism. Certainty and nihilism are twin brothers: both fail to accept reality, the possibility of change, of contradiction, or of modification of even the most advanced scientific ideas, those of Einstein included. As the sun sets over traditional western-born ideologies which for two centuries have conditioned the world, the utopia of worldly certainty provides a platform from which to launch a final attempt to secularize religion and metaphysics.

Uncertainty provides the raw material for searching, for asking, for developing, for creating, for doing. When uncertainty reaches intolerable levels, of course, it must be reduced. But the most intolerable level of uncertainty in life is that of full definitive certainty, because this is the point of death and here the choice will depend on what each and every one of us believes as individuals.

3. The Limits of the Industrial Revolution

3.1 Production is not isolated from the Non-Monetarized World

Common sense people, and even economists, have always admitted and considered it a fact that a substantial part of productive activities in life and in society are performed within a non-monetarized context. Most of the great classical economists from Adam Smith to John Stuart Mill have devoted a considerable part of their writings to the notion of productive labour and of value broadly inclusive of non-monetarized activities.

In fact, however, the very notion of value upon which Adam Smith founded the first comprehensive synthesis of economic theory has, in practice, led to the exclusion of a non-monetarized contribution to the creation of wealth in industrial societies.

Given the priorities and functioning of the Industrial Revolution, given also the type of scientific and philosophical ideas dominant up to the beginning of last century, this attitude was ultimately both legitimate and theoretically justified.

First, there was the problem of managing what was a clear priority: It was obvious that the wealth of nations could be developed in an unprecedented way, thanks to the advance of industrialization. The main social mechanism for promoting this process, which meant specialization, increase in trade and investment, was the development of the monetarization of the economy. Money was clearly, and often still is, the tool in social engineering which can solve the complex logistic problems which accompany the development of industrialization.

Second, at a more theoretical level the notion of value proposed by Adam Smith was derived from a measurement system based on a market price born of the interplay between supply and demand. The price, the monetarized value of goods, is the clear, easily quantifiable yardstick by which economics has seemed able to measure its own performance in an unambiguous way. But this is not all. The reference price of a good, defined by its monetarized value, is a type of measurement which has had a great advantage over other parameters in social sciences. It is a quantified, apparently precise reference, which avoids the vaguer statements, indicators and performance evaluations used in other social sciences. In this way economics came very close to the dream of having at hand an instrument by which to measure value (price), which would bring this discipline much closer to natural sciences where phenomena are normally more clearly defined and frequently enjoy self-evident systems of measurement. In this sense the monetarized economic value derived from price could be considered the equivalent of measuring the speed of light, the weight of a body, the boiling point of water or the thermal inertia of a metal.

To summarize: convenience, practicality and reference to the scientific method of analysis, combined during the Industrial Revolution, focused attention on monetarized activities as the key tool for developing the wealth of nations.

Today, in the new service economy, the predominance accorded to monetarized activities has to be placed in a broader perspective. The mastering of monetarized phenomena and the smooth functioning of the monetarization process are a key condition in situations where increasing the quantity of tools and products and their utilization is the prime priority. Another phenomenon becomes fundamental: the crossing back and forth of products and services over the line separating scarce (priced) goods from free ones.

One has to also consider the fact that criticism of “money” during the Industrial Revolution very often derived from pre-industrial attitudes: from philosophies and cultures of an essentially conservative nature, even when presented in “progressive” terms, which always retained some abstract reference to the past. As a result many socialist thinkers, even the young Karl Marx, tried to envisage a society “without money”. Such visions, while purporting to address the future, were in reality the product of social inertia and nostalgia for a time when – prior to the Industrial Revolution – monetarization was limited to a small part of economic life, and when the accumulation of money was socially unproductive. However, it was a more mature Marx himself who, as one of the last classical economists, was to lay to rest the discussion on ‘use-value’ (including both monetarized and non-monetarized activities). In The Capital he reduced it to the idea that “use” simply refers to the destination of goods, and thus finally eliminated any residual interest in the actual non-monetarized activities of economic life.

“The transition to the modern Service Economy represents in fact a basic shift in the notion of value.”

Later, neo-classical economists did, from time to time, return to the notion of non-monetarized economic activities, but always explained them by analogy with the monetarized system (for example, the practice of attributing “ghost” prices to non-monetarized transactions).

The transition to the modern Service Economy represents in fact a basic shift in the notion of value: the importance of restoring to non-monetarized activities full economic value is at last beginning to be acknowledged. The notions of “human capital” and “sustainability” are cases in point.

“There is a price for every good that is scarce. If it has no price it cannot be scarce, but must be freely available”. This typical economic assertion applies to many situations: air is essentially free whereas a piece of bread costs money. But it completely obscures the process whereby a good might become free or, vice versa, become scarce. When resources, which were once free or available at very low cost, become an increasing cost component within the industrial production system, we realize that, after all, the monetarized economic system has had, and continues to have, an effect on the non-monetarized one, that, in the drive to reduce scarcity through increases in productivity in the monetarized system, scarcity is sometimes produced in the non-monetarized sector (and at best “internalized” only after the scarcity producing process has started). On the other hand, we may start to consider today that some technological advances (e.g. the use of the computer) as well as some modifications in social behaviour can result in the transformation of scarce products and services into free goods.

The limits to the Industrial Revolution – as an efficient system for increasing the overall wealth of nations – thus become apparent when the increase in scarcities in the non-monetarized world offsets or over-compensates the decrease in scarcities in the monetarized one. This also means that these two worlds are interdependent. Clearly, a system for accounting and monitoring increasing scarcities in the non-monetarized sector must, more than it is at present, be built into our overall accounting systems (using existing pollution tax schemes might be one way of achieving this).

This should also be the basis for integrating, in a wider vision, the goals of economics and the ambitions of the environmental movement in their quest to promote the wealth of nations.

Within this framework the very notion of sustainable development is based on the best use and preservation of resources, human and material, taking into due account the notions of utilization in time and the issue of uncertainty.

4. The “Service” Economy

4.1 The Growth of Services in the Production of Wealth

As our society becomes more complex, so do the regulations governing human interaction including product utilization and safety limits.

In pre-industrial society very few people could, or needed to read. In the service society however, most people will need to be “computer literate”. Mass education has been among the service functions which, throughout the Industrial Revolution, have undergone a period of rapid expansion, so that today it constitutes a large sector with great potential for improvement.

As vast as and, in some cases even larger than the education service in the modern economy are the health and national defence sectors.

In order to understand properly and evaluate the modern Service Economy, it is essential that one bears in mind that the growth of services is the result of the specific and successive evolution of the production process itself. The development of technology, which changed production processes in order to enhance efficiency, produced the great development of service functions at all phases of the transformation process.

All the services we have mentioned are essential in planning, accompanying and supporting production up to the point-of-sale as well as products during their period of utilization. The maturing Industrial Revolution however, has brought to light another important service to be added to the list: the management of waste.

Waste has always been the by-product of any type of human activity and production: by peeling a banana we produce waste; the same is true when we cut an arrow from a piece of wood. When the Industrial Revolution set in motion a vast trend towards the concentration of production and its specialization, waste inevitably also started to be concentrated and to accumulate. This is not necessarily a negative phenomenon. During the history of the Industrial Revolution waste had often been turned into usable by-products and even major new products such as, for instance, nitrogen fertilizers as by-products originating from the explosives industry or phosphorous as a base for detergents and fertilizers from waste produced by the iron and steel industry. At its most advanced stage, when the principle of product specialization had been stretched to its limits, the Industrial Revolution created a growing number of problems because of waste which could not be economically transformed into useful products.

Concentration, specialization and increased levels of dangerous secondary effects are therefore the negative outcome of the use in various sectors of more sophisticated and advanced science-based technology. Parallel to the increase in industrial waste, the extension of conspicuous consumption to a constantly increasing number of people has also meant an enormous increase in the amount of waste produced by millions of consumers in both quantitative and qualitative terms.

Every product ends up as waste in the long run! Most materials, including our own bodies, become waste at the end of their production and utilization cycle and some of that waste can be transformed into new raw material. In some cases this transformation process occurs naturally (as with organic waste), in others, only after a lapse of time involving recycling intervention by man. The recycling of waste is in most cases limited, either by “economic entropy” (when the cost of full recycling would be prohibitive) or by physical (absolute) entropy (when full recycling proves impossible for physical reasons).

Waste prevention and recycling are therefore one of the key economic concerns of the Service Economy.

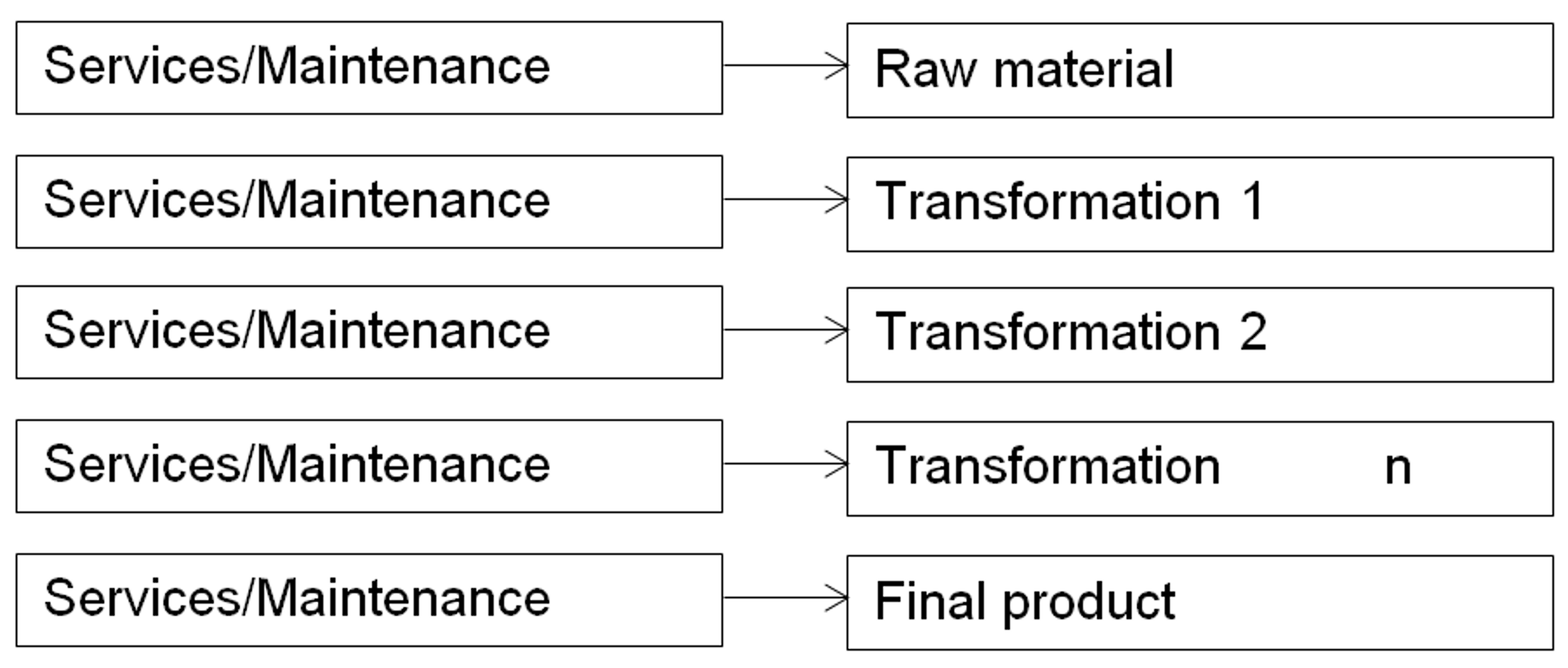

Figure 1 indicates that, in a situation typical of the Industrial Revolution, the production process was considered to be complete the moment a product or tool was available for sale on the market. In the Service Economy, the real issue in terms of economic value appears to be the maximization of the combined utilization of products and services during their lifetime, an operation which takes into account a series of costs prior to, during and after production.

Figure 1. Services and maintenance in the production sector†

On the one hand the traditional notion of economic value is linked to the existence and marketability of a product. On the other, the notion of economic value in the new Service Economy is extended to include the period of utilization and the costs incurred, including those for waste treatments. The notion of value in the Service Economy is in essence linked to the value of any product (or service) in terms of its performance or result over time. It is this utilization value during the utilization period which is the key issue: the effective performance (value) of an automobile as a mode of transport has to be accounted in terms of its period (and frequency) of utilization, and the effective benefit (value) of a drug has to be accounted in terms of the level of health achieved. Whereas, in the industrial economy, the key question was: “What is a product’s ‘monetarized’ value?” The Service Economy asks another question: “What is a product’s ‘utilization’ value? What function does it serve, how well and for how long?”

The development of the Service Economy in the future has to be thought of as a global process involving the whole economy following on from the Industrial Revolution, rather than simply the result of growth of the traditional tertiary sector.

In fact, service functions are integrated into all productive activities in the industrial as well as the agricultural sector. It is essential to note that modern technology has, in most cases, greatly reduced manufacturing costs and increased service costs. The distinction between the functions performed in a modern computerized office and a control centre in a production factory is often rapidly disappearing. This fact has led some authors, when describing the characteristics of the contemporary economy, to speak about a “super-industrial” economy or a “Third Industrial Revolution” instead of the “Service Economy”. These authors cite those sectors where the technology is most advanced and then point out that what is in fact happening is a process of industrialization of the traditional service sectors.4 This is clearly an important phenomenon but it overlooks the spectacular increase of service functions within the traditional productive sectors.

The development of telecommunications, of banking and financial services, of insurance, of maintenance and engineering, cannot be accounted for in terms of their being merely new kinds of “production”, extensions of what had already occurred in textiles, iron and steel and the chemical industry. Selling a product (i.e. a machine) once (i.e. at a given moment in time) is a different business from fulfilling a maintenance contract over an extended period of time, during which the seller remains contractually committed to the consumer for the utilization of the “product”. The relevant issue here is really one of understanding, of what the selling of products in a Service Economy actually involves. We switch from an “Industrial Revolution” mentality to a Service Economy mentality, when we add to the cost of producing products that of maintenance (washing and possibly repairing) during their lifetime, plus the cost of their disposal and replacement when we assess their value in terms of their actual utilization.

4.2 The Horizontal Integration of all Productive Activities: The End of the Theory or the Three Sectors of Economic Activity and the Limits to Engel’s Law

Traditional economic theory still distinguishes between three sectors: the primary or agricultural, the secondary or industrial, and the tertiary which includes all services, sometimes subdivided further to produce a quaternary sector.5 Such a theory focuses essentially on the industrialization process where predominantly agricultural societies are those which are not yet industrial, and where the tertiary sector is frequently no more than a “trash can” used to classify all those economic activities which simply cannot be called industrial.

In reality, for all three types of society – agricultural, industrial and service – the relevant issue is the choice of priority in stimulating the production of wealth and welfare. In an industrial society, agriculture does not disappear. Quite the contrary. Agricultural production becomes more and more efficient thanks to its industrialization. Industry does not develop as a completely separate productive activity from agriculture, but influences the traditional way agricultural products are produced and distributed. In the same way, the Service Economy is not an outgrowth completely detached from the industrial productive structure, but permeates that structure, making it predominantly dependent on the performance of service functions within (as well as outside) the production process. The real phenomenon therefore is not the decline and growth of three vertically separate processes or sectors, but their progressive horizontal inter-penetration. In other words, the new Service Economy does not correspond to the economy of the tertiary sector in the traditional sense, but is characterized by the fact that service functions are today predominant in all types of economic activity.

With every fundamental switch from one priority mode of wealth and welfare production to another, there is a modification in the perception of needs or demand. The very definition of what constitutes a basic need also changes.

In an agricultural society, the agricultural (pre-industrial) system of production was obviously perceived as addressing the problem of satisfying basic needs. After the onset of industrialization, and in line with the history of economic theory, which until then had coincided essentially with its development, primary needs were defined in terms of what basic needs the manufacturing system (integrating key agricultural production) could satisfy. Engel’s law states that services are secondary in most cases because they only fulfil non-essential needs. In this approach the Industrial Revolution is supposed to be an efficient method of providing people with food, shelter and health. Only once these basic needs are satisfied can the consumption of “services” commence.

In reality, however, the true impetus towards the Service Economy has been precisely the fact that services are becoming indispensable in making available basic products and services which fulfil basic needs. Services no longer constitute a mere secondary sector, but are moving to the forefront of economic activity, where they have become indispensable production tools in meeting basic needs and the essential means whereby the wealth of nations may be made to increase.

The insurance industry is a typical example. Until a few decades ago everybody, including those in the insurance industry itself, accepted that insurance policies covering, for example, life risks or material damage, were a typical secondary product in the economic sense that they could only expand once basic needs had been satisfied by material production.

However, during the years following 1973, when the growth of GNP in the world dropped from an average of 6% to less than 3% per year, the overall sales of policies continued to grow at about 6% per year. If insurance consumption was of secondary importance the slowdown in other activities, and in particular in manufacturing would, according to Engel’s law, have produced more than a proportional reduction in the sale of insurance. The explanation for this continuous growth of insurance activities, even in periods of declining growth, lies precisely in the nature of the modern production system which depends on insurance and other services as key tools to guarantee its proper functioning, based on the availability of products and services. At a very advanced technological level of production, where risks and vulnerabilities are highly concentrated and represent an essential managerial challenge, insurance has become – increasingly so in recent decades - a fundamental pre-condition for investment. Similarly, at a more general level, social security, health and life insurance have by now achieved the status of a primary good in most “industrialized countries”.

4.3 From Product Value to System Value

Another key difference between the industrial economy and the Service Economy is that the former attributes value essentially to products which exist materially and which are exchanged, while value in the Service Economy is more closely related to performance and real utilization (over a given period) of the products (material or not) integrated in a system. Whereas during the classical economic revolution the value of products could be identified essentially with the costs involved in producing them, the notion of value in the Service Economy is shifting towards evaluation of costs in terms of the results obtained in utilization.

The first approach considers the value of a washing machine per se, the second evaluates the actual performance of the washing machine, taking into account not only its cost of production but also all other kinds of costs (learning time for those using the machine, maintenance and repair costs etc.). The applicability of the two approaches is, in most cases, inherent in the technological complexity of the product: in the case of simple products and tools, the assessment of value can be limited to the tool or product per se. Nobody buying a hammer would think it necessary to take courses to learn how to use it. In the case of a computer, however, the cost of learning how to use it tends to exceed the purchase cost of the machine itself, especially where the former includes the cost of essential software.

Similarly, people buying goods such as dishes or even a bicycle might not consider signing a maintenance contract. With purchases of electronic typewriters, photocopiers, or even television sets, however, maintenance contracts – even for individual consumers – are more and more common. In the Service Economy it is not a tool that is being purchased, for people are buying functioning systems, not products. People buy performance.

System evaluation, i.e. the organization of tools and persons in a given environment to obtain desirable and economically valuable results, must also take account of various degrees of complexity as well as vulnerability in systems’ functioning.

The notion of systems becomes essential then in the Service Economy. Systems produce positive results or economic value when they function properly. The notion of system operation (or functioning) has to be based on real time and the dynamics of real life. Whenever real time is taken into consideration the degree of uncertainty and probability, which conditions any human action, becomes a central issue.

The economics of the Industrial Revolution could, in contrast, rely on the fiction of a perfect equilibrium theory (outside real time), based on an assumption of certainty. During most of the economic history of the Industrial Revolution, risk and uncertainty have been the meat of historians and sociologists. The first systematic study to give timid though serious consideration to risk and uncertainty was that carried out by Frank Knight during the 1920s.6

Any system working to obtain some future result by definition operates in a situation of uncertainty, even if different situations are characterized by different degrees of risk, uncertainty or even indetermination. But risk and uncertainty are not a matter of choice: they are simply elements of the human condition.

Rationality therefore is not so much a problem of avoiding risks and eliminating uncertainty, but of controlling risks and of reducing uncertainty and indetermination to acceptable levels in given situations.

Furthermore, the very systemic nature of modern economic systems and the increasing technological developments requires an ever deeper economic understanding and control of the increasing vulnerability and complexity of these systems. The Siberian railway accident of June 5, 1988, when a leak from an LNG pipeline led to an explosion that destroyed two trains, killing all passengers, can serve as an example of systemic risks.

Unfortunately, the notion of vulnerability is generally misunderstood. To say that vulnerability increases through increase in the quality and performance of modern technology might seem paradoxical. In fact, the higher level of performance of most technological advances relies on a reduction in the margins of error that a system can tolerate without breakdown. Accidents and management mistakes can still happen - even if less frequently - but their effects now have more costly systemic consequences. Opening the door of a car in motion does not necessarily lead to a catastrophe. In the case of a modern airplane, it will. This shows that the notions of system functioning and of vulnerability control become a key economic function within which the contributions of, for example, economists and engineers must be integrated. In a similar way, problems of social security and savings for the individual have to take vulnerability management into account. Thus the notion of risk and the management of vulnerability and uncertainty become key components of the Service Economy.

4.4 The Notion of Risk in the Industrial Revolution and in the Service Economy – Moral Hazards and Incentives

The first great economists did not study risk-taking in detail. It was rather taken for granted by the cultural environment of the time, even if Schumpeter made more explicit reference to the risk-taking entrepreneur. It was not until 1992 that the first comprehensive study of the subject was made, by Frank Knight in his Risk, Uncertainty and Profit.7 But even Knight tended to confine himself to a discussion of risk of the entrepreneurial type. The field of pure risk linked to the vulnerability of systems was still considered too secondary to be given priority among the managerial objectives of firms.

The activities of the service sector and of insurance in particular, have traditionally been regarded as secondary or marginal in the national economy, even if they have existed for centuries. Theories and even attitudes have not yet adjusted to the new facts in this field. Some types of non-entrepreneurial risk are nevertheless now seen as more important due to changes in social philosophy. This applies to risks covered by social security and workers’ protection in industrialized countries. Indeed as early as the 1850s the government of Prussia had organized the first compulsory insurance scheme for miners. But at the time of the great depression in 1929 this type of risk management was still in its infancy.

The development of social security can be attributed mainly to changes in social philosophy, which in turn is conditioned by the changing levels and characteristics of the risks and vulnerability produced by the modern environment. Indeed, the growth of risk and vulnerability, interwoven into the functioning of the economic system, largely explains why we now experience a new risk dimension and a fundamental change in our expectations concerning the possibilities for traditional growth.

The connotation of risk in the Service Economy covers a much wider area than the notion of risk in the Industrial Revolution. With the latter the main risk area involved was the so-called entrepreneurial or commercial risk; while the Service Economy has to be extended to include so-called ‘pure risk’.

An entrepreneurial risk is one where the people involved in an activity can influence its purpose and manner by deciding to produce, to sell or to finance etc.

Pure risk is beyond the control of those involved in an activity. It depends on the vulnerabilities of their environment or of the system within which they work, and it will materialize by accident, by chance. This notion of pure risk is exclusively related to the notion of the vulnerability of systems we have been discussing in the preceding paragraphs and is a hallmark of the Service Economy.

One of the great differences between neo-classical economics and the new Service Economy is that not only is “entrepreneurial” risk taken into account (as in the case of Frank Knight), but that the notion of economically relevant risk is extended to include the notion of pure risk. Globally the notion of risk, therefore, has two fundamentally different but complementary connotations.

Today, in any significant economic endeavour, equal strategic importance must be given to both types of risk (both being linked to the concept of systems vulnerability).

Many people when discussing risk management (meaning the management of pure risk) do not make a clear link with the global strategy of risk. Therefore, instead of showing clearly how the two risks are correlated, they tend to confuse or confound them.

The distinction between pure and entrepreneurial risk is also to be found in the notion of “moral hazard”.8 This notion has long been familiar to insurers when they have had to face damages occasioned by those who have exposed themselves to risk for reason of profit. Take for instance the case of somebody who burns down his own home in order to collect the insurance (the cause of over 20% of fires!).

4.5 The New Entrepreneur in the Service Economy

Managers and entrepreneurs in the service economy must be able to take a broad view of risk, one which embraces both forms (the entrepreneurial and the pure) of the phenomenon. Even the most advanced management schools today are often lagging behind in this respect, whereas the reality of pure risk has long since begun to impose enormous burdens on managers.

Risks have to be understood at all levels and controlled as to their level of manageability. Vulnerabilities can, and must be diminished and checked. Only then can a strategic vision be developed and new challenges discovered.

Should their vision of the real world be partial or inadequate, both the entrepreneur and the public at large will be beset by the feeling of being overwhelmed by the risks and vulnerabilities of modern life. Yet that sense of powerlessness, of inadequacy, is rather the result of our cultural inability to identify, adjust to and accept the realities of our contemporary world. Thus, it is very much a question of attitude. This inability to adjust leads to pessimism and fatalistic paralysis, like the sailor who, instead of using the winds to steer his boat, allows them to determine the direction in which his boat is pushed. It is crucial that we be able to identify these new winds blowing within the Service Economy, and that we recognize the challenges posed by the new risks, and by our increased concern for product quality and utilization value, for what they really are: opportunities for defining new directions, for stimulating renewed activity in our quest for real economic and social growth.

4.6 Tradability and Homogeneity of Services

Much of the literature on the Service Economy quotes two specific issues which reflect current difficulties in defining its characteristics. In most cases these difficulties stem from an underlying psychological attitude which views services or more precisely the Service Economy, as a kind of new “product” manufactured by a new type of “industry”.

Our difficulties in clearly stating the problem once again stem from the cultural or theoretical frame of reference used for analysis rather than from the problem itself. A particular point in case is the notion of tradability and homogeneity of services. It is often said that an analysis of the Service Economy is almost impossible because services refer to such disparate entities as haircuts, telecommunications or maintenance and health activities. But the same can be said of products; there is little homogeneity between a pullover, an airplane, orange juice and a watch. In fact all “industrial products” are homogeneous only insofar as they are viewed from the standpoint of the production system, i.e. the manufacturing methods of production developed and improved by the Industrial Revolution. If one looks at services with an “industrial” mentality one will inevitably discover that some of them can easily be assimilated to an industrial product while others cannot. However, the exercise is pointless since it tries to fit empirical evidence into an obsolete frame of reference.

The real difference between the industrial and Service Economies, upon which homogeneous theoretical references can be built, is economic value. During the Industrial Revolution economic value was linked to a product’s existence and to improvements in productivity that derived essentially from improvements in the manufacturing process. Economic value in the Service Economy, on the other hand, is derived from the functioning of a system, the productivity of which can only be measured in terms of improved and increased performance as related to the costs in the entire cycle from raw material to waste. The reference is not to the “product” but to its “utilization”, i.e. its proper and useful functioning process.

Increases in productivity in the Industrial Economy are measured by the costs of the inputs used for producing a tool or a product. In the Service Economy, measuring the same costs of inputs without reference to specific performance (not necessarily products) is very close to nonsense. The productivity of a health system is in “producing” healthy people. In both cases measurement of the result has to inevitably integrate qualitative “stock” parameters. This can be achieved fairly easily with common sense and a minimum of consensus. Measuring the performance of educational systems must inevitably be linked to an evaluation of the quality of the trained student in relation to the purpose of his or her learning. No indicator of the salaries of the teachers or investment in school buildings will ever suffice to properly measure educational productivity.

Living and working in a Service Economy also means looking at industrial products from a service point of view, i.e. looking at the function of tools, at how well such tools are used in practice, and at the results achieved with them.

In economic terms the Industrial Economy is about the evaluation of production of wealth in terms of added exchange value, while the Service Economy is all about the measurement of utilization value. If, therefore, the notion of homogeneity, or its absence, is used in our analysis of both the Industrial and Service Economies, such notions reveal maladjustment of the conceptual framework. It might of course be quite legitimate to choose one or the other. But it all depends on how efficient one evaluation system or the other is and in which direction the empirical evidence is moving. When we look hard at services as functions and performing systems within the Service Economy we find great variety in the activities pursued (and this is as typical of the Service Economy as it was with a wide range of goods of the Industrial Economy), but not necessarily absence of homogeneity. In the Service Economy, a restaurant performs the function of providing food for clients, a function which is, of course, very different from that of teaching or entertaining. But whatever its nature, the function always aims at achieving certain results that in each case can be readily identified.

The same problem arises with tradability. Many service functions are tested or considered in a way which assumes they can be fitted into the analytical framework developed for analyzing trade in industrial products.

Since the Service Economy is about producing results where the customer or user happens to be, it is clear that the notion of trade when applied to this context must alter radically. We can no longer distinguish between trade in services and the movement of production factors or investment as was the case in “industrial” economic theory. In many cases trade in the Service Economy inevitably combines and confounds the two. For many companies, and especially for those in traditional “service sectors”, the equivalent of local or international trade in products is the organization of delivery systems where the customer is located.

While a traditional producer of a machine will export a “product” to any place in the world, the exporter of a service will have to rely much more upon an established office or point of distribution at the place of use. In both cases a transition from a classical industrial to a Service Economy occurs when, for example, the sport of a machine must be accompanied by so much software that what was formerly the simple “physical” transfer of a product now becomes an on-site investment operation in order to guarantee the proper functioning of a product at the place of its use.

The question of trade in services and their tradability is representative of a more general movement which has characterized the development of society and the economy over the last few centuries: from locally closed and largely autonomous production units with small markets to ever greater interpenetration in a world market. During the Industrial Revolution the explosion in trade essentially concerned hardware (products). What we are now witnessing as the spread of service-performing systems is an entirely new chapter in the annals of trade, involving not only the movement of physical tools and products but also of the ways and means of their use and co-production.

At first sight then, inherent in this spread of the World Service Economy is a mechanism for more balanced world development, based more and more on increased trade and investment.

4.7 Material and Immaterial Values in the Service Economy

Numerous books and articles on the Service Economy (as well as on the “information” economy), have suggested that in the present economic system we are increasingly faced with so-called “immaterial” goods and values.

This notion of “immaterial” comes from the observation that during the classical Industrial Revolution the production process had mainly to do with material (hardware goods and tools). In our present service information society, however, goods are very often “immaterial” (software), as for instance an item of information or a computer programme (the support or transmission system remains “material”).

Whether merely implied or explicitly stated, contained within this approach is the claim that the Service Economy is less “materialistic”, more open to “immaterial” values: Similarly the word “quality” is used as an analogy for “immaterial” and is frequently related to the notion that a higher degree of education is an essential prerequisite of proper production. All these analyses in fact maintain a dichotomy between tools and their utilization. Today, the notion of “knowledge society” has become fashionable. It has been forgotten that the civilization process has always been based (since the Stone Age) on more “knowledge”. What is new, in fact, is the acceleration of this process.

At the risk of repetition it should be emphasized that in the Service Economy priority is given to functions, the primary concern being with result-producing systems. However it is equally obvious that these systems (even if they produce abstract artifacts like communications) are heavily dependent on material tools.

A function or a “system” is immaterial per se, just as a machine tool is “material” per se. Industrialization required a different level of investment in knowledge than traditional agriculture, but knowledge per se is nothing new. Even the man who invented the bow and arrow was an “intellectual”.

Once this becomes clear we are more likely to describe current higher and increasing levels of education not as something new, but simply as something more appropriate to present economic development.

The notion of “immaterial” values stems basically from the sense that values are produced, and go beyond what is normally measured by current (industrial) economics. If in some cases we can identify “deducted values” (the example of the economic system overestimating the real increase in wealth), there are also many cases in which the results, in terms of the real wealth of modern technology, are underestimated.9

This takes us back to the problem of measuring the results against the costs (monetarized costs) of production, and of the absolute necessity of measuring value by some accepted indicators of personal and national wealth.

5. Value and Time in the Service Economy: The Notion of Utilization

5.1 The Product Cycle: from Raw Materials to Recycled Materials

The “life” of any product can be divided into five distinct phases: research, design and conception; production, involving a transformation of natural resources; distribution (transport and packaging, marketing and publicity); the useful life over a variable period of time (the utilization period); and the disposal of the discarded good (recycling or waste disposal). This whole process can be referred to as the Product-Life Factor.10

The fast replacement of goods has been a persistent trend in economic history, and has gained momentum in our fashion-based consumer society (the syndrome of bigger-better-faster new products), as economists have become preoccupied with production optimization, economy of scale and fast depreciation and replacement. The success of such industrial production has been measured in terms of flow at the Point-of-Sale (expressed for example in the GNP), while the notion of the use of a product over time, its utilization, has been largely neglected.

However, it is precisely this utilization period which is the main variable in wealth creation! Who determines the length of the utilization period?

5.2 Accounting for Value in the Service Economy

Measuring Value in the Industrial Revolution: The Monetarized Flow

We have attempted to show that price is the yardstick, the reference criterion, around which we organize a measurement system capable of quantifying economic phenomena and results within the framework of the industrial process.

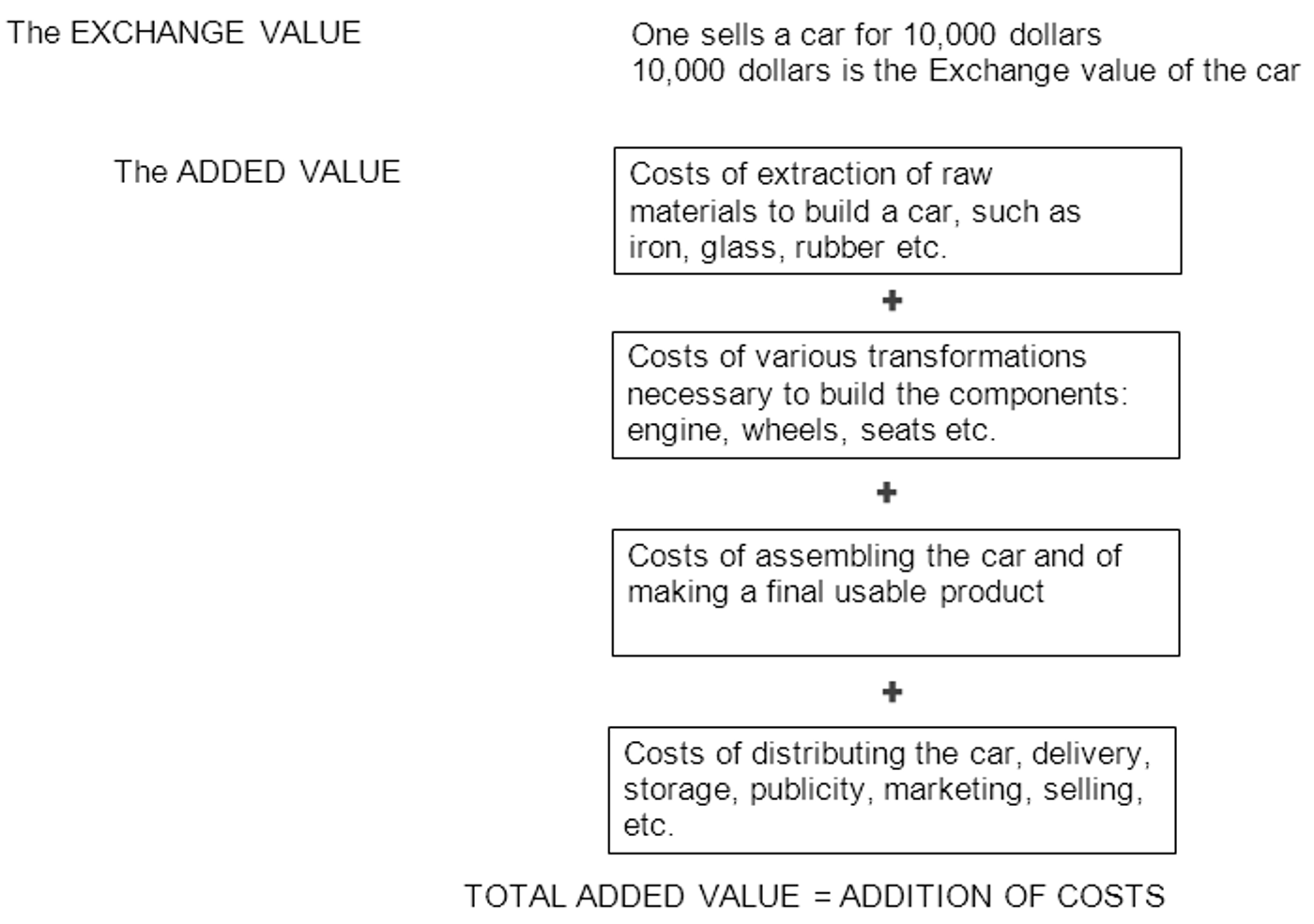

Price is given by exchange and the money obtained from each transaction is then used to remunerate all those who have contributed to the production of that which is transacted, i.e. goods or services. Labour is paid wages or salaries, and capital (representing an accumulation of labour in terms of tools made available for production, e.g. plant, machinery, systems, knowledge levels and managerial capacity) receives interest. Each contribution to the various steps in transforming raw materials into usable products or functions represents a “value added”. Adam Smith built his notion of value on this idea of “value added” and considered it equivalent to the “exchange value”. Figure 2 summarizes these notions. However the notion of value added has not simply remained historically a basis for economic theory. In recent decades it has become a reference for the fiscal system through the introduction of value added taxes.

Figure 2: The classical economic concept of value in the industrial society:

The example of an automobile.‡

It is essential to understand that the measurement of value added in economics refers to the measurement of a flow. Although reference is made to the “selling price” (which could give the impression that it is the measurement of a result), the reference to the cost of the production factors is conceptually linked to the measurement of what contributes to the production of wealth, and not to the measurement of wealth itself. This can best be explained as a bathtub with two taps.§

Over recent decades we have seen the emergence of a new type of problem linked to environmental and ecological constraints, which strongly suggests that the monetarized flow does not always lead to additional wealth, for the monetarized flow contains a non-negligible element of pollution which does not add to, but destroys wealth. The measurement of growth as expressed in the Gross National Product is precisely and exclusively the measurement of such a monetarized flow at the macro-economic-national level. It excludes the standard accounting practice used by all industrial companies and individuals: an accounting of the total assets or stock available and total liabilities incurred (the Balance Sheet), of which an analysis of the flow of activity performed during a given period of time (the Statement of Income and Expenses) is an integral part. At the microeconomic level it is a matter of common knowledge and, indeed, of common sense that the differential in the total value of assets (e.g. stock) does not necessarily coincide with the volume of activity performed over a given period of time. The accounting of assets is a process which reveals an accumulation from an activity over a longer period of time, rather than simply indicating whether the monetarized flow over the same period has increased or decreased.

During the Classical Industrial Revolution it could be assumed that the amount of the monetarized flow largely corresponded to increases in the stock of wealth. In the Service Economy this is no longer true. The real level of wealth (i.e. the stock) depends also on non-monetarised contributions and deducted values. In the past too, value added coincided largely with the real utilization value and as such became the primary indicator of growth in wealth. But the notion of utilization value itself refers to the assets (stock) and the way they are used, in contrast to the notion of added value which refers to the flow of monetarized production.

The measurement of such stock can of course only be approximate and will be partly subjective. This means that decisions about what has value then become partly a matter for political consensus, similar to the estimated “goodwill” in a company’s Balance Sheet. The choice in future may well be between a system of flow measurement which is quantitatively precise but increasingly devoid of significance, and systems of asset measurement which might be less precise but will be more relevant to the real world. The quantification of non-monetarized wealth components can be achieved through adequate indicators. This is a crucial topic, as any method of asset accounting would also make possible a better definition of riches and poverty, and thus avoid the perpetuation of a higher level of wealth than officially recorded, for the non-monetarized contributions to the wealth of one country may be higher than those of another.

5.3 Old and New Shortcomings: Wealth and Riches, the Paradox of Relative Prices, Deducted Value, and Non-Accounted Value

Classical economists, and in particular Ricardo, were well aware of the methods for the accounting of economic wealth that they were devising were not really comprehensive of the real level of wealth of an individual or a country. A clear distinction was made between the notion of riches on the one hand and wealth on the other. There was even an implicit acceptance that there could be situations where an increase in wealth would not correspond to an increase in riches.

However, these considerations remain secondary because the main problem during the Industrial Revolution was to identify the most dynamic system for increasing the wealth of nations via the industrialization process, and to concentrate on its development. Discrepancies between wealth and riches could be considered of minor importance. The writings of classical economists and some of their later commentators were very much influenced by the fact that the first formulation of economic theory was a description of the industrialization process: the priority, which was quite adequate for this purpose, was to measure a flow of goods and the value added, whether supply or demand-based.

In the Service Economy, where the industrialization process per se is no longer identified as the prime mover in increasing the wealth of nations, the problem is quite different and the contradiction between wealth and riches much more important.

“The present accounting system is inadequate, even in the positive sense, for measuring many increases in real wealth.”

The divergence of the notion of riches from the notion of wealth corresponds to what can be called the development of deducted values in the modern economy. Increase in these deducted values stems from the increasing higher allocation of economic resources to activities which do not add to the real level of wealth (or of riches), but which are in fact absorbed by the rising costs of the functioning of the economic system.

Air and water pollution are obvious cases of diminishing real wealth (or of diminishing riches). If money is invested to depollute water or to develop alternative solutions such as bottled water, special reservoirs for drinking water, or swimming pools next to polluted seashores, we are once again confronted by “catch 22” situations where investments are necessary to compensate for riches lost through, for example, pollution: these investments are not net added value to our wealth!

The growing discrepancies between levels of wealth and riches (or the contradiction between economically accounted wealth and real wealth) clearly indicate the need to refer increasingly to stock, i.e. variations in real wealth, as a substitute for the measurement of productive flows (the bathtub example). Furthermore there is also a problem of matching real added values to deducted values. A new conceptual approach for measuring the real results will have to replace the simple analysis of the costs of an isolated activity.

The notion of deducted value implies the need to take into consideration the notion of negative value. In terms of economic analysis this is already a step in the right direction, given that in many cases the negative side of economic activities has simply remained unaccounted for. Diminishing increase in an economic situation has to be in fact distinguished from a net negative process. Measuring wealth through flows that do not fill a bathtub, or even worse, that are shut off, excludes the notion of negative flows. Only by looking at the stock can positive and negative variations be measured and a decision taken as to whether the flows produce values added or values deducted.

We should also bear in mind that the present accounting system is inadequate, even in the positive sense, for measuring many increases in real wealth. This phenomenon relates to certain paradoxes concerning the notion of relative prices.

Relative prices and the changes they undergo are one of the major indicators of whether a new technology or production system has really been effective in a given sector. When there is great progress in a new sector the cost of products not only diminishes per se, but their price, relative to other products on the market, also falls steeply. Thirty years ago, the price of a small calculator was the equivalent of 500 kilos of bread. It is now sometimes the equivalent of less than 1 kilo of bread. This means that, in terms of bread, the relative prices of pocket calculators have fallen sharply.

At the level of the individual, the substitution of a rare and expensive product (as, for instance, calculating machines fifty years ago) for a cheap product greatly increases one’s riches, but can diminish wealth. The fact that we can buy products today, such as pocket calculators which thirty or forty years ago we could not afford to buy for private use, is an indicator that, in real terms we are much richer today. But in terms of the monetarized wealth at our disposal, any person who could afford such a machine thirty or forty years ago was considered to be much richer than we are today, when we need little money to buy it.

At the macro-economic level, this phenomenon may be less contradictory. If, today, the price of pocket calculators is 1/10th of what it was twenty years ago, and if, instead of selling ten calculators thirty years ago, it is possible to sell 1,000 today, we have increased the sales value ten fold in terms of money. But the real wealth of people has increased much more: some of the revenues generated through the expansion of the pocket calculator market can be used for buying those goods which have remained expensive, i.e. the relative price of which has remained high.

In measuring our real wealth, merely knowing if and by how much the world has grown richer is by no means sufficient. While in some ways we have become poorer over the last twenty years because we must pay more for previously free goods or services such as uncontaminated drinking water or swimming in non-polluted water, we have, in other ways, become richer by having pocket calculators and video cassettes available for the equivalent of a few hours, or even minutes of salaried work. And we can afford to see high quality operas and plays that in Moliere’s day were reserved for Kings and Emperors.

Our attempts to measure the value added and to examine the mechanism of relative prices lead, therefore, in terms of evaluating increases in wealth, to conclusions that are much more complex than first expected. The easy way out is to measure the levels of real wealth available (its utilization value) with approximate indicators. The complication of “Industrial Revolution accounting” is nicely described by the paradox of hell and heaven, when applied to the notion of scarcity. Heaven, being probably blessed by an infinite stock of goods and services of all sorts (material and spiritual), knows nothing of scarcity. Economics and the economy therefore do not exist. There are no prices and there is no money since everything is readily available without any restriction or work. Heaven, then, must be something very different from earth, but it is also a place of zero GNP. Hell, as the opposite of heaven, is a place which consumes a lot of energy in maintaining its celebrated image and presumed activities. Therefore, it probably needs to develop a huge value added which nobody has ever tried to measure. GNP must be very high indeed!

On our earth, the maximum possible achievement in the fight against scarcity is to create abundance in as many sectors as possible. But human and economic development also entails identifying and coping with new scarcities. Scarcity is ultimately the hallmark of the system of disequilibrium within which human endeavour is destined to operate: it is the sine-qua-non of man’s quest for fulfilment.